Financing sustainability: How do investors and issuers in APAC's sustainable finance market view the present market opportunities and constraints?

To learn more:

Financing sustainability: How do investors and issuers in APAC's sustainable finance market view the present market opportunities and constraints?

To learn more:

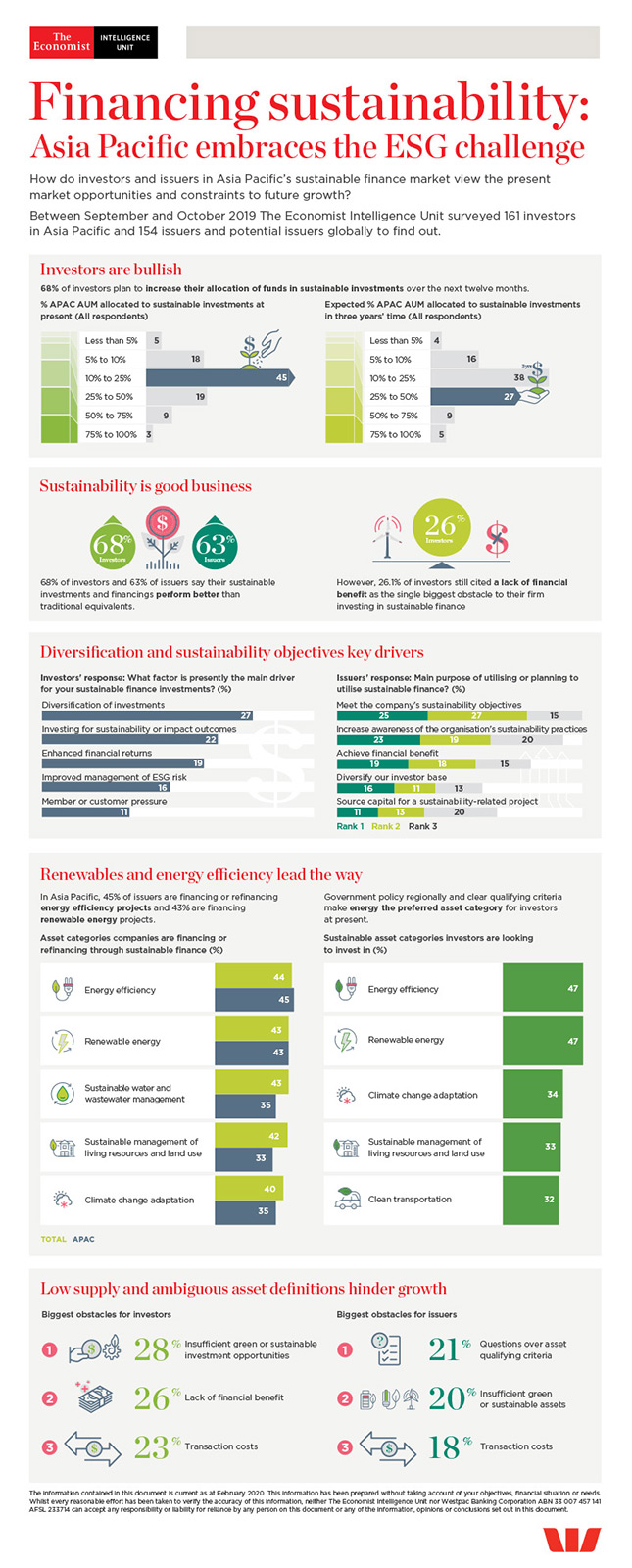

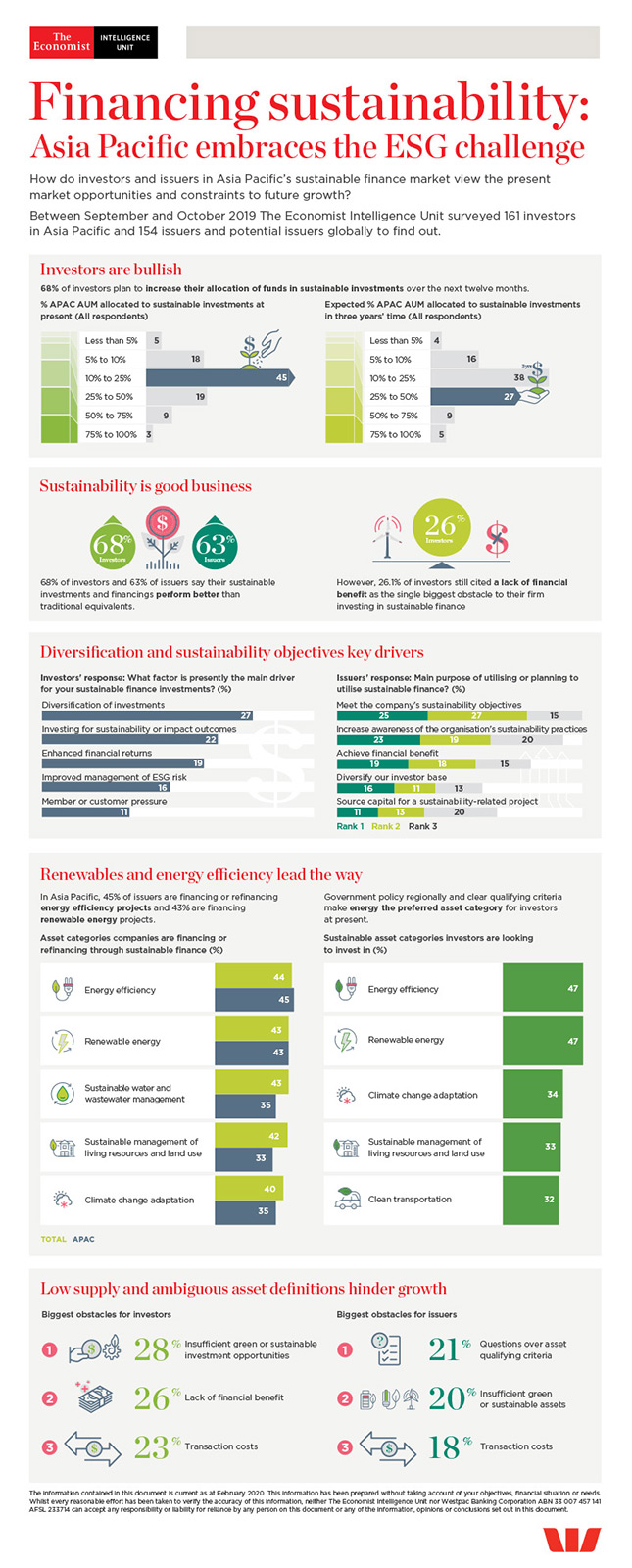

Financing sustainability: Asia Pacific embraces the ESG challenge is an Economist Intelligence Unit report, sponsored by Westpac. It explores the drivers of sustainable finance growth in Asia Pacific as well as the factors constraining it. The analysis is based on two parallel surveys—one of investors and one of issuers—conducted in September and October 2019.

If the countries of Asia Pacific are to limit the negative environmental effects of continued economic growth, and companies in the region are to mitigate their potential climate risks and make a positive business contribution through improving the environment and meeting the UN's Sustainable Development Goals (SDGs), large volumes of investment in sustainable projects and businesses need to be mobilised. A viable sustainable finance market is taking shape in the region to channel commercial investor funds, and both investors and issuers say they are achieving a financial benefit from their investment and financing activities. The market is still in the early stages of development, however, and must expand and mature to meet investor needs.

The chief constraint on sustainable finance growth in the region has been the limited supply of bankable sustainable projects. Our research suggests supply is increasing, but with investor demand continuing to grow apace, the gap will remain an obstacle in the short- to medium-term. Among the organisations in our issuer survey, only 7% have used sustainable finance instruments to fund projects. However, nearly nine in ten (87%) said they intend to do so in the next year, which should begin to bridge the gap between supply and demand.

Based on issuers’ stated intentions, investors will have a range of instruments to choose from, including green loans and bonds and sustainability loans and bonds. Large numbers of investors indicate that they intend to deploy a greater proportion of capital to these over the next three years.

What is driving the strong demand for financing sustainability in Asia Pacific? How can companies increase supply and start to see the benefits of sustainable finance in the next three years? We interviewed Richard Brandweiner, CEO of Pendal Australia, and Sophia Cheng, CIO of Cathay Financial Holdings and chair of Asia Investor Group on Climate Change, to find out.

To learn more: Download report | View infographic

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.

Enjoy in-depth insights and expert analysis - subscribe to our Perspectives newsletter, delivered every week

The Economist Group is a global organisation and operates a strict privacy policy around the world. Please see our privacy policy here