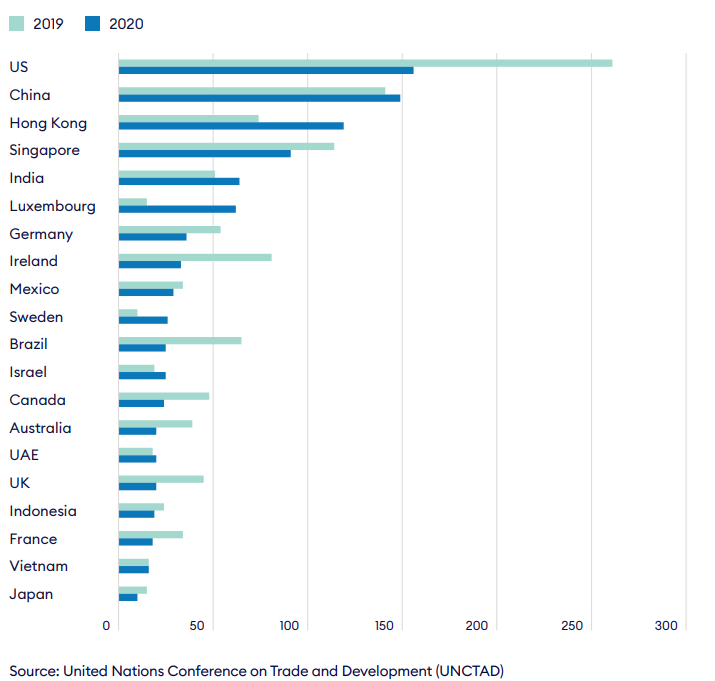

Whilst the immediate effects have been severe, the pandemic has further accelerated trends that are reshaping the global investment landscape, such as the push for digital, sustainable and resilient solutions in a world that has turned more fragmented. Estimates suggest that in 2020 global trade in goods fell by 8%, while foreign direct investment (FDI) flows fell by a record 35% to US£1trn, the lowest figure since 2005.1 2 The retraction in global cross-border investments was more severe in developed economies, where FDI inflows and outflows fell by almost 60%. On the other hand, developing economies saw FDI inflows and outflows fall by only 10% largely due to resilient flows in Asia, particularly in China and India.3

During the pandemic the internationalisation of major multinational enterprises (MNEs) stagnated, although the degree of this effect varied considerably across industries. The value of announced greenfield investment fell by 33% to a record low of US$564bn, cross border M&A investment fell by 6% to US$475bn while project finance deals registered a 42% decline to US$367bn in 2020.4 The UNCTAD forecasts suggest global FDI flows have recover some ground in 2021 and return to pre-pandemic levels (2019) in 2022. Developed economies are expected to drive the growth in FDI, particularly in M&A activity and public investment support. These measures will have a positive effect on infrastructure, green, and digital economy sectors.5

Over the past two decades, the increasing investment in services, enlarged pool of cross border investors and the focus on emerging technologies have shaped the global investment landscape. The gradual servicification of manufacturing and the rapid rise of global digital technology companies have driven an upwards trajectory for investment in services. Services accounted for 60% of announced greenfield projects and 71% of announced cross border M&A deals in 2020.6 The sources of the investment flows are also becoming more diversified, with the emerging markets accounting for almost one fifth of global M&A deals by value and almost half the total value of global greenfield and international project investment in 2020.7 State-owned investors (SOIs), including largely emerging-market-located sovereign wealth funds (SWFs) have also become prevalent in the investment landscape with a growing appetite for alternative asset classes and active investment strategies.

Changing guards: Top host economies by FDI inflows (2019-20)

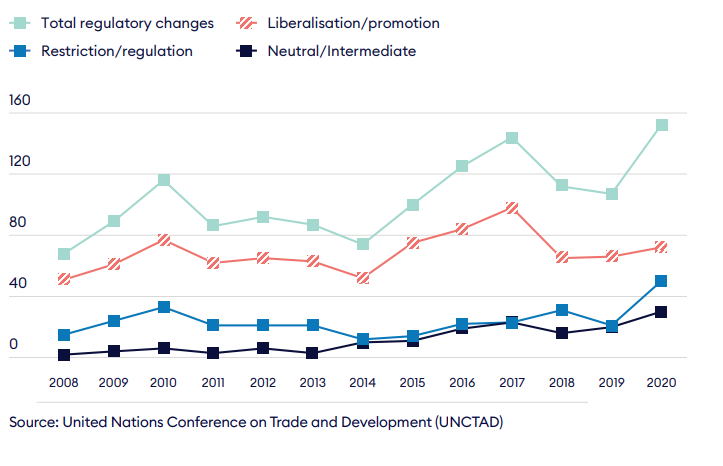

As the global economy recovers from the pandemic, major forces ranging from emerging technologies, investment policy sustainability and geopolitics will reshape the pattern of the global investment landscape. FDI regulations and policies, already gaining traction prior to the pandemic, have been deployed by national governments to address supply chain vulnerabilities and the risk of predatory takeovers of strategic sectors. The number of investment policy measures adopted in 2020 rose by 40% compared to 2019, with the ratio of restrictive policy measures to liberalisation measures increasing by 41%.8

GVCs will also adopt new modes of business operation to enhance resilience, flexibility and uncertainty of considering the current global business environment. This could involve elements of reshoring or regionalisation for businesses, while governments are expected to gear up efforts to increase sustainability of business operations through integration of environmental, social and governance standards into regulatory frameworks for foreign investments and capital markets. Geopolitics and the changing geography of global demand will impact the international investment as developing countries continue to deepen their participation in global investment flows and tension remains high in the rivalry between the US-China.9

Policies matter: Number of investment policy measures adopted globally between 2008-2020