- 66% of banking executives say new technologies will continue to drive the global banking sphere for the next five years while regulatory concerns around these technologies remain top of mind for banking executives (42%).

- 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks.

- With 45% of respondents set on transforming their existing business models into digital ecosystems, banks will continue to adapt their internal structures to digital technologies in order to enhance customer experience, product offerings and new revenue streams.

The coronavirus crisis has focused the attention of banks firmly on new challenges. Bank branch traffic was already falling before the pandemic, and this trend will only intensify with society in lockdown: customers are unable to leave their homes while employees are working remotely or frequently absent due to illness. “Banks have planned for years for disaster recovery if their technology failed but have never planned for disaster recovery if their buildings closed,” says Chris Skinner, a leading influencer and champion of digitalisation in finance. “This is the big lesson of the crisis.”

The lockdown will most likely accelerate the digitisation of banking,1 a sector which already faces intense competition from payment players, big technology and e-commerce firms. According to the latest global banking survey conducted by The Economist Intelligence Unit (now in its seventh year and for the first time expanded to include respondents from commercial and private banks), 45% of respondents say their strategic response to this challenge is to build a “true digital ecosystem”. This aim to integrate self-built digital services and third-party offerings was cited more than any other response and has increased from 41% of respondents in 2019.

This article explores three central elements of banking digitisation: where banks currently are in their digital journey; what they are doing, not only to overcome challenges but also to increase user engagement through different technologies and channels; and how they are seizing opportunities through reorganisation into more agile structures.

Methodology

In February-March 2020 The Economist Intelligence Unit, on behalf of Temenos, surveyed 305 global banking executives on themes relating to the digitisation of banking. The survey included respondents from retail, corporate and private banks in Europe (25%), North America (24%), Asia-Pacific (18%), Africa and the Middle East (16%) and Latin America (17%). Respondents performed different job functions: marketing and sales (18%), IT (13%), customer service (7%) and finance (14%), while almost half were C-suite executives (49%). The coronavirus pandemic emerged half-way through the survey.

The survey is part of a worldwide research programme on new frontiers in a global age of banking. It draws on in-depth interviews with retail, corporate and private wealth banks, regulators, international organisations and consultancies around the world. The survey research and interviews will be featured in a series of articles and an infographic throughout 2020.

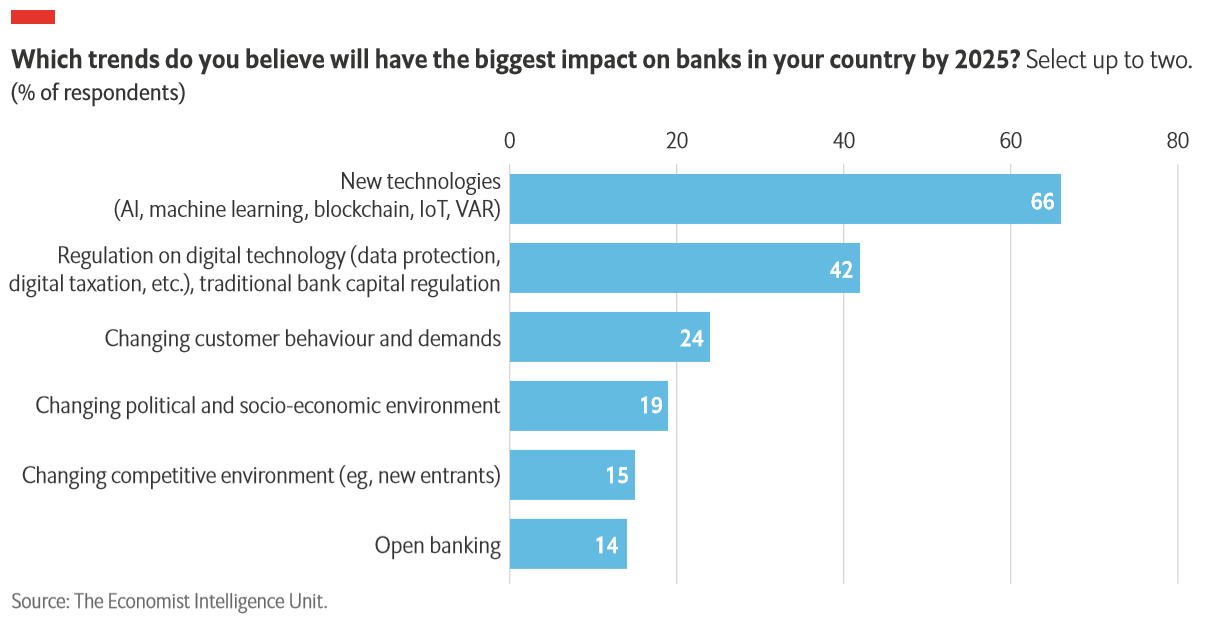

New technologies will continue to drive global banking for the next five years while regulatory concerns around these technologies remain top of mind for banking executives.

A large majority of respondents (66%, up from 42% in 2019) cite new technologies such as artificial intelligence (AI), machine learning, blockchain or the Internet of Things (IoT) as having a significant impact on the sector. This highlights the importance of these new tools in fending off the competitive threat posed by tech-driven, non-traditional entrants to the banking sector such as payment players PayPal and ApplePay (cited by 50% of respondents globally), or big tech firms like Google, Facebook and Alibaba (34%).

Regulation of digital technology (such as data protection) has weighed on banks’ profit and loss (P&L) since the 2008 financial crisis and is now considered the second most impactful trend in the industry (as cited by 42% of respondents). New regulation could be a game changer for the development of open banking in certain regions, but it could also allow non-traditional competitors to enter the sector.

There is slightly less apprehension about neobanks (a concern cited by 20%) which have not managed to dent savings or lending volumes to a significant extent. Some early challengers are shifting their strategies from directly offering financial products to selling their expertise to existing banks with bigger brands, more reach and higher capital.2 In fact, 84% believe that fintechs will continue to have a material cost advantage over traditional banks: investing in fintechs is a priority innovation strategy for over a quarter of respondents (26%), and even more so in the retail space (33%).

As the importance of advanced technologies rises, that of changing customer behaviours and demands—while still viewed as impactful by 28% of respondents—continues to decline. In 2019, 31% of respondents cited it as highly significant compared with 58% in 2018. This may be due to the fact that banking clients now display higher digital adoption rates and have established digital expectations. Moreover, a majority of respondents (59%) agree with the statement that “the traditional branch-based banking model will be dead” by 2025, up from 44% in 2019.

In the shift towards enterprise agility, DevOps—a set of practices which bring together software development and IT operations—and modern cloud-based platforms could be transformative, according to 84% of respondents. The computing power and flexibility of cloud-based technologies and services remain of prime interest to banks with 27% of respondents focusing their technology investment in this area (see also below). Unsurprisingly, 81% believe a multi-cloud strategy will become a regulatory prerequisite after several years of regulatory focus on cloud technologies in the UK and the US.3

Banks are adapting their internal structures to digital technologies in order to enhance customer experience, product offering and new revenue streams.

An overwhelming majority of respondents (83%) believe that platformisation of banking and other services through a single entry point will steer the market. This is driving banks towards transforming their existing business models into true digital ecosystems according to 45% of respondents.

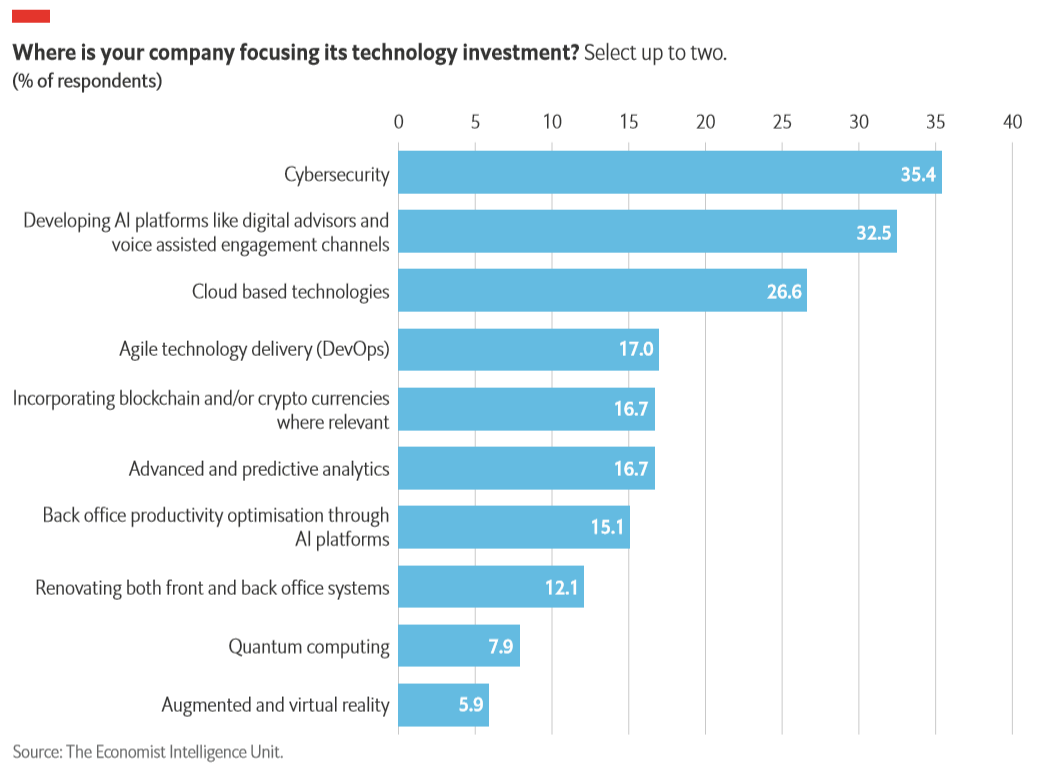

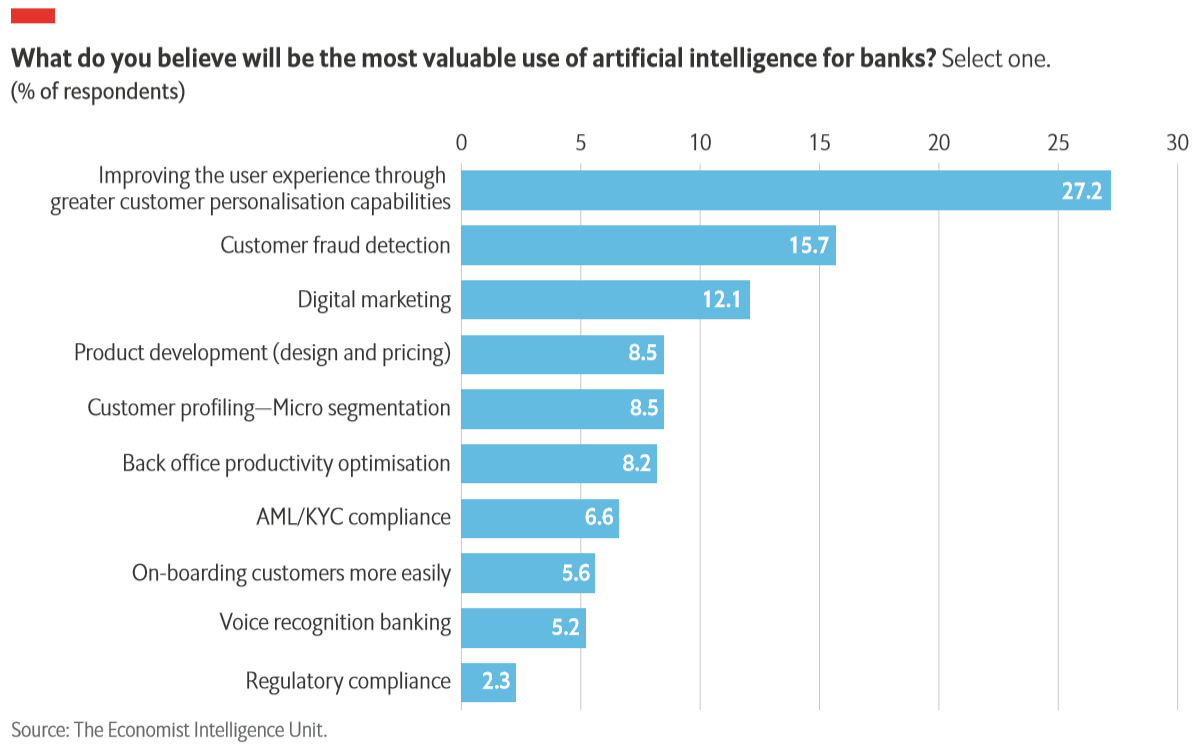

Where are banks focusing their digital efforts? For many, technology investment hinges on cybersecurity (35%), which reflects widespread concerns about data breaches. The development of AI platforms like digital advisors and voice assisted engagement channels is cited by 33% of respondents and cloud-based technologies by 27%. AI will undoubtedly play a central role in the digital shift: 77% of respondents agree that unlocking value from AI will be a key differentiator between winning and losing banks.

However, banks may be missing a trick by focusing purely on AI’s customer-facing capabilities while downplaying other benefits in the value chain, which focus more on productivity, customer retention and monitoring functions (see chart 2 below). There are concerns among customers about how AI technologies will use their data and whether it is safe: 34% of respondents expressed concern about lack of clarity surrounding data use while 40% were unsure about the security of their personal financial information. Despite these reservations, there are signs of greater product innovation within the sector: 30% of respondents expect to maintain their own product offerings and become an aggregator of third-party banking or non-banking products (up from 28% last year).

Increasing numbers of banks anticipate AI will help generate new business. “As investment algorithms get more advanced, they will be used more widely in portfolio management. Not to use the over-hyped AI term, but advanced algorithms for investment strategies will gain strength,” explains Nic Dreckmann, chief operating officer and head of intermediaries at private bank Julius Bär.

For the entire customer journey to succeed, respondents report that broader deployment of AI in fraud detection (16%) and backoffice functions (8%) are likely to feature more heavily in future business plans. At HSBC Private Bank, AI is already integrated in back office functions, according to chief operating officer Anil Venuturupalli. For banks worldwide of all sizes, cultural change will be central to deploying technologies such as AI effectively.

Building greenfield banks is an increasingly popular strategy to achieve digital agility.

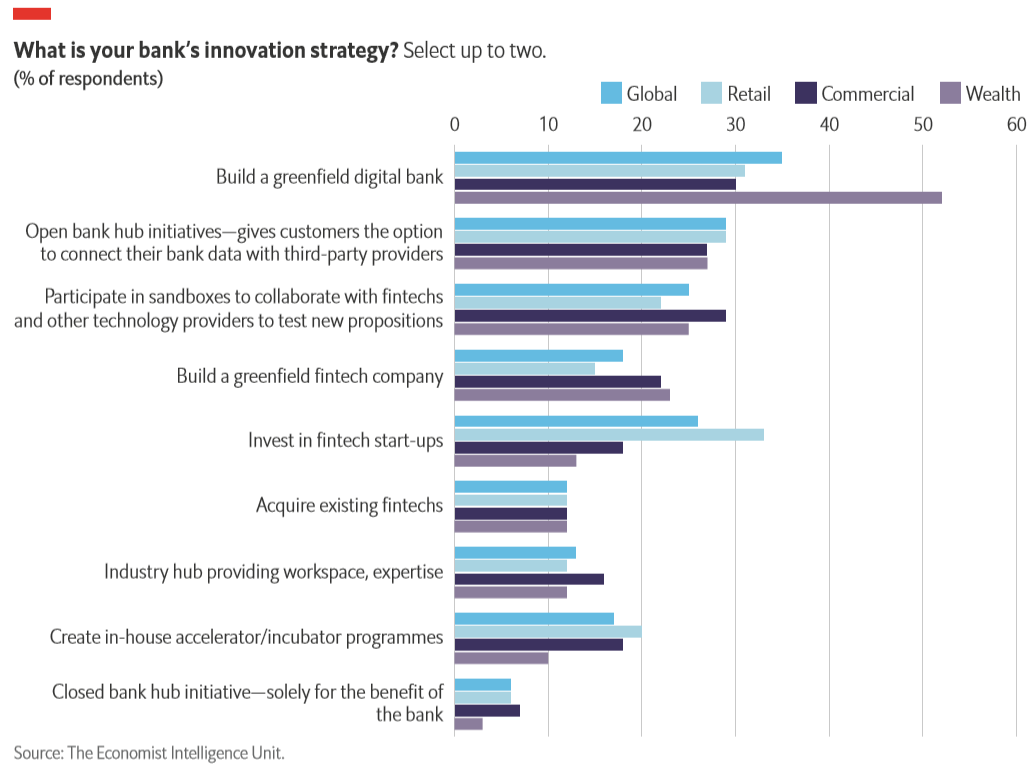

Last year, building a greenfield digital bank was a top innovation strategy among retail bankers (cited by 36%). A priority again this year for respondents globally (35%), it was particularly strongly expressed by respondents in the wealth sector: 52% believe this to be the best way to compete most cost effectively (see chart 4).

Open bank hub initiatives that give customers access to third-party offerings remain important as respondents’ second preference (29%). This is followed by investment in fintech start-ups, which 26% of respondents cite as part of their innovation strategy. Although less of a concern than in 2019, 25% of banks are looking to participate in sandboxes to collaborate with fintechs and other technology providers to test new propositions.

Banks are also developing digital strategies to move away from their current operating models and promote greater agility. Improving product agility and the ability to launch new products is cited as the third most important strategic priority (26%), after improving customer experience and engagement (32%), and mastering digital marketing (31%). Migrating client usage to digital from physical channels tops the list of priorities for retail banks (35%, compared with 31% globally). Some banks, such as HSBC, have started to build out from existing operations and draw in third-party expertise where necessary to deliver digital private banking around the world. “We are looking at developing a hybrid engagement model where technology will handle all of the administrative touchpoints for our clients,” says Mr Venuturupalli.

Traditional means of banking such as cash will fall by the wayside as agility becomes increasingly aligned with the digitisation of transactions and products. A majority of respondents (75%) think paper notes will represent less than 5% of all retail transactions globally by 2025.

As technology and demand changes at an ever-faster pace, banks in general will need to adopt new working practices and administrative structures that align with their business strategies and priorities, particularly if they are to capitalise on different digital advantages by 2025.

However, it seems developing agile structures that break down internal barriers is not yet a widespread priority given that only 17% of respondents said this was a focal point for their technology investment. This further raises the question of whether banks will be able to achieve their strategic greenfield bank and broad ecosystem plans on time and within budget drawing only on in-house resources.

|

AI with a profitable purpose Many banks are clear on what they want to achieve from AI. The dual priorities for CaixaBank of Spain are freeing up staff time and improving employee productivity. The bank processes over 12,000 transactions per second in peak hours and boasts a 900 terabytes data pool to improve the customer experience. The bank’s 100-strong business intelligence unit uses big data, AI and machine learning to communicate with customers more efficiently. As a result, branch staff levels are half the euro zone average and CaixaBank’s costs are the lowest of its domestic peer group. AIdriven virtual assistants used by advisors and customers have more than doubled sales conversion rates in just one year. |

Lessons from lockdown

While the coronavirus pandemic has highlighted how quickly financial institutions need to adjust when the unexpected hits, it has also demonstrated many opportunities to be seized from a digital banking perspective.

As lockdowns were introduced, bank phone services were overwhelmed in the UK and the US.4 Operational processes struggled to incorporate government relief financial schemes, but some banks managed to demonstrate the real value of agility.

Citizens Bank of Edmond, Oklahoma, has just one branch and 55 members of staff. The bank was quick to send out loan relief forms to borrowers and modify overdraft arrangements to offer early access to direct payments from the US government: its speed of response left larger competitors trailing behind. Chief executive Jill Castilla made use of the bank’s social media platforms to offer advice and reassurance—and a personal line of contact for worried customers. Some banks, such as US-based Atlantic Union Bank, moved to streamline their loan application workflows with new digital platforms,5 while others looked to increase their customer outreach via digital channels.6

However, the need to introduce a human touch to the digital experience predates the covid-19 pandemic. Banks were already looking for innovative ways to achieve this, often by providing opt-in communication channels to clients. For example, two US banks— Oregonbased Umpqua Bank and Iowa-based Hills Bank—have been using mobile banking apps that give customers direct access to a digital banker of their choice for a variety of services including bank-account opening and transfer of funds.7 In Turkey, VafikBank has a fleet of direct sales agents who visit digital banking customers at their office or home to provide expert advice on more complex products such as loans.

|

US digital banking gets a boost Fintechs have found it harder to challenge the established banks in the US than they have in Europe and Asia. That may be about to change. Last year, we highlighted progress at Varo Money, a mobile banking firm that offers loans alongside checking and savings accounts. After a three year wait, the Federal Deposit Insurance Corporation approved Varo’s application for a bank charter earlier this year. Once final approval is granted, the licence will eventually allow Varo to offer its accounts to US customers with the same US$250,000 deposit guarantee that established bank customers enjoy. Varo subsequently received more good news from a surprising source. In March 2020 its New York-based fintech competitor Moven surprised the market by closing its consumer-facing business, blaming market conditions for a lack of development funding. Moven then chose Varo as the destination of choice for customers facing account closures, citing its core focus on financial wellness. “We care deeply about our Moven banking customers which is why we made the thoughtful decision, as we transition away from our consumer business, to recommend Varo for their banking needs,” said Moven CEO Marek Forysiak. For Varo Money, finally receiving that national bank charter will be the icing on the cake. Its founder and CEO Colin Walsh comments that “becoming a fully chartered bank will give us greater opportunity to deliver products and services that positively impact the lives of everyday people around the country”. |

Click here to view the infographic.

[1] See, for example: https://www.investorschronicle.co.uk/shares/2020/03/11/will-uk-banks-catch-the-coronavirus/ ; https://gulfbusiness.com/howfintech-is-revamping-the-financial-landscape-amid-covid-19-outbreak/ ; https://www.finextra.com/newsarticle/35561/rush-to-digitisation-will-seefintech-sector-flourish-post-covid-19

[2] Moven shuts all consumer accounts, pivots to B2B-only service for banks, Fintech Futures, 26 March 2020 https://www.fintechfutures.com/2020/03/moven-shuts-all-consumer-accounts-pivots-to-b2b-only-service-for-banks/

[3] See, for example, https://www.fintechfutures.com/2016/12/fca-green-lights-cloud-technologies/ and https://uk.reuters.com/article/us-usacongress-cloud/u-s-house-lawmakers-ask-regulators-to-scrutinize-bank-cloud-providers-idUKKCN1VD0Y4

[4] The inability of some banks to process loans at the start of the crisis was widely reported in the press, for example: https://www.theguardian.com/ business/2020/apr/15/covid-19-bailout-loans-issued-uk-firms-banks

[5] https://www.forbes.com/sites/tomgroenfeldt/2020/04/20/sba-ppp-loans-at-atlantic-union---13-days-6500-applications-14-billion/#37365af1cacc

[6] https://ibsintelligence.com/ibs-journal/ibs-news/icici-bank-launches-its-digital-banking-platform-in-the-wake-of-covid-19/

[7] https://thefinancialbrand.com/94429/umpqua-human-digital-bank-mobile-chat-covid-coronavirus/