Alongside professional services, it plays a pivotal role in the modern economy and international trade flows. The Covid-19 pandemic significantly disrupted the industry that was already being reshaped by the effects of the global financial crisis, sustainability drive and digital innovation. Digital transformation, changing customer preferences and regulatory pressures, are also challenging existing business models in financial and related professional services.

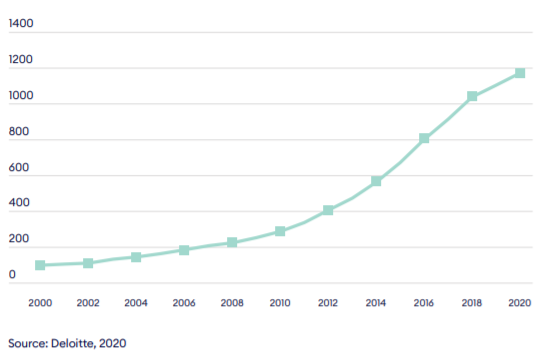

Despite entering the pandemic more resilient than it has been prior to the previous crisis, and stronger than expected performance in 2021, the global banking sector may register losses as a result of the pandemic over the next years. These will show in the form of credit losses, with defaults expected to soar as state support is withdrawn. One estimate forecast the industry’s loss in revenue at US$3.7trn over the next five years.1 Moreover, the uneven nature of the post-pandemic recovery will hit some regions and sectors harder than others. There is limited scope for wider margins in developed markets, with interest rates low and financial services utilisation high. In developed economies there is much greater space to reach new customers, despite the increase in credit risks.2 Digital technologies are restructuring the way financial services are provided, the competition dynamics and how the customers interact with the industry. The rise of financial technology (fintech), blockchain and artificial intelligence companies, are threatening traditional providers of financial services through increased competition. Challenger neobanks (digital-only providers) and telecom providers are gradually increasing their share in the market, both in terms of processes and services offered to customers. Traditional providers that struggle to shift activities to digital channels risk losing market share and the ability to reach new customers. In 2018 fintech companies already accounted for 38% of unsecured personal lending in the US, while they are “economically relevant” in SME financing in China, the US and the UK, according the Bank for International Settlements (BIS).3

Fintech boom: Number of UK Fintech companies (rebased at year 2000), 2000-2020

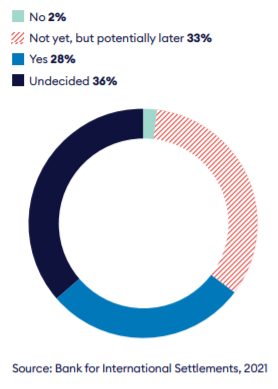

Digital currencies have increasingly become the focus in central banks around the world amid growing government, business and consumer interest. A Central Bank Digital Currency (CBDC) would allow central banks to issue electronic money available to all households and businesses, allowing them to make payments in CBDC. A report from the Bank for International Settlements highlighted that 28% of 50 central banks surveyed were looking into CBDC interoperability.4 Of the major world economies, China is thought to be the most advanced CBDC testing, with the e-CNY digital yuan expected to launch in 2022.5 CBDCs could bring wider access, stronger governance and privacy standards to digital payments systems, currently dominated by cryptocurrencies such as Bitcoin.

Going digital: Willingness of central Banks to adopt range of approaches to interoperabilty of Central Bank Digital Currency (CBDCs) (%), 2021

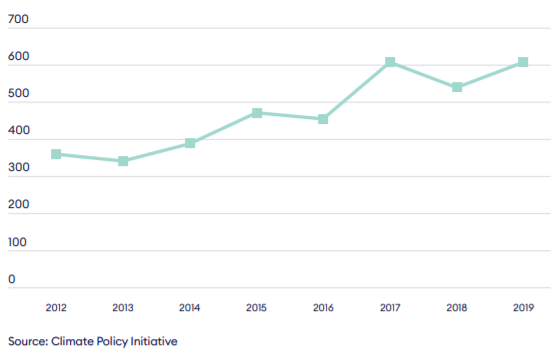

There is also growing consensus that financial services actors need to upgrade their agenda towards climate finance, as net zero cannot be achieved without the funding needed to mitigate the physical risks of the impact of climate change. Global climate financing was estimated to have reached up to US$620 in 2019, the bulk of which through debt issuance. Financing a transition to a climate-resilient economy will require much greater investment than is currently being committed, and failure to provide it will result in even more investment for climate adaptation and mitigation in the longer term. Estimates suggest that US$100-150trn will be needed to reach the 1.5-degree target by 2050.6

Climate finance growth: Total global climate finance flows (US$bn), 2012-2019

The growing prominence of institutional and private investment in climate financing has prompted regulatory efforts to drive climate related activities. Regulation is responding to market developments with new tools, such as green bonds, and shaping the disclosure requirements through the launch of the Taskforce on Climate-related Financial Disclosures. However, more needs to be done to incentivise climate financing and the financial services industry has a vital role in facilitating the tools and mechanisms that will help address climate change.