A path to peace through inclusion

The peace accord agreed late last year between the government and the FARC paramilitary group gives Colombia a historic opportunity to improve the living standards of all its people. More than half a century of conflict cost an estimated 220,000 lives and led over 5m people to flee their homes, with severe consequences for the country’s prosperity, especially in the rural areas where violence was concentrated.

More from this series

white paper

A path to peace through inclusion

As the implementation of the peace accord begins, Colombia’s economy is facing the toughest conditions in many years.

Related content

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

Breaking Barriers: Agricultural trade between GCC and Latin America

The GCC-LAC agricultural trading relationship has thus far been dominated by the GCC’s reliance on food imports, specifically meat, sugar, and cereals. Over the past two years, however, there has been a notable decline in the share of sugar imported from LAC, and 2017 saw the biggest importers in the GCC—Saudi Arabia and the UAE—impose a ban on Brazilian meat.

Market players on both sides of the aisle are keen to grow the relationship further, but there are hurdles to overcome. In this report, we explore in greater depth the challenges that agricultural exporters and importers in LAC and the GCC face. We consider both tariff and non-tariff barriers and assess key facets of the trading relationship including transport links, customs and certification, market information, and trade finance.

Key findings of the report:

GCC will need to continue to build partnerships to ensure a secure supply of food. Concerns over food security have meant that the GCC countries are exploring ways to produce more food locally. However, given the region’s climate and geology, food imports will remain an important component of the food supply. Strengthening partnerships with key partners such as those in LAC, from which it sourced 9% of its total agricultural imports in 2016, will be vital to food security in the region.

There is a wider range of products that the LAC countries can offer the GCC beyond meat, sugar and cereals. Providing more direct air links and driving efficiencies in shipping can reduce the time and cost of transporting food products. This will, in turn, create opportunities for LAC exporters to supply agricultural goods with a shorter shelf life or those that are currently too expensive to transport. Exporters cite examples such as berries and avocados.

The GCC can engage small and medium-sized producers that dominate the LAC agricultural sector by offering better trade financing options and connectivity. More direct air and sea links can reduce the cost of transporting food products, making it viable for smaller players to participate in agricultural trade. The existing trade financing options make it prohibitive for small and medium-sized players too. Exporters in LAC suggest that local governments and private companies in the GCC can offer distribution services with immediate payments to smaller suppliers at a discount.

Blockchain technology is poised to address key challenges market players face in agricultural trade. Through a combination of smart contracts and data captured through devices, blockchain technology can help to reduce paperwork, processing times and human error in import and export processes. It can improve transparency, as stakeholders can receive information on the state of goods and status of shipments in real time. Finally, it can help with food safety and quality management—monitoring humidity and temperature, for instance, along the supply chain can help to pinpoint batches that may be contaminated, minimising the need for a blanket ban on a product.

A path to peace through inclusion

As the implementation of the peace accord begins, Colombia’s economy is facing the toughest conditions in many years. After a long period of strong growth, external factors including the apparent end of a long bull market in commodities and a sharp rise in the US dollar have helped slow the rate of GDP growth from an average of over 4% a year during 2001–15 (and record high of an annualised 8% in the first quarter of 2007) to 2% in 2016.

Related content

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

Breaking Barriers: Agricultural trade between GCC and Latin America

The GCC-LAC agricultural trading relationship has thus far been dominated by the GCC’s reliance on food imports, specifically meat, sugar, and cereals. Over the past two years, however, there has been a notable decline in the share of sugar imported from LAC, and 2017 saw the biggest importers in the GCC—Saudi Arabia and the UAE—impose a ban on Brazilian meat.

Market players on both sides of the aisle are keen to grow the relationship further, but there are hurdles to overcome. In this report, we explore in greater depth the challenges that agricultural exporters and importers in LAC and the GCC face. We consider both tariff and non-tariff barriers and assess key facets of the trading relationship including transport links, customs and certification, market information, and trade finance.

Key findings of the report:

GCC will need to continue to build partnerships to ensure a secure supply of food. Concerns over food security have meant that the GCC countries are exploring ways to produce more food locally. However, given the region’s climate and geology, food imports will remain an important component of the food supply. Strengthening partnerships with key partners such as those in LAC, from which it sourced 9% of its total agricultural imports in 2016, will be vital to food security in the region.

There is a wider range of products that the LAC countries can offer the GCC beyond meat, sugar and cereals. Providing more direct air links and driving efficiencies in shipping can reduce the time and cost of transporting food products. This will, in turn, create opportunities for LAC exporters to supply agricultural goods with a shorter shelf life or those that are currently too expensive to transport. Exporters cite examples such as berries and avocados.

The GCC can engage small and medium-sized producers that dominate the LAC agricultural sector by offering better trade financing options and connectivity. More direct air and sea links can reduce the cost of transporting food products, making it viable for smaller players to participate in agricultural trade. The existing trade financing options make it prohibitive for small and medium-sized players too. Exporters in LAC suggest that local governments and private companies in the GCC can offer distribution services with immediate payments to smaller suppliers at a discount.

Blockchain technology is poised to address key challenges market players face in agricultural trade. Through a combination of smart contracts and data captured through devices, blockchain technology can help to reduce paperwork, processing times and human error in import and export processes. It can improve transparency, as stakeholders can receive information on the state of goods and status of shipments in real time. Finally, it can help with food safety and quality management—monitoring humidity and temperature, for instance, along the supply chain can help to pinpoint batches that may be contaminated, minimising the need for a blanket ban on a product.

Drivers of prosperity in Africa

Related content

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

Breaking Barriers: Agricultural trade between GCC and Latin America

The GCC-LAC agricultural trading relationship has thus far been dominated by the GCC’s reliance on food imports, specifically meat, sugar, and cereals. Over the past two years, however, there has been a notable decline in the share of sugar imported from LAC, and 2017 saw the biggest importers in the GCC—Saudi Arabia and the UAE—impose a ban on Brazilian meat.

Market players on both sides of the aisle are keen to grow the relationship further, but there are hurdles to overcome. In this report, we explore in greater depth the challenges that agricultural exporters and importers in LAC and the GCC face. We consider both tariff and non-tariff barriers and assess key facets of the trading relationship including transport links, customs and certification, market information, and trade finance.

Key findings of the report:

GCC will need to continue to build partnerships to ensure a secure supply of food. Concerns over food security have meant that the GCC countries are exploring ways to produce more food locally. However, given the region’s climate and geology, food imports will remain an important component of the food supply. Strengthening partnerships with key partners such as those in LAC, from which it sourced 9% of its total agricultural imports in 2016, will be vital to food security in the region.

There is a wider range of products that the LAC countries can offer the GCC beyond meat, sugar and cereals. Providing more direct air links and driving efficiencies in shipping can reduce the time and cost of transporting food products. This will, in turn, create opportunities for LAC exporters to supply agricultural goods with a shorter shelf life or those that are currently too expensive to transport. Exporters cite examples such as berries and avocados.

The GCC can engage small and medium-sized producers that dominate the LAC agricultural sector by offering better trade financing options and connectivity. More direct air and sea links can reduce the cost of transporting food products, making it viable for smaller players to participate in agricultural trade. The existing trade financing options make it prohibitive for small and medium-sized players too. Exporters in LAC suggest that local governments and private companies in the GCC can offer distribution services with immediate payments to smaller suppliers at a discount.

Blockchain technology is poised to address key challenges market players face in agricultural trade. Through a combination of smart contracts and data captured through devices, blockchain technology can help to reduce paperwork, processing times and human error in import and export processes. It can improve transparency, as stakeholders can receive information on the state of goods and status of shipments in real time. Finally, it can help with food safety and quality management—monitoring humidity and temperature, for instance, along the supply chain can help to pinpoint batches that may be contaminated, minimising the need for a blanket ban on a product.

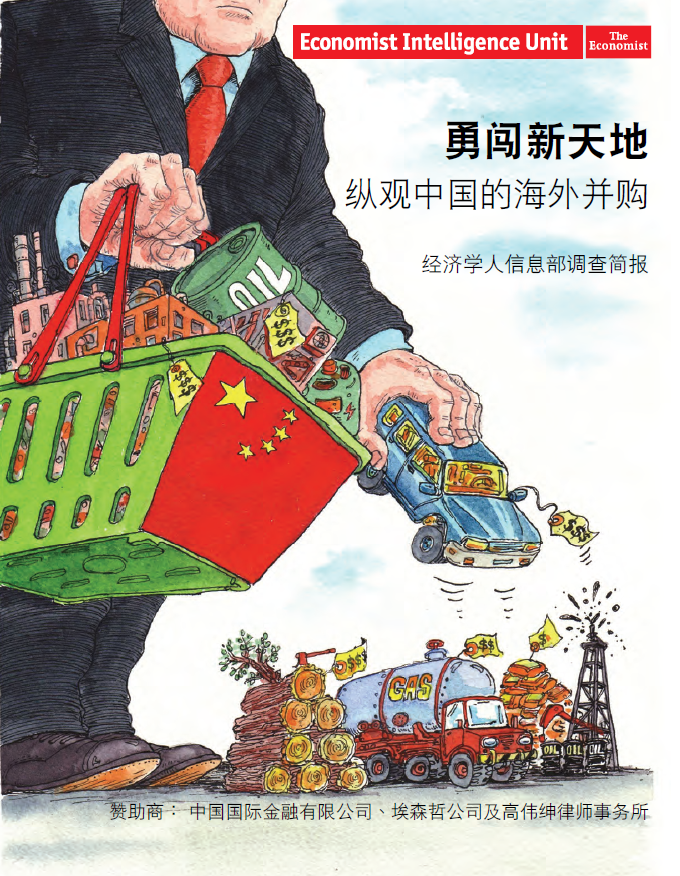

A brave new world - Chinese

诸多迹象显示中国经济实力呈持续增长态势,其中一个现象就是寻求在海外收购资产的中国公司数量急剧增长。2009年,当发达经济体仍然在全球金融危机的泥沼中举步维艰时,中国公司进行跨国收购的数量却创下了新的历史记录,总数约298宗。许多中国投资都深受资金短缺的西方企业欢迎,因为如果没有中国的投资,它们将面临严峻的生存危机。然而,中国的大肆收购却引发了诸多忧虑,尤其当有中国国有企业参与海外竞购时,这种担忧便愈发强烈。与此前的西方同行一样,中国企业逐渐意识到要顺利完成并购绝非易事,进行跨过并购尤为如此。

在《勇闯新天地:纵观中国的海外并购》(A brave new world: The climate for Chinese M&A abroad)报告中,我们试图了解这些计划进行海外资产收购的中国企业的担忧与期望,并试图为这些企业提供一个视角,让它们能够了解潜在并购对象和国外监管机构所存在的关切。

Related content

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

Breaking Barriers: Agricultural trade between GCC and Latin America

The GCC-LAC agricultural trading relationship has thus far been dominated by the GCC’s reliance on food imports, specifically meat, sugar, and cereals. Over the past two years, however, there has been a notable decline in the share of sugar imported from LAC, and 2017 saw the biggest importers in the GCC—Saudi Arabia and the UAE—impose a ban on Brazilian meat.

Market players on both sides of the aisle are keen to grow the relationship further, but there are hurdles to overcome. In this report, we explore in greater depth the challenges that agricultural exporters and importers in LAC and the GCC face. We consider both tariff and non-tariff barriers and assess key facets of the trading relationship including transport links, customs and certification, market information, and trade finance.

Key findings of the report:

GCC will need to continue to build partnerships to ensure a secure supply of food. Concerns over food security have meant that the GCC countries are exploring ways to produce more food locally. However, given the region’s climate and geology, food imports will remain an important component of the food supply. Strengthening partnerships with key partners such as those in LAC, from which it sourced 9% of its total agricultural imports in 2016, will be vital to food security in the region.

There is a wider range of products that the LAC countries can offer the GCC beyond meat, sugar and cereals. Providing more direct air links and driving efficiencies in shipping can reduce the time and cost of transporting food products. This will, in turn, create opportunities for LAC exporters to supply agricultural goods with a shorter shelf life or those that are currently too expensive to transport. Exporters cite examples such as berries and avocados.

The GCC can engage small and medium-sized producers that dominate the LAC agricultural sector by offering better trade financing options and connectivity. More direct air and sea links can reduce the cost of transporting food products, making it viable for smaller players to participate in agricultural trade. The existing trade financing options make it prohibitive for small and medium-sized players too. Exporters in LAC suggest that local governments and private companies in the GCC can offer distribution services with immediate payments to smaller suppliers at a discount.

Blockchain technology is poised to address key challenges market players face in agricultural trade. Through a combination of smart contracts and data captured through devices, blockchain technology can help to reduce paperwork, processing times and human error in import and export processes. It can improve transparency, as stakeholders can receive information on the state of goods and status of shipments in real time. Finally, it can help with food safety and quality management—monitoring humidity and temperature, for instance, along the supply chain can help to pinpoint batches that may be contaminated, minimising the need for a blanket ban on a product.

Talking US trade: The view from Hong Kong - Traditional Chinese

本文基於《貿易條款:了解美國的貿易動態》(Terms of trade: Understanding trade dynamics in the US)報告進行的調查撰寫。報告由美國運通(American Express)委託經濟學人智庫(The Economist Intelligence Unit/EIU)撰寫,此調查獲得香港50位高管的回應。本文從外國公司的 角度審查了與世界上最大的經濟體交易的主要層面。

16520

Related content

Terms of Trade: Understanding trade dynamics in the US

The findings are based on an executive survey of 531 companies that trade with the US, conducted by The EIU in March and April 2016, as well as desk research and interviews with experts.

Key findings:

- Companies are optimistic about future trade activity with the US. Two-thirds of respondents in our survey anticipate that their company’s trade with the US will increase over the next five years, with over 43% expecting an increase of 10% or more.

- Companies face a number of issues in trading with the US, but none of these are perceived to be insurmountable. Survey respondents cited exchange-rate volatility (41%), transport costs and delays (32%), trade-related infrastructure (32%) and making payments (32%) as their top challenges.

- The overall quality of trade-related infrastructure in the US is rated highly. Deeper investigation, however, points to shortcomings with ports and land borders, revealing that infrastructure development has not kept pace with the increase in trade activity and requires significant investment for expansion and automation.

- Delays at ports and land-border crossings arise primarily as a result of regulatory requirements. The top sources of regulatory challenges include customs duties and valuation (26% of respondents), licensing requirements (23%) and product-quality standards (20%).

- The post-9/11 security paradigm shift has increased the administrative requirements faced by foreign companies.

- Trade-related regulatory challenges impose significant additional costs on foreign companies. Over 40% of survey respondents indicate that trade-related regulatory challenges increase the cost of doing business by 10-30%, with an additional 15% reporting an increase of more than 30%.

- Payment-related challenges arise from a range of issues, particularly process inefficiencies (52%) and limited payment visibility (52%).

- Foreign companies look to key developments in policy and politics to understand the outlook for trading with the US, closely tracking the rhetoric on the campaign trail for the 2016 US presidential election.

- The negotiation of new trade deals, the Trans-Pacific Partnership (TPP) in particular, will bring new opportunities. Survey findings strongly corroborate this sentiment: 49% of respondents expect the TPP to improve opportunities for trade with the US market moderately, while an additional 29% believe it will improve opportunities substantially.

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

SMEs and Global Growth

This EIU article series, sponsored by Mazars, explores the challenges facing mid-market firms when expanding internationally for the first time. They look at companies in a range of industries and home markets and show how these have responded to the challenges.

Read and download all five articles below.

More from this series

article

SMEs and Global Growth: The High-Tech Advantage

To a greater extent every day, information technology is levelling the playing field for small and mid-sized enterprises

article

SMEs and Global Growth: Meeting Logistics Challenges

A small or mid-sized enterprise (SME) establishing a presence in a new foreign market faces steep learning curves on

article

SMEs and Global Growth: Navigating the Legal and Tax Maze

American statesman and inventor Benjamin Franklin once famously said that nothing is certain in life except death and

article

SMEs and Global Growth: Sustaining Growth and Development

When a small or mid-sized enterprise (SME) ventures abroad for the first time, its first aim is typically to kick-start

article

SMEs and Global Growth: Finding Local Partners

Hoping to profit from a wave of investment in China by large multinationals, small and mid-sizedenterprises (SMEs) based

Related content

The Hinrich Foundation Sustainable Trade Index 2018

Yet the enthusiasm in Asia for trade does not appear to have waned. This broad societal consensus behind international trade has enabled Asian countries to continue broadening and deepening existing trading relationships, for example, by quickly hammering out a deal for the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) in early 2018 following the US’s withdrawal from its predecessor in 2017.

Asia, then, finds itself in the unique position of helping lead and sustain the global economy’s commitment to free and fair trade. It is in this context that the need for sustainability in trade is ever more crucial.

The Hinrich Foundation Sustainable Trade Index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policymakers, business executives, and civil society leaders must take into account when managing and advancing international trade.

The index was commissioned by the Hinrich Foundation, a non-profit organisation focused on promoting sustainable trade. This, the second edition of the study, seeks to measure the capacity of 20 economies—19 in Asia along with the US—to participate in the international trading system in a manner that supports the long-term domestic and global goals of economic growth, environmental protection, and strengthened social capital. The index’s key findings include:

Countries in Asia, especially the richer ones, have broadly regressed in terms of trade sustainability. Hong Kong is developed Asia’s bright spot, recording a slight increase in its score and topping the 2018 index. Several middle-income countries perform admirably, led by Sri Lanka. For the economic pillar, countries generally performed well in terms of growing their labour forces as well as their per-head GDPs. For the social pillar, sharp drops for some countries in certain social pillar indicators contribute to an overall decline. For the environmental pillar, with deteriorating environmental sustainability in many rich countries, China, Laos and Pakistan are the only countries to record increases in scores. Sustainability is an ever more important determinant of FDI and vendor selection in choosing supply-chain partners. Companies are improving the sustainability of their supply chains by restructuring and broadening relationships with competitors and vendors.

The Global Illicit Trade Environment Index 2018

To measure how nations are addressing the issue of illicit trade, the Transnational Alliance to Combat Illicit Trade (TRACIT) has commissioned The Economist Intelligence Unit to produce the Global Illicit Trade Environment Index, which evaluates 84 economies around the world on their structural capability to protect against illicit trade. The global index expands upon an Asia-specific version originally created by The Economist Intelligence Unit in 2016 to score 17 economies in Asia.

View the Interactive Index >> Download workbook

Breaking Barriers: Agricultural trade between GCC and Latin America

The GCC-LAC agricultural trading relationship has thus far been dominated by the GCC’s reliance on food imports, specifically meat, sugar, and cereals. Over the past two years, however, there has been a notable decline in the share of sugar imported from LAC, and 2017 saw the biggest importers in the GCC—Saudi Arabia and the UAE—impose a ban on Brazilian meat.

Market players on both sides of the aisle are keen to grow the relationship further, but there are hurdles to overcome. In this report, we explore in greater depth the challenges that agricultural exporters and importers in LAC and the GCC face. We consider both tariff and non-tariff barriers and assess key facets of the trading relationship including transport links, customs and certification, market information, and trade finance.

Key findings of the report:

GCC will need to continue to build partnerships to ensure a secure supply of food. Concerns over food security have meant that the GCC countries are exploring ways to produce more food locally. However, given the region’s climate and geology, food imports will remain an important component of the food supply. Strengthening partnerships with key partners such as those in LAC, from which it sourced 9% of its total agricultural imports in 2016, will be vital to food security in the region.

There is a wider range of products that the LAC countries can offer the GCC beyond meat, sugar and cereals. Providing more direct air links and driving efficiencies in shipping can reduce the time and cost of transporting food products. This will, in turn, create opportunities for LAC exporters to supply agricultural goods with a shorter shelf life or those that are currently too expensive to transport. Exporters cite examples such as berries and avocados.

The GCC can engage small and medium-sized producers that dominate the LAC agricultural sector by offering better trade financing options and connectivity. More direct air and sea links can reduce the cost of transporting food products, making it viable for smaller players to participate in agricultural trade. The existing trade financing options make it prohibitive for small and medium-sized players too. Exporters in LAC suggest that local governments and private companies in the GCC can offer distribution services with immediate payments to smaller suppliers at a discount.

Blockchain technology is poised to address key challenges market players face in agricultural trade. Through a combination of smart contracts and data captured through devices, blockchain technology can help to reduce paperwork, processing times and human error in import and export processes. It can improve transparency, as stakeholders can receive information on the state of goods and status of shipments in real time. Finally, it can help with food safety and quality management—monitoring humidity and temperature, for instance, along the supply chain can help to pinpoint batches that may be contaminated, minimising the need for a blanket ban on a product.

SMEs and Global Growth: Meeting Logistics Challenges

A small or mid-sized enterprise (SME) establishing a presence in a new foreign market faces steep learning curves on several fronts. It must familiarise itself with the needs and preferences of a new market, ensure compliance with a new set of laws, find and train local staff, arrange financing, and sometimes learn a new language at the same time.

16513

Related content

SMEs and Global Growth: Finding Local Partners

Hoping to profit from a wave of investment in China by large multinationals, small and mid-sizedenterprises (SMEs) based in Germany flocked to that country in the 1990s. China’s government welcomed them: like many other countries, China was intrigued by Germany’s Mittelstand firms— usually stable, technologically sophisticated, family owned firm —and wanted to learn from them. But despite the welcome—or perhaps because of that desire to learn from the newcomers— China often required the newcomers to establish formal joint ventures with Chinese partners. This requirement did not diminish the German SMEs’ interest; indeed, many Mittelstand firms saw the joint ventures as a way to get acclimated in China.

Today, though, the partnership requirements have eased for the approximately 5,200 German firms invested in China. As a result, most German firms have decided to go it alone in the Chinese market. Turck Technology, a family-owned German industrial automation company with annual sales of around €500m, is a case in point. It established a wholly owned subsidiary in China rather than partner with a Chinese firm. Its aim was to maintain control, ensure consistent quality, and protect its designs. The firm’s Chinese sales are about €40m a year, “the same level as our competitors,” says Christoph Kaiser, Turck’s managing director.

By now, only 12% of the German companies invested in China use formal joint ventures, says Alexandra Voss, executive director of the German Chamber of Commerce in north China. “Where the former joint venture requirements no longer exist, German companies tend to purchase the joint venture shares from their former partner rather than extending the agreement,” she says.

JOINT-VENTURE “LIGHT”

Between the two extremes—a formal joint venture and a go-it-alone subsidiary—there is a wide range of looser partnerships possible between SMEs in different countries. Among the most popular such tie-ups are those involving licensing and technical co-operation agreements. The challenge for SMEs in these arrangements—as in full-fledged joint venture deals—is to preserve their proprietary information while benefitting from enhanced access to the local market.

For example, James Cropper, a family-owned UK paper maker, expanded internationally in recent years, to the point where around half of its £88m revenue now comes from export markets. In China, it signed a technical co-operation agreement with a local firm to design fibres for high-end carbon bicycles. Despite cooperating on adapting products for the local market, the agreement sets strict guidelines to protect James Cropper’s know-how. “We wanted to keep control of intellectual property,” says its CEO Phil Wild.

Licencing agreements are another way to boost foreign sales without requiring a formal joint venture. Under such agreements, a local company buys the rights to market (and sometimes produce and develop) the exporting firm’s brand or products. The local partner does not have equity rights, making such agreements popular among small exporters with limited capital.

Australian pharmaceuticals firm Suda and its Chinese partner Eddingpharm provide an example of a licencing agreement. Suda, with revenues of just A$6.3m a year, would have struggled to afford to expand into China in its own name, or to invest in a joint venture. In late 2015, it signed a licensing agreement with Eddingpharm to produce and sell its drugs in China. Among the sweeteners for Suda: an upfront payment of US$300,000 and another US$200,000 when its product is registered in China. For small companies, licencing can offer an immediate cash injection, as well as a way to enter new markets.

A “lighter” variant of a licencing agreement is a simple sales-representative deal, in which a local firm contracts to market, sell and distribute the exporting firm’s products in the target market. David Butler, CEO of the South African Chamber of Commerce in London, says many of his country’s food exporters take this approach in the UK, benefiting from the market reach of UK retail chains and specialist distribution firms.

Such arrangements can help to avoid the biggest danger inherent in full-fledged joint ventures: their high failure rate. McKinsey, the management consultancy, estimates that up to 60% of international ventures fail.1 Among the major problems: partners may have incompatible objectives, for example with one wanting to maximise long-term market share and the other wishing to make a quick profit. The US advisory firm Water Street Partners finds that around twothirds of joint venture CEOs say the owners are misaligned on long-term strategy and on budget issues.2 A more limited technical co-operation agreement can sidestep such fundamental issues.

MATCH-MAKERS

What all these partnerships—the full-fledged joint venture agreements and the “lighter” variants— share in common is the marriage of an exporting firm’s product know-how and a local firm’s market expertise. Regardless of the form that a partnership takes, the fundamental questions apply: how to find the right local partner, and how to structure the agreement to avoid common pitfalls.

“That’s the million dollar question,” says Mr Harris, the US lawyer. “[The answer] is usually based on the [specific] business involved. If you are an educational software company, you think about partnering with the top one or two companies in China that distribute or sell educational software. If you make high-end [technical] widgets, you may partner with the one or two best high-end widget companies in China—whose widgets, though high-end for China, are not nearly as good as yours, and therefore they could use your help. You find these companies yourself, or you hire a consultant to help you find them.”

The routes to finding foreign partners vary. James Cropper found its Chinese partner via the contacts it had made in the country by selling there directly. It sought out Chinese partners with expertise and complementary skills for its high-end fibres division. It also looked for Chinese firms with industry contacts and specialist expertise to sell to high-end bicycle manufacturers.

Indeed, the search for such partners is often mutual, with Chinese firms eager for foreign partnerships. Eddingpharm, the pharma company licensing products from Suda, first entered the business via licensing deals with multinational pharma companies Novartis and Baxter in the early 2000s. In 2012, backed by international investors, Eddingpharm established a US subsidiary to seek out other product lines for distribution in China, as well as deals to develop and market such products. Among its wins: an agreement with Suda to develop and market an insomnia drug which the small Australian company would have struggled to sell in China on its own.

Companies that lack contacts in a target foreign market often turn to consultants for help. Firms such as Prospect Chinese Services, which is staffed by Chinese nationals and has offices across the UK and China, advise clients ranging from hotels and universities to car manufacturers wishing to enter the Chinese market. It claims to offer a ‘one stop shop’ for UK companies, comprising market research and market entry strategy services, support with first contacts, and advice on negotiations.

Other match-makers include government export promotion agencies, which compile large databases of foreign companies and can put exporters in touch with potential foreign partners. Erin Butler of the US Export Assistance Centre says that US SMEs supplying the oil industry approached her for contacts in growth markets such as North Africa. Like James Cropper, the US oil industry suppliers also used their domestic sales forces to make initial contacts with potential foreign partners. The search criteria for finding the right local partners tend to be similar, across a range of businesses: that is, local partners who supply expertise, skills and contacts that are complementary to those of the exporting SME.

ACQUISITIONS-PLUS

Exporters making a long-term commitment to a foreign market often acquire a local company to establish a stable presence in that market. One example is Palfinger, an Austrian SME and construction-machinery maker, which bought companies across the world to access their markets and to diversify away from over-reliance on building mobile cranes. Its foreign plants gave Palfinger a lower-cost, more flexible production base to supply new markets, which in turn helped it to withstand a series of economic storms.

A buying spree was not Palfinger’s sole expansion tool, however. It also established joint ventures with local companies in some major export markets, particularly in China and Russia, using the partners’ local market dominance to boost its own sales. In 2012 Palfinger established two joint ventures with SANY, China’s biggest manufacturer of construction equipment. One of the ventures was established to sell Palfinger products in China, and the other to distribute SANY products outside of the country. In 2013 the companies agreed to a share swap, with SANY taking a 10% stake in Palfinger in exchange for an equal stake for Palfinger in one of SANY’s operating units. For Palfinger, this helped to cement a deep presence in China, while for SANY the deal boosted its own globalisation efforts.

In 2014, Palfinger set up two more joint ventures, this time with Russia’s largest truck maker Kamaz. One builds chassis to hold Palfinger’s mobile cranes, and the other produces cylinders for construction machinery. Under the deal, Palfinger agreed to invest in modernising the production plant. In return, Palfinger gained entry to Russia’s specialist construction machinery market. “We couldn’t buy them [SANY and Kamaz],” spokesman Hannes Roither says drily when asked why the firm chose joint ventures.

Significantly, the local ventures provided a buffer when local markets weakened, due to their strong local customer base. “There have been serious market crashes in both countries” in recent years, Mr Roither says. “But we were able to protect our own sales by increasing market share when foreign competitors withdrew from the country.”

Similarly, the German luxury hotel group Steigenberger set up a joint venture with a local company to accelerate its expansion into India. Steigenberger owns 116 hotels in 12 countries, generating 2013 revenues of €500m. In 2016 it announced a joint venture with MBD, an Indian hotel group, with Steigenberger retaining a controlling stake. MBD will manage the joint venture including sales, while the German company will manage international marketing, training and brand development.

The companies have complementary skills, with Steigenberger a leader in five-star hotel management and MBD an established player within India. Also, and equally crucially, they share the same aim: the rapid roll out of luxury hotels in India. The joint venture plans to open 20 hotels over the next 15 years. Managing Director Sonica Malhotra Kandhari says it would take between three and five years for either partner acting alone to open a single hotel.

KEYS TO SUCCESS

Structuring any type of partnership agreement with a foreign partner can be tricky, says Dan Harris, a founder of the US law firm Harris Bricken, which specialises in joint ventures in China. He advises clients to keep a majority stake in a joint venture, and to protect their intellectual property zealously regardless of the nature of the co-operation. He offers the cautionary tale of a US firm whose Chinese partner began to manufacture the US partner’s products under the Chinese firm’s name. Some remedies are simple: “Many times we find that the [US] company had not registered a patent in China,” Mr. Harris says.

Beyond that, a key to success is to look carefully at the fundamentals: ensuring that the partners’ skills and expertise are complementary to those of the exporting SME; establishing that the aims of both partners are aligned; and making long-term commitments to the target markets. These elements—complementary skills, similar aims, and long-term commitments—are as close as an SME can come to finding a recipe for success in forming international partnerships.

Download the article here

SMEs and Global Growth: Navigating the Legal and Tax Maze

American statesman and inventor Benjamin Franklin once famously said that nothing is certain in life except death and taxes. Nowadays, no one is more painfully aware of that—at least the part about taxes—than small and midsized enterprises (SMEs) entering foreign markets for the first time.

The complexity of foreign tax, regulatory and legal regimes is the most frequently cited reason why SMEs avoid foreign markets. The range of such barriers is wide, encompassing different tax treatment for similar products in different countries, varying product-composition and packaging rules, different standards for protecting intellectual property (IP), and complicated customs clearance procedures even within a free trade area. While the specific legal and tax barriers vary widely, they all represent essentially the same problem for SMEs: high compliance costs and the risk that, when implemented, regulations will be interpreted in unfavourable ways.

Such risks and costs are at the root of SMEs’ reluctance to export. According to the Confederation of British Industry (CBI), only one-fourth of European companies export. Dutch entrepreneurs’ association MKB-Nederland says that only 20% of Dutch companies export; according to a survey by logistics giant UPS, only 10% of French companies export.

Complex tax and legal issues also explain why SMEs that do export tend to do so only within a free trade area. A large-scale survey of SME owners and directors in seven European countries, carried out by UPS1 in 2015, found that, in four of the seven countries looked at, the complications of clearing customs or of complying with export regulations was among the top three reasons for not exporting outside of the European Union.

Overall, around 80% of EU-based SME exporters confine their exporting to the EU, according to Ben Digby, the CBI’s international director. Others venture farther afield, but to markets with which the EU has a free trade agreement, such as South Korea. An example is offered by UK pottery and tableware manufacturer Portmeirion: It says its export business to South Korea skyrocketed after the country signed a free trade agreement with the EU in 2010. By 2011, South Korea had surpassed the company’s home market in the UK, and became its second-biggest market after the US.

A LABYRINTH OF HEALTH RULES

Examples such as Portmeirion’s should not suggest that a free trade agreement sweeps away all legal and regulatory complications for exporters. Nothing could be further from the truth. Even within the EU single market, among countries with similar standards for products and services, legal and regulatory hurdles arise for exporters. An example is the maze of national rules that determine which pharmaceuticals qualify for medical prescriptions within the national health system.

Laboratoires Expanscience, a French pharmaceuticals SME specialising in skin cosmetics, faced such a problem in the UK. It entered the UK market a few years ago with, among other products, a range of skin creams under the Mustela brand; the creams are used for treating babies’ minor skin problems, among other uses. However, the firm’s UK sales are limited (currently below £1 million a year) because its products are not registered for prescription by the National Health Service (NHS). Registering with the NHS is an expensive and time consuming process: Raj Sandhan, the managing director of Expanscience’s UK distributor, Metro Health and Beauty, says that one of the French firm’s competitors had to wait five years to receive NHS approval. As a recent entrant to the market, Laboratoires Expanscience sells its products instead over-the-counter in independent pharmacies, which limits its sales volumes.

Family-owned with annual revenues of €272m, Laboratoires Expanscience is an active exporter, with subsidiaries in 14 of the 85 countries in which it sells. More than half its total revenue comes from foreign sales. Although it has not applied for NHS approval, its Mustela products are widely available on prescription in other countries. Its Bébé 123 Vitamin Barrier Cream has been classified a drug in the US, meaning that it can be sold on prescription, as well as through retail chains such as Walgreen’s. Obtaining such approvals can be a long process, the firm has found; but the resulting increase in sales that such approval brings makes that investment worthwhile.

INTRICACIES OF VAT

Registering for reimbursement of value-added taxes (VAT) also presents a hurdle for many exporters, even within the EU single market. National VAT rates for the same product vary considerably across the EU: the standard rate varies widely, from 19% in Germany to 21% in the Netherlands and 24% in Greece. Moreover, some states impose ‘additional’ taxes on imported products, leading to variations in tax treatment even within the EU. Belgium taxes imported bottled water and fruit juices, for example, whereas neighbouring France does not. All this causes headaches for importers, who must comply with a patchwork of European tax rules.

At company level, the VAT quilt in Europe causes other types of problems. To receive reimbursement for VAT paid, a company must register with national authorities. The threshold for VAT registration varies widely among EU member states, from €10,000 in Portugal to £83,000 in the UK. One SME dealing with the VAT registration rules is Emois Gourmands, a UK start-up selling French gourmet food in London. Emois Gourmands founder and CEO Cecile Faure says that her firm buys directly from producers in France, does not use middlemen and does not add a big mark-up, thus enabling it to sell products at lower prices than UK supermarkets charge.

But Ms Faure says her firm’s small size puts it at a disadvantage in the VAT department. Her firm is not large enough to qualify for VAT registration in the UK. To avoid paying VAT on imports without being able to offset the tax payment through sales, Ms Faure has to hire a freight forwarder to make the upfront payment. Details such as this can make even a deep free-trade area such as the EU less free than intended. “I applied for VAT registration several times but was repeatedly tuned down,” says Ms Faure. “It’s expensive for a small company.”

UNRAVELLING CUSTOMS CLASSIFICATIONS

A further complication for SMEs is finding a way through the thicket of regulations governing customs clearance and customs classification. An export product’s customs classification is more than just a number: it is a unique identifying code which determines the product’s tariff and VAT treatment, if applicable, and whether the product is permitted to be sold in the destination country in the first place. Some defence-related products, for example, are subject to both export- and import-restrictions. In theory, the World Trade Organisation’s standard product classifications take all the mystery out of identifying products. In practice, it is not so simple, since the WTO’s guidelines can be applied inconsistently across countries. This causes problems for all types of companies, but SMEs, with their relatively limited resources, can be hit particularly hard.

Varying classification of the same product can appear even within a single market such as the EU, according to Christine Debats, international development manager at Conex, a small French company that handles customs clearance for importers and exporters. Television set-top boxes are classified according to their main function, for example. If this is deemed to be recording broadcasts, then imported boxes are subject to a tariff of 13.9%. If the main function is considered to be internet access, then the duty is 0%. The ambiguity comes when the box does both things— leading to a WTO ruling that the EU’s customs treatment of set-top boxes was out of compliance with its rules. That ruling, in turn, forced the EU to issue a complex set of new rules for classifying settop boxes. This example shows how standardised customs classifications sometimes do not keep up with the rapid pace of product development, making it hard to predict the customs treatment of some goods.

But modernising customs classification and clearance can bring pitfalls of its own. In May 2016 the European Commission introduced the Union Customs Code as part of an effort to modernise customs. The initiative aims to enable traders to file all customs declarations remotely by 2020. This will require joining together all of the disparate IT systems used by EU countries—a hugely ambitious undertaking involving a host of detailed changes to the customs treatment of products. This is a huge challenge, considering that “customs classifications change constantly,” says Ms Debats.

PATENT ‘PROTECTION’: ENTER THE TROLLS

Other official attempts to promote efficiency and reduce the paperwork burdens of exporters and investors within the EU are causing a different set of problems. The EU’s planned Unified Patent Court, which is expected to start operating this year, will enable pan-European patent protection via a single filing, thereby cutting the cost of filing patents in multiple national jurisdictions. However, the unified system will also increase the risk of facing patent infringement challenges all across the EU rather than in individual countries.

That risk is increasingly a reality for exporters to and within the EU, as a result of the appearance in Europe of so-called “patent trolls”. These are firms that acquire patents to technologies that they have no intention of developing themselves, for the purpose of blocking others from using the technology. The patent trolls prevent the use of those technologies by threatening firms developing those technologies with patent infringement lawsuits.

The practice originated in the US, where patent trolling has become a big business. Specialist patent trolls are joined by multinationals that actively buy and police patents in their sectors. A surge in patent litigation has led the federal government, as well as some US states, to clamp down on the trolls. One result of the US clamp-down “is that the patent trolls have come over to Europe,” says Edward Borovikov, a lawyer in France with global law firm Dentons.

So far, many of the problems have centred on Germany, where the courts support patentholders’ rights vigorously (as they do in the Netherlands), Mr Borovikov says. However, the pan- European patent system increases trolls’ potential rewards if they win a case, since compensation will be calculated across the entire EU and not only in the affected country. “A case will cost at least €200,000-300,000, which SMEs simply can’t afford,” says Mr Borovikov. “Twenty years ago, intellectual property was not a huge concern in Europe. Now companies must check very carefully for possible patent infringements to avoid being sued by trolls.”

Patent trolls are a particular threat to SMEs. In the US, half of all patent troll lawsuits are against companies with revenues of US$10 million or less. The average cost of defending such lawsuits is US$3.2m—enough to put many SMEs out of business, according to Snapdragon, a consultancy offering intellectual property protections.

Similar cases are emerging against European SMEs. Toll Collect, a mid-sized German company with 600 employees, was targeted recently by such a case. It holds a government contract for a road-pricing system for trucks in Germany, with some terminals placed in neighbouring countries including the Netherlands. Toll Collect was sued by a German firm, Papst, which owns a European patent for road-pricing systems. The case was filed in the Netherlands among other places, and a Dutch court found in Papst’s favour.

Staying clear of patent trolls is not, of course, the only issue for exporters wishing to protect their markets. In many parts of the world, the issue is far simpler: enforcing the IP protections already on the books. In China, for example, “the problem is not necessarily with the legislation, but with the implementation” of IP rights, says Christoph Kaiser, managing director in China for Turck Technology, a family-owned German industrial automation company with annual sales of around €500m. Similarly, Dutch biotech firm Keygene has yet to set up a full subsidiary in China because of IP concerns. CEO Arhen van Tunen believes that IP rights for products such as his—innovative crop improvements—are weak in China. The company holds more than 500 patents, but these are only as good as local enforcement of property rights.

FINDING A WAY

Such concerns keep giant emerging markets such as China and India out of reach for many European SMEs. So, for instance, although most large Dutch companies such as Philips and ABN Amro are well established in both countries, few SMEs have followed their example. Fewer than 200 Dutch firms operate in India. A 2016 survey of Dutch companies active in China, carried out by the Dutch Ministry of Foreign Affairs,4 found only about 1,000 Dutch companies in the country, out of a total of 871,000 Dutch companies, most of them SMEs. “The barriers to doing business mentioned most often concern government relations and the Chinese regulatory environment,” the Ministry says. “Bureaucracy and the lack of transparency in legislation are the most common hurdles.”

Opaque rules and inconsistent application of regulations governing health products, among others, along with customs classification issues and variable VAT rules even within a single market create day-to-day problems for all exporters. These problems are felt most keenly by firms new to exporting and short on resources for figuring out the details of the regulatory, legal and tax systems in each of its export markets. Free trade agreements, along with various initiatives to reduce the paperwork burdens on exporters and cross-border investors, can help. But occasionally well-intended efforts, such as the pan-European patent filing system and the remote customs-clearance initiative, have unintended consequences that actually can increase the burden on exporters. It remains for policy makers to improve on these efforts, to avoid having newly internationalising SMEs turn back from their efforts to venture abroad.

Download the article here

SMEs and Global Growth: The High-Tech Advantage

To a greater extent every day, information technology is levelling the playing field for small and mid-sized enterprises (SMEs). Export markets, in particular, are no longer the exclusive domain of large players with the resources to field global sales and production staffs. Today, even startups can use the Internet to sell abroad, and to commission foreign firms to produce their designs cheaply.

For some new firms, in fact, geographical boundaries hardly come into play at all: they market and sell to consumers worldwide directly, becoming global players almost from the start. A good example is Skype, an Internet phone service set up by two Scandinavian entrepreneurs in 2003. In short order, Skype grew from a start-up to a global player with US$2 billion in annual revenues.

Skype is a classic example of a ‘micro-multinational’, a phrase coined by Google chief economist Hal Varian to describe small firms that acquire a global presence by using technology. However, such instant international presence is more the exception than the rule. Most small companies have to build an international presence the slow way, by building up their brands and creating networks of international business partners. Information technology helps in this effort, but does not produce instantaneous results as it might with specialised communications services providers such as Skype.

Indeed, even technology companies typically need a certain scale and an established brand to expand beyond their home markets. A good example is IceMobile, a Dutch company that creates mobile apps and has launched a successful drive abroad. The firm did do so by first establishing its brand in the Netherlands, and then partnering with another Dutch firm with a complementary product—brand loyalty programmes—to expand abroad. Its experience illustrates that, for most mid-sized firms a certain initial size and heft in the home market is a prerequisite for export success.

Broadly speaking, technology has helped to foster three types of SME exporter. First, there are companies such as IceMobile with established brands at home, which can use technology to export their business models. Second, there are so-called ‘born global’ firms such as Skype, which sell products globally right from the start-up phase. And third, some mid-sized companies use technology to outsource and offshore a core activity.

VENTURING ABROAD

Although technology is fostering a new generation of smaller, export-focused companies, this development should be seen in perspective. Most SMEs remain focused on their home markets and have no plans to venture abroad anytime soon. This is particularly true of SMEs based in large markets such as the United States. US statistics show that 304,000 out of the country’s 5.8m companies—only 5.5% of the total—exported in 2014.1 Moreover, most of those exports went to neighbours Canada and Mexico. “The domestic market is big enough to grow sales in by itself, and small companies often lack the resources to export,” explains Erin Butler, a commercial officer of the US Commerce Department’s Export Assistance Centre in New Orleans.

Most European SMEs focus on their national markets, too, despite the advantages of the European single market. Only about one-fourth of continental European companies trade internationally, according to the Confederation of British Industry (CBI). In fact, the figure is driven upwards by Germany, where more than half (54%) of all manufacturing companies export, according to the Deutscher Industrie- und Handelskammertag (DIKW), an industry body. In the Netherlands, a big trading country, around 20% of firms export, often as suppliers to local multinationals, says the Dutch business federation MKB.

Similarly, France has comparatively few exporting companies, with foreign trade dominated by a relative handful of large firms. In a recent survey, United Parcel Service, the world’s largest package delivery company, found that only 10% of French companies export.2 French government figures show there are only 120,000 French exporting companies, a third of the number in Germany. In the UK, just 8% of companies export directly, and another 7% supply foreign markets indirectly as part of multinationals’ supply chains, the CBI says.

Yet there is evidence that the Internet is changing this picture, encouraging more SMEs to look abroad for growth. For example, Petit Bateau, a privately-owned French children’s clothing company with 2013 sales of €300m, now sells successfully to other European countries over a website launched in 2006. The web site built upon an international chain of shops started by Petit Bateau in 2001, which, in turn, built on a mail-order business the firm started in the late 1980s. The web site, in short, enhances the firm’s international offering, but is not the basis for it. The basis is a fashion business that was developed over decades in the home market, and then expanded through mail order and traditional bricks-and-mortar shops.

Similarly, the director of a successful UK fashion brand, which now earns around half of its £380m annual revenue in foreign markets, expects explosive growth from Internet sales—but sees this growth as building on the firm’s existing brand strength. “The Internet technology became available for us to increase our presence abroad around six years ago,” says an executive of

the firm, who requested anonymity. The web site automatically detects where a user is based, enabling options such as home delivery or “click and collect” at a local store.

As with Petit Bateau, these marketing channels complement, rather than replace, an established foreign presence. The UK firm opened its first foreign store in the US in the late 1990s, and then steadily built up a network of shops worldwide, as well as supply arrangements with foreign department stores. As these examples show, the companies that benefit most from leveraging their established brands via the Internet are often those occupying a specialised market niche, such as a fashion brand or a unique technology.

‘BORN—OR RE-BORN—GLOBAL’

Many ‘born global’ companies, in contrast, sell a high-technology product internationally right from the start. As noted above, Skype and social media platforms such as Facebook fit this description. Another example is Bausey Medical Solutions, a US firm marketing a medical diagnostic app. The firm says it has attracted interest from Europe as well as the US. In Germany, start-ups such as SoundCloud, a global online audio distribution platform, and the photo-editing and photo-sharing app EyeEm, have quickly built a global presence.

In some cases, the growth afforded by Internet marketing is so rapid that a company is, in effect, ‘re-born global’. IceMobile, for example, built an established national presence by providing mobile apps for Dutch companies such as ABN Amro bank and the Albert Heyn grocery store chain. It then proceeded to build an international presence. In 2012 it merged with another Dutch company, BrandLoyalty, which produces loyalty programmes for retailers. Most of its revenues now come from foreign markets, as the combined company uses IceMobile technology to offer shoppers mobile access to their accounts. Clients include companies such as Lowes Foods (US), Dutch-owned SPAR China, and Danish retailer Coop, says its chief executive Jeroen Pietryga. “The possibilities are increasing fast,” he adds, pointing to the possible use of customer data to design and implement loyalty schemes.

Similarly, Globalstar, a listed US communications company, grew quickly in international markets after making major technology investments. “It cost us US$1bn to launch our satellite network,” says Jay Monroe, Globalstar’s chairman, with industry backers including Deutsche Aerospace and Vodaphone funding the launch of a system that supports satellite phone and data transmission. That investment enabled the company to occupy a niche selling global positioning and tracking devices, including satellite phones for individuals visiting remote regions.

Mr Monroe talks of bringing the retail price down to US$100 (less than half of the launch price at the start of next year). “The potential market could be 500,000 units a year in time,” he claims, with interest from the major car makers (looking for reliable connectivity for their vehicles) as well as retailers. That would be a large increase for a company with 2015 revenues of US$90.5m. The potential is being factored into its share price: the company is valued at more than US$1bn. Like IceMobile’s, Globalstar’s experience shows that technology companies can tap into global markets to win rapid growth, but must have an initial scale and established technology to do so.

OUTSOURCING AND OFFSHORING A CORE ACTIVITY

Mid-sized companies can also expand abroad in a third way: outsourcing a core activity, such as manufacturing, to a foreign partner, using information technology to ensure close adherence to product specifications and guidelines. Mid-sized manufacturers based in Germany in particular have led the movement to move manufacturing to lower-wage partners in Asia and Eastern Europe. In many cases, such moves are in response to technology-driven offshoring of production by the SMEs’ key multinational customers.

This pattern is well established, and predates the Internet revolution. Many German mid-sized firms set up production in Asia as they followed their multinational customers there; leading automakers, for example, have been manufacturing in China since the 1980s. The German Chamber of Commerce says that more than 5,000 German firms now operate in China and that, with local production so well established, attention has shifted to exploiting the huge Chinese market. By now, 93% of German firms say that they are in China for its sales potential, while just 43% are there because of lower production costs.

The shift wrought by information technology is not that it allows firms to outsource or offshore core activities, but that it makes it much cheaper and easier for smaller companies to follow the lead of bigger companies in doing so. A good example is Bowers & Wilkins, a UK company that produces loudspeakers and other audio equipment. Three quarters of its £125 million annual revenue comes from a plant it opened in China to cut costs. That plant allowed it to market speakers priced at just a few hundred pounds, compared to the £35,000 price of some of its UKmanufactured systems (or up to £1 million for a bespoke stadium system).

Beyond facilitating offshoring, the Internet combined with technologies such as 3D printing and automated manufacturing are changing the nature of manufacturing itself. A case in point is Local Motors, a US company that uses open-source online vehicle designs and then manufactures the vehicles through a global network of small plants, sometimes through 3D printing. The firm employs just 15 full-time staff, relying on an online network of 12,000 freelance designers. To date, it has produced about 50 off-road vehicles, and plans to produce another 1,500. Its combination of open-source design and distributed manufacturing allows this mid-sized firm to compete with automotive giants burdened with large fixed costs.

A LOOK AHEAD: CONSTRUCTIVE DISRUPTION

Examples such as Local Motors show how new technologies that benefit SMEs also disrupt established business models across a range of industries. In manufacturing, a shift to flexible manpower and online intellectual property is calling into question the old fixed-plant business model, which requires mass manufacturing to benefit from economies of scale.

Moreover, highly automated production—for example, the use of robots—will eventually erode the cost advantage of basing production in low-wage countries, as labour becomes less important to costs, says Erik Brynjolfsson, a professor of management at the MIT Sloan School of Management and director of the MIT Initiative on the Digital Economy. This will allow mid-sized firms to shift production away from low-wage countries and into target markets abroad, or indeed back to their home markets to facilitate close monitoring of quality and product design.