- AI will separate the winning banks from the losers, 77% of executives in the industry agree

- Covid-19 may intensify the use of AI, making effective governance all the more urgent

- A review of regulatory guidance reveals significant concerns including data bias, “black box” risk and a lack of human oversight

- Guidance has so far been “light touch” but firmer rules may be required as the use of AI intensifies

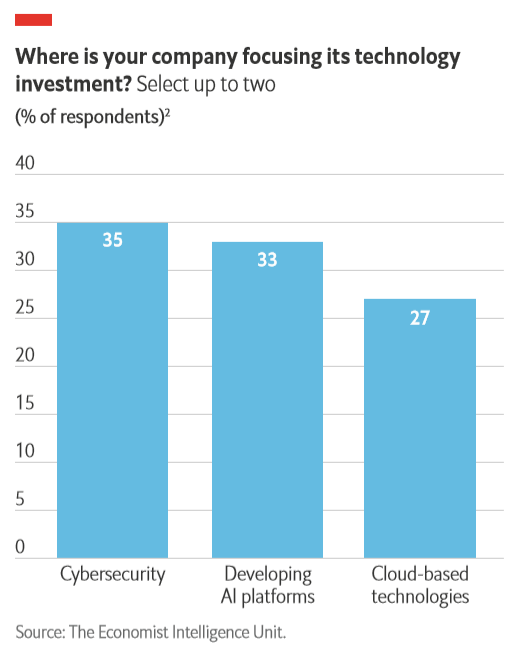

The ability to extract value from artificial intelligence (AI) will sort the winners from the losers in banking, according to 77% of bank executives surveyed by The Economist Intelligence Unit in February and March 2020. AI platforms were the second highest priority area of technology investment, the survey found, behind only cybersecurity.

At the time, the covid-19 pandemic was in full effect in Asia and the rest of the world was beginning to understand its gravity. Since then, the depth and extent of covid-19’s impact on consumer behaviour and the global economy have come into clearer focus.

Covid-19 has already triggered an uptick in digital banking—in the US Citibank is reported to have seen a tenfold surge in activity on Apple Pay during lockdown, for example1. But the disruption to businesses and households has only just begun, and banks will need to adapt to rapidly changing customer needs.

As such, the criticality of AI adoption is only likely to increase in the post-pandemic era: its safe and ethical deployment is now more urgent than ever.

In common with most matters of governance and safety, banks will look to regulatory authorities for guidance on how this can be achieved. Until a few years ago regulators adopted a wait-and-see approach but, more recently, many have issued a number of studies and discussion papers.

In order to assess the key risks and governance approaches that banking executives must understand, The Economist Intelligence Unit undertook a structured review of 25 reports, discussion papers and articles on the topic of managing AI risks in banking. The main findings are summarised in the table on page 3 and examined throughout this article.

Risks known and unknown

The nature of the risks involved in banks’ use of AI does not differ materially from those faced in other industries. It is the outcomes that differ should risks materialise: financial damage could be caused to consumers, financial institutions themselves or even to the stability of the global financial system.

Our review reveals that prominent risks include bias in the data that is fed into AI systems. This could result in decisions that unfairly disadvantage individuals or groups of people (for example through discriminatory

Some AI models have a complexity that many organisations, including banks, have never seen before. Prag Sharma, senior vice-president and emerging technology lead, Citi Innovation Labs

lending). “Black box” risk arises when the steps algorithms take cannot be traced and the decisions they reach cannot be explained. Excluding humans from processes involving AI weakens their monitoring and could threaten the integrity of models (see table for a comprehensive list of AI risks in banking).

At the root of these and other risks is AI’s increasingly inherent complexity, says Prag Sharma, senior vice-president and emerging technology lead at Citi Innovation Labs. “Some AI models can look at millions or sometimes billions of parameters to reach a decision,” he says. “Such models have a complexity that many organisations, including banks, have never seen before.” Andreas Papaetis, a policy expert with the European Banking Authority (EBA), believes this complexity—and especially the obstacles it poses to explainability—are among the chief constraints on European banks’ use of AI to date.

Governance challenges

The guidance that regulators have offered so far can be described as “light touch”, taking the form of information and recommendations rather than rules or standards. One possible reason for this is to avoid stifling innovation. “The guidance from governing bodies where we operate continues to encourage innovation and growth in this sector,” says Mr Sharma.

Another reason is uncertainty about how AI will evolve. “AI is still at an early stage in banking and is likely to grow,” says Mr Papaetis. “There isn’t anyone who can answer everything about it now.”

The documents that banking regulators have published on AI range from the succinct (an 11-page statement of principles by MAS—the Monetary Authority of Singapore) to the voluminous (a 195-page report by Germany’s BaFin—its Federal Financial Supervisory Authority), but the guidance they offer converges in several areas.

At the highest level, banks should establish ethical standards for their use of AI and systematically ensure that their models comply. The EBA suggests using an “ethical by design” approach to embed these principles in AI projects from the start. It also recommends establishing an ethics committee to validate AI use cases and monitor their adherence to ethical standards.4

For regulators, paramount among the ethical standards must be fairness—ensuring that decisions in lending and other areas do not unjustly discriminate against individuals or specific groups of people. De Nederlandsche Bank (or DNB, the central bank of the Netherlands) emphasises the need for regular reviews of AI model decisions by domain experts (the “human in the loop”) to help guard against unintentional bias.5 The Hong Kong Monetary Authority (HKMA) advises that model data be tested and evaluated regularly, including with the use of bias-detection software.6 “If you have a good understanding of your underlying data,” says Mr Sharma, “then a lot of the algorithmic difficulties in terms of ethical behaviour or explainability can be addressed more easily”.

|

Monitoring the modellers at Citi Bias can creep into AI models in any industry but banks are better positioned than most types of organisations to combat it, believes Prag Sharma, senior vice-president and emerging technology lead at Citi Innovation Labs. “Banks have very robust processes in place, learned over time, that meet strict external [regulatory] and internal compliance requirements,” he says. At Citi, a model risk management committee reports directly into the bank’s chief risk officer and operates separately from the modellers and data science teams. Consisting of risk experts as well as data scientists, the committee’s task, says Mr Sharma, is to scrutinise the models that his team and others are developing exclusively from a risk perspective. The committee’s existence long predates the emergence of AI, he says, but the latter has added a challenging new dimension to the committee’s work. Maximising algorithms’ explainability helps to reduce bias. Once a team is ready to deploy a model into production, the model risk management committee studies it closely with explainability one of its key areas of focus. “[The risk managers] instruct us to explain all the model’s workings to them in a way that they will completely understand,” says Mr Sharma. “Nothing hits our production systems without a green light from this committee.” |

Ensuring the right level of explainability, as Mr Papaetis suggests, is arguably banks’ toughest AI challenge. Most of the regulator guidance stresses the need for thorough documentation of all the steps taken in model design.

Ensuring the right level of explainability is arguably banks’ toughest AI challenge.

The EBA, says Mr Papaetis, recommends taking a “risk-based approach” in which different levels of explainability are required depending on the impact of each AI application—more, for example, for activities that directly impact customers and less for low-risk internal activities.

Are more prescriptive approaches needed?

Regulators generally consider banks’ existing governance regimes to be adequate to address the issues raised by AI. Rather than creating new AI-specific regimes, most regulators agree that current efforts should instead be focused on updating their governance practices and structures to reflect the challenges posed by AI. Ensuring that the individuals responsible for oversight have adequate AI expertise is integral, according to DNB.

|

Fit for purpose? Applying existing governance principles to AI In Europe, bank adoption of AI-based systems may be described as broad but shallow. In a recently published study the European Banking Authority (EBA) found that about two-thirds of the 60 largest EU banks had begun deploying AI but in a limited fashion and “with a focus on predictive analytics that rely on simple models”.7 This is one reason why Andreas Papaetis, a policy expert with the EBA, believes it is too early to consider developing new rules of governance for the EU’s banks that focus on AI. Mr Papaetis points out that the EBA’s existing guidelines on internal governance and ICT (information and communications technology) risk management are adequate for AI’s current level of development in banking. The existing framework is sufficiently flexible and not overly prescriptive, he says. “That enables us to adapt and capture new activities or services as they develop. So at the moment we don’t think that AI or machine learning require anything additional when it comes to governance.” In any event, the EBA’s approach, he says, will be guided by European Commission policy positions on the role of AI in the economy and society.8 Mr Papaetis does not exclude the possibility of more detailed regulatory guidance on AI in areas such as data management and ethics. Should bias and a lack of explainability prove to be persistent problems, for example, regulators may need to consider drafting more specific rules. But at present, he says, “no one can predict what challenges AI will throw up in the future”.

|

More regulatory guidance will almost certainly be needed in the future, says Mr Sharma, and some of it may require the drafting of rules. He offers as an example the uncertainty among experts around the retraining of existing AI models. “Does retraining a model lead to the same or a new model from a risk perspective?” he asks. “Does a model need to go through the same risk review process each time it is retrained, even if that happens weekly, or is a lighter-touch approach possible and appropriate?”

Should a major failure be attributed to AI— such as significant financial losses suffered by a group of customers due to algorithm bias, evidence of systematic discrimination in credit decisions or algorithm-induced errors that threaten a bank’s stability—authorities would no doubt revisit their previous guidance and possibly put regulatory teeth into their non-binding recommendations.

The need to monitor and mitigate such risks effectively makes it incumbent on regulators to build AI expertise that meets or betters that of commercial banks. As AI evolves, strong governance will inevitably be demanded at all levels of the banking ecosystem.

[1] Antoine Gara, “The World’s Best Banks: The Future Of Banking Is Digital After Coronavirus”, Forbes, June 8th 2020. https://www.forbes.com/sites/ antoinegara/2020/06/08/the-worlds-best-banks-the-future-of-banking-is-digital-after-coronavirus/

[2]Top three responses shown. For full results “Forging new frontiers: advanced technologies will revolutionise banking”, The Economist Intelligence Unit, 2020. https://eiuperspectives.economist.com/financial-services/forging-new-frontiers-advanced-technologies-will-revolutionise-banking

[3] The Economist Intelligence Unit reviewed 25 reports, discussion papers and articles published in the past three years by banking and financial sector supervisory authorities, central banks and supranational institutions, as well a handful of reports from universities and consultancies, on the theme of managing the risks associated with AI. The points of guidance listed below are distilled from studies and discussion papers published in the past two years by financial sector supervisory authorities, regulatory agencies and supranational institutions. These include the European Banking Authority, Monetary Authority of Singapore, DNB (Bank of the Netherlands), Hong Kong Monetary Authority, CSSF (Financial Sector Supervisory Authority of Luxembourg), BaFin (Federal Financial Supervisory Authority of Germany), ACPR (Prudential Supervision and Resolution Authority of France), and the European Commission.

[4] European Banking Authority, EBA Report on Big Data and Advanced Analytics, January 2020. https://eba.europa.eu/file/609786/ download?token=Mwkt_BzI

[5] De Nederlandsche Bank, General principles for the use of Artificial Intelligence in the financial sector, July 2019. https://www.dnb.nl/en/binaries/ General%20principles%20for%20the%20use%20of%20Artificial%20Intelligence%20in%20the%20financial%20sector2_tcm47-385055.pdf

[6] Hong Kong Monetary Authority, Reshaping Banking with Artificial Intelligence, December 2019. https://www.hkma.gov.hk/media/eng/doc/keyfunctions/finanical-infrastructure/Whitepaper_on_AI.pdf

[7] ibid.

[8] The commission launched a public debate on AI policy options in early 2020 and is expected to announce its policy decisions later this year.