Why coronavirus will accelerate the fourth Industrial Revolution

Related content

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Risks and opportunities in a changing world

Read our Taxing digital services, U.S. tax reform: The global dimension, & Planning for life after NAFTA articles by clicking the thumbnails below.

Covid-19 concerns could accelerate digital currency adoption. Awareness and use trends already high, according to a new Economist Intelligence Unit (EIU) survey.

Related content

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Risks and opportunities in a changing world

Read our Taxing digital services, U.S. tax reform: The global dimension, & Planning for life after NAFTA articles by clicking the thumbnails below.

Untapped Capital: understanding the retail investor pool

Untapped capital: Understanding the retail investor pool is written by The Economist Intelligence Unit and sponsored by PrimaryBid. In-depth interviews with financial market experts were conducted in addition to extensive desk research and data analysis.

Key Findings:

• Europe has witnessed a recovery in retail ownership of listed companies since the 2008 financial crisis. European households own 15.6% of listed shares across EU and UK stock exchanges, up from 13.3% in 2013 and 12.7% in 2007

Related content

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Risks and opportunities in a changing world

Read our Taxing digital services, U.S. tax reform: The global dimension, & Planning for life after NAFTA articles by clicking the thumbnails below.

A new shade of green: Sukuk for sustainability

The first green bonds were issued a little over a decade ago by multilateral institutions and municipalities. Green bond issuance is now growing by about 50% annually according to Sean Kidney, CEO and co-founder of the Climate Bonds Initiative, an investor-focused NGO based in London. Last year, green bond issuance reached a record of US$258bn, much of it coming from the US, France and China. “For investors, green bonds are a great way to address concerns about climate change and to put money in assets that they think are going to be lower risk,” says Mr Kidney.

17376

Related content

Resetting the agenda: How ESG is shaping our future

The Covid-19 pandemic has exposed a wealth of interconnections – between ecological and human wellbeing, between economic and environmental fragility, between social inequality and health outcomes, and more. The consequences of these connections are now filtering through, reshaping our society and economy.

In this setting, the need to integrate environmental, social and governance (ESG) factors when investing has become even more critical. Institutional investors must employ ESG not just to mitigate risks and identify opportunities, but to engage with companies to bring about the positive change needed to drive a sustainable economic recovery in the post-Covid world.

In order to understand how ESG could be both a new performance marker and a growth driver in this environment, as well as how institutional investors are using ESG to make investment decisions and to assess their own performance, The Economist Intelligence Unit (EIU), sponsored by UBS, surveyed 450 institutional investors working in asset and wealth management firms, corporate pension funds, endowment funds, family offices, government agencies, hedge funds, insurance companies, pension funds, sovereign wealth funds and reinsurers in North America, Europe and Asia-Pacific.

Download the report and infographic to learn more.

Charting the course for ocean sustainability in the Indian Ocean Rim

Charting the course for ocean sustainability in the Indian Ocean Rim is an Economist Intelligence Unit report, sponsored by Environment Agency Abu Dhabi and the Department of Economic Development Abu Dhabi, which highlights key ocean challenges facing the Indian Ocean Rim countries and showcases initiatives undertaken by governments and the private sector in the region to address these challenges.

Click here to view the report.

Fixing Asia's food system

The urgency for change in Asia's food system comes largely from the fact that Asian populations are growing, urbanising and changing food tastes too quickly for many of the regions’ food systems to cope with. Asian cities are dense and are expected to expand by 578m people by 2030. China, Indonesia and India will account for three quarters of these new urban dwellers.

To study what are the biggest challenges for change, The Economist Intelligence Unit (EIU) surveyed 400 business leaders in Asia’s food industry. According to the respondents, 90% are concerned about their local food system’s ability to meet food security needs, but only 32% feel their organisations have the ability to determine the success of their food systems. Within this gap is a shifting balance of responsibility between the public and private sectors, a tension that needs to and can be strategically addressed.

Financing sustainability | Insights video

What is driving the strong demand for financing sustainability in Asia Pacific? How can companies increase supply and start to see the benefits of sustainable finance in the next three years? We interviewed Richard Brandweiner, CEO of Pendal Australia, and Sophia Cheng, CIO of Cathay Financial Holdings and chair of Asia Investor Group on Climate Change, to find out.

Related content

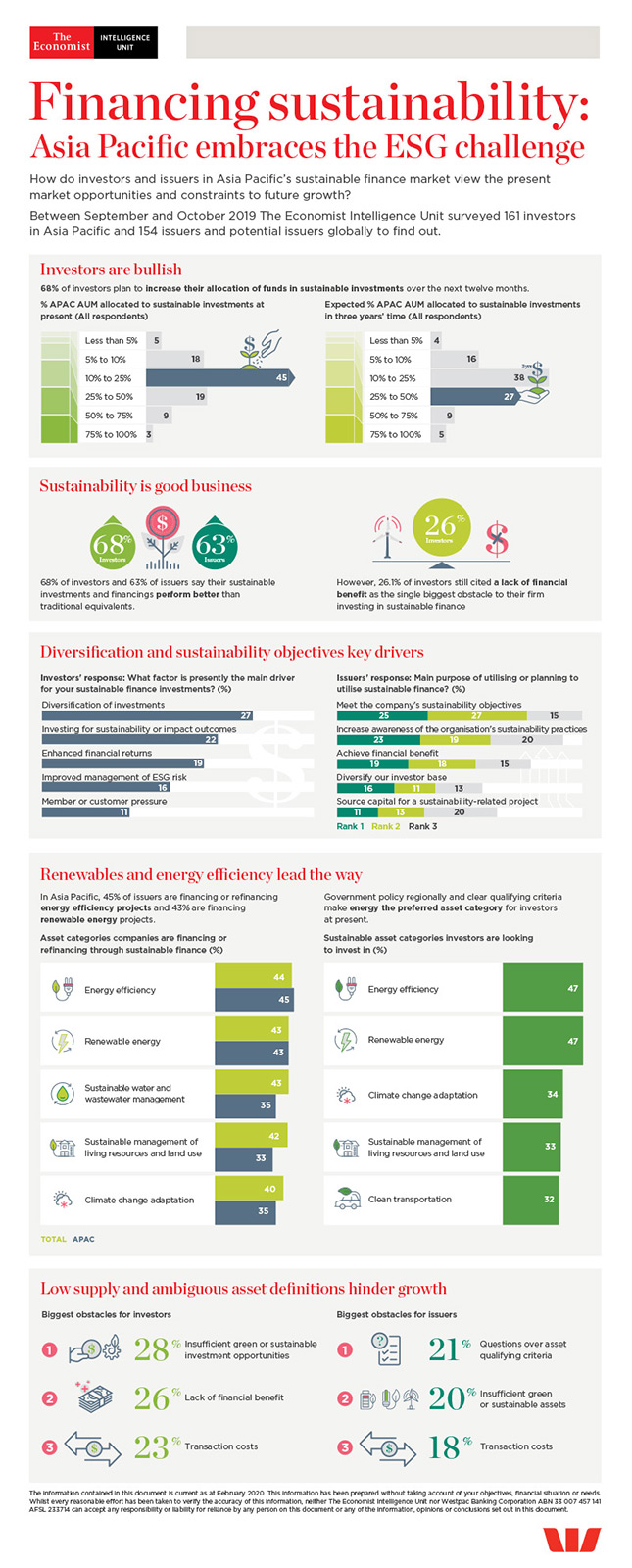

Financing sustainability: Asia Pacific embraces the ESG challenge

Financing sustainability: Asia Pacific embraces the ESG challenge is an Economist Intelligence Unit report, sponsored by Westpac. It explores the drivers of sustainable finance growth in Asia Pacific as well as the factors constraining it. The analysis is based on two parallel surveys—one of investors and one of issuers—conducted in September and October 2019.

If the countries of Asia Pacific are to limit the negative environmental effects of continued economic growth, and companies in the region are to mitigate their potential climate risks and make a positive business contribution through improving the environment and meeting the UN's Sustainable Development Goals (SDGs), large volumes of investment in sustainable projects and businesses need to be mobilised. A viable sustainable finance market is taking shape in the region to channel commercial investor funds, and both investors and issuers say they are achieving a financial benefit from their investment and financing activities. The market is still in the early stages of development, however, and must expand and mature to meet investor needs.

The chief constraint on sustainable finance growth in the region has been the limited supply of bankable sustainable projects. Our research suggests supply is increasing, but with investor demand continuing to grow apace, the gap will remain an obstacle in the short- to medium-term. Among the organisations in our issuer survey, only 7% have used sustainable finance instruments to fund projects. However, nearly nine in ten (87%) said they intend to do so in the next year, which should begin to bridge the gap between supply and demand.

Based on issuers’ stated intentions, investors will have a range of instruments to choose from, including green loans and bonds and sustainability loans and bonds. Large numbers of investors indicate that they intend to deploy a greater proportion of capital to these over the next three years.

Financing sustainability | Infographic

Financing sustainability: How do investors and issuers in APAC's sustainable finance market view the present market opportunities and constraints?

To learn more:

Download report | Watch video

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Financing sustainability: How do investors and issuers in APAC's sustainable finance market view the present market opportunities and constraints?

To learn more:

Related content

Financing sustainability: Asia Pacific embraces the ESG challenge

Financing sustainability: Asia Pacific embraces the ESG challenge is an Economist Intelligence Unit report, sponsored by Westpac. It explores the drivers of sustainable finance growth in Asia Pacific as well as the factors constraining it. The analysis is based on two parallel surveys—one of investors and one of issuers—conducted in September and October 2019.

If the countries of Asia Pacific are to limit the negative environmental effects of continued economic growth, and companies in the region are to mitigate their potential climate risks and make a positive business contribution through improving the environment and meeting the UN's Sustainable Development Goals (SDGs), large volumes of investment in sustainable projects and businesses need to be mobilised. A viable sustainable finance market is taking shape in the region to channel commercial investor funds, and both investors and issuers say they are achieving a financial benefit from their investment and financing activities. The market is still in the early stages of development, however, and must expand and mature to meet investor needs.

The chief constraint on sustainable finance growth in the region has been the limited supply of bankable sustainable projects. Our research suggests supply is increasing, but with investor demand continuing to grow apace, the gap will remain an obstacle in the short- to medium-term. Among the organisations in our issuer survey, only 7% have used sustainable finance instruments to fund projects. However, nearly nine in ten (87%) said they intend to do so in the next year, which should begin to bridge the gap between supply and demand.

Based on issuers’ stated intentions, investors will have a range of instruments to choose from, including green loans and bonds and sustainability loans and bonds. Large numbers of investors indicate that they intend to deploy a greater proportion of capital to these over the next three years.

Financing sustainability | Insights video

What is driving the strong demand for financing sustainability in Asia Pacific? How can companies increase supply and start to see the benefits of sustainable finance in the next three years? We interviewed Richard Brandweiner, CEO of Pendal Australia, and Sophia Cheng, CIO of Cathay Financial Holdings and chair of Asia Investor Group on Climate Change, to find out.

To learn more: Download report | View infographic

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

The perfect time for tech in insurance

In recent years, agile players have started harnessing new and emerging technologies to transform the insurance space – and the timing couldn’t be better, the CEO of not-for-profit Insurtech Australia, Rita Yates says.

“Consumers today have completely different expectations from what they had five years ago," she says. "They want everything to be instant, mobile and automated, rather than having to get on the phone and speak to someone.”

Artificial intelligence and big data are two of the most significant new technologies as insurance is inherently a numbers game.

17343

Related content

Tailored with technology | Economic growth

Executives surveyed for this report are optimistic. Of 660 executives we surveyed across eight countries and three industry groupings, fifty-three percent responded that technology will be “much more important” to economic growth five years from now and 42% responded that it will be ”more important.” Only 3.5% answered that the impact of technology would be “about the same” and less than 1% answered it would be “less important.”

Other findings from the research include:

Not surprisingly, the fourth sector surveyed, technology, was the most optimistic, with 61% of executives answering that tech would be “much more important.” At the market level, in Hong Kong just 31% of executives believe tech will be “much more important” in five years. On the other end of the spectrum was India, where 73% answered that tech will be “much more important.” Executives from larger firms, which we define for the purposes of this study as having annual revenue of A$200mn and above (roughly US$137mn at current exchange rates), were more positive on the importance of tech to economic growth than were executives at smaller firms. When asked what their primary considerations are for selecting a technology partner, the two most-popular answers among the six options provided were “the company reputation” and evidence of “ongoing development and investment in the technology and/or platform.” Both received 54% of responses.Is your company ready to tailor with technology?

Take interactive survey to find out >

Tailored with technology: Economic growth is the third in a series of papers from The Economist Intelligence Unit sponsored by ANZ. This report is based on the results of a survey of more than 750 executives across eight markets.

This paper was written by Chris Clague. Findings from the survey were supplemented with research and in-depth interviews with experts and executives. Our thanks are due to the following people, listed alphabetically by surname:

Simon Evenett, professor of international trade and economic development, University of St Gallen Gog Soon Joo, chief futurist and chief skills officer, Skills Future Singapore Andrew Hoad, chief executive officer, Asia, DP World Ritesh Kumar, chief executive officer, Indonomics Consulting Jayant Menon, lead economist, Office of the chief economist and director general, Asian Development Bank Yasunori Mochizuki, fellow for IoT, robotics and smart cities, World Economic Forum

Tailored with technology | Corporate Growth

There is a strong link between corporate growth and technology, according to the first report in The Economist Intelligence Unit’s Tailored with Technology research programme sponsored by ANZ Bank. The report, which is focused on corporate growth, is based on a survey of more than 750 executives in eight economies: Australia, New Zealand, China, Hong Kong, India, Singapore, the United Kingdom and the United States. In the coming weeks, additional reports and articles will be published on the topics of sustainability and the macro-economy, as well as specific industries.

Nine in ten of firms surveyed have strong plans to increase technology adoption in the next five years Improving data analytics was the most popular form of technology, with 44% of the more than 750 executives selecting it as the top benefit The challenges are many, with 51% firms citing security and privacy as a concern and 43% citing technology skills among employeesThe link between corporate growth and technology has always existed, but it’s growing stronger, with nine in ten executives responding that they have plans to increase their adoption of new and emerging technologies. These technologies include robotics, software-defined network, and machine learning, among others. They are being used to accomplish a range of objectives, such as improving efficiency, growing internationally and reducing costs.

The most popular trend today in the survey was big data and analytics. Nearly 38% of respondents selected it as being among their top three priorities, higher than cyber security, artificial intelligence and cloud computing. Big data and analytics are being used by firms for client attraction and retention, as well as risk management and forecasting.

There are barriers to technological adoption, however. Security and privacy is chief among them, with more than 51% of respondents selecting it as one of the three biggest challenges. It was followed at 43% by technology skills among employees and at 39% technology standards and regulation. Many organisations see organisational solutions to these problems, whether it is fostering more cooperation between the chief technology officer and his c-suite counterparts or changing individual mindsets in the workforce.

Is your company ready to tailor with technology?

Take interactive survey to find out >

Tailored with technology | Sustainability

At the same time, there are multiple challenges involved with using technologies for greater sustainability. One is a lack of strategic guidance about where to invest time and money. Another is a lack of clarity as to the best type of technologies to harness.

Successful companies are meeting the needs of an increasingly sustainability-conscious consumer base and turning it into a competitive advantage. The report’s key findings are:

Sustainability is increasingly viewed as a way to increase profit. Besides doing good and contributing to the United Nations Sustainable Development Goals (SDGs), companies realise there is a market opportunity in being sustainable. Technology is increasingly important to boosting sustainability. Almost all survey respondents recognise the importance of technology. Certain industries are thriving as a result of this commercial opportunity. Several technology trends are expected to contribute. Currently led by big data and analytics, but increasingly expected to include artificial intelligence in the development of smart cities in particular. The potential benefits of technology are vast. A large majority of survey respondents expect a spending increase on technology over the long-term, which bodes well for companies and society alike.Is your company ready to tailor with technology?

Take interactive survey to find out >This is the second in a series of papers and articles from The Economist Intelligence Unit, sponsored by ANZ. This report, and the others to follow, is based on the results of a survey of more than 750 executives across eight markets.

This paper was written by Kim Andreasson and edited by Chris Clague. Findings from the survey were supplemented with research and in-depth interviews with experts and executives. Our thanks are due to the following people, listed alphabetically by affiliation:

Michael Cooke, Senior vice president, global HSE and sustainability Affairs, ABB Mikkel Flyverbom, Professor of communication and digital transformations, Copenhagen Business School Mark Milstein, Director of the Center for Sustainable Global Enterprise, SC Johnson College of Business, Cornell University Alexa Dembek, Senior vice president, Chief technology & sustainability officer, DuPont Tim O’Leary, Executive director, government and regional affairs & chief sustainability officer, Telstra

How fintech is fuelling growth

In our survey of more than 750 executives across eight countries, we found 95 percent of companies in the financial services sector are reaping major benefits from deploying fintech services.

17341

Related content

Tailored with technology | Corporate Growth

There is a strong link between corporate growth and technology, according to the first report in The Economist Intelligence Unit’s Tailored with Technology research programme sponsored by ANZ Bank. The report, which is focused on corporate growth, is based on a survey of more than 750 executives in eight economies: Australia, New Zealand, China, Hong Kong, India, Singapore, the United Kingdom and the United States. In the coming weeks, additional reports and articles will be published on the topics of sustainability and the macro-economy, as well as specific industries.

Nine in ten of firms surveyed have strong plans to increase technology adoption in the next five years Improving data analytics was the most popular form of technology, with 44% of the more than 750 executives selecting it as the top benefit The challenges are many, with 51% firms citing security and privacy as a concern and 43% citing technology skills among employeesThe link between corporate growth and technology has always existed, but it’s growing stronger, with nine in ten executives responding that they have plans to increase their adoption of new and emerging technologies. These technologies include robotics, software-defined network, and machine learning, among others. They are being used to accomplish a range of objectives, such as improving efficiency, growing internationally and reducing costs.

The most popular trend today in the survey was big data and analytics. Nearly 38% of respondents selected it as being among their top three priorities, higher than cyber security, artificial intelligence and cloud computing. Big data and analytics are being used by firms for client attraction and retention, as well as risk management and forecasting.

There are barriers to technological adoption, however. Security and privacy is chief among them, with more than 51% of respondents selecting it as one of the three biggest challenges. It was followed at 43% by technology skills among employees and at 39% technology standards and regulation. Many organisations see organisational solutions to these problems, whether it is fostering more cooperation between the chief technology officer and his c-suite counterparts or changing individual mindsets in the workforce.

Is your company ready to tailor with technology?

Take interactive survey to find out >

Tailored with technology | Sustainability

At the same time, there are multiple challenges involved with using technologies for greater sustainability. One is a lack of strategic guidance about where to invest time and money. Another is a lack of clarity as to the best type of technologies to harness.

Successful companies are meeting the needs of an increasingly sustainability-conscious consumer base and turning it into a competitive advantage. The report’s key findings are:

Sustainability is increasingly viewed as a way to increase profit. Besides doing good and contributing to the United Nations Sustainable Development Goals (SDGs), companies realise there is a market opportunity in being sustainable. Technology is increasingly important to boosting sustainability. Almost all survey respondents recognise the importance of technology. Certain industries are thriving as a result of this commercial opportunity. Several technology trends are expected to contribute. Currently led by big data and analytics, but increasingly expected to include artificial intelligence in the development of smart cities in particular. The potential benefits of technology are vast. A large majority of survey respondents expect a spending increase on technology over the long-term, which bodes well for companies and society alike.Is your company ready to tailor with technology?

Take interactive survey to find out >This is the second in a series of papers and articles from The Economist Intelligence Unit, sponsored by ANZ. This report, and the others to follow, is based on the results of a survey of more than 750 executives across eight markets.

This paper was written by Kim Andreasson and edited by Chris Clague. Findings from the survey were supplemented with research and in-depth interviews with experts and executives. Our thanks are due to the following people, listed alphabetically by affiliation:

Michael Cooke, Senior vice president, global HSE and sustainability Affairs, ABB Mikkel Flyverbom, Professor of communication and digital transformations, Copenhagen Business School Mark Milstein, Director of the Center for Sustainable Global Enterprise, SC Johnson College of Business, Cornell University Alexa Dembek, Senior vice president, Chief technology & sustainability officer, DuPont Tim O’Leary, Executive director, government and regional affairs & chief sustainability officer, Telstra

Tailored with technology | Economic growth

Executives surveyed for this report are optimistic. Of 660 executives we surveyed across eight countries and three industry groupings, fifty-three percent responded that technology will be “much more important” to economic growth five years from now and 42% responded that it will be ”more important.” Only 3.5% answered that the impact of technology would be “about the same” and less than 1% answered it would be “less important.”

Other findings from the research include:

Not surprisingly, the fourth sector surveyed, technology, was the most optimistic, with 61% of executives answering that tech would be “much more important.” At the market level, in Hong Kong just 31% of executives believe tech will be “much more important” in five years. On the other end of the spectrum was India, where 73% answered that tech will be “much more important.” Executives from larger firms, which we define for the purposes of this study as having annual revenue of A$200mn and above (roughly US$137mn at current exchange rates), were more positive on the importance of tech to economic growth than were executives at smaller firms. When asked what their primary considerations are for selecting a technology partner, the two most-popular answers among the six options provided were “the company reputation” and evidence of “ongoing development and investment in the technology and/or platform.” Both received 54% of responses.Is your company ready to tailor with technology?

Take interactive survey to find out >

Tailored with technology: Economic growth is the third in a series of papers from The Economist Intelligence Unit sponsored by ANZ. This report is based on the results of a survey of more than 750 executives across eight markets.

This paper was written by Chris Clague. Findings from the survey were supplemented with research and in-depth interviews with experts and executives. Our thanks are due to the following people, listed alphabetically by surname:

Simon Evenett, professor of international trade and economic development, University of St Gallen Gog Soon Joo, chief futurist and chief skills officer, Skills Future Singapore Andrew Hoad, chief executive officer, Asia, DP World Ritesh Kumar, chief executive officer, Indonomics Consulting Jayant Menon, lead economist, Office of the chief economist and director general, Asian Development Bank Yasunori Mochizuki, fellow for IoT, robotics and smart cities, World Economic ForumSustainably green: Creating a sustainable future for finance

About this report

The concept of sustainable investment is not new. Its origins lie in the 1980s with the advent of socially responsible investment. However, particularly since 1995, investors have taken measures to include environmental, social and governance (ESG) factors in their decision-making processes. “Green” investment has come to be very much tied to developments in the most established of “sustainable” finance markets, the green bond market.

Related content

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Risks and opportunities in a changing world

Read our Taxing digital services, U.S. tax reform: The global dimension, & Planning for life after NAFTA articles by clicking the thumbnails below.

A Whole New World: How technology is driving the evolution of intelligent banking in North America

North American bankers sense danger more than most when new entrants join their market, according to a global retail banking survey conducted by the Economist Intelligence Unit. In anticipation of 2020, nearly a third of local respondents (33%) are feeling pressure from the changing competitive environment, compared to 28% globally. An even more pressing issue for North American bankers is keeping on top of changing customer behaviour and demands (cited by 34% for 2020 and 33% for 2025).

17325

Related content

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Risks and opportunities in a changing world

Read our Taxing digital services, U.S. tax reform: The global dimension, & Planning for life after NAFTA articles by clicking the thumbnails below.