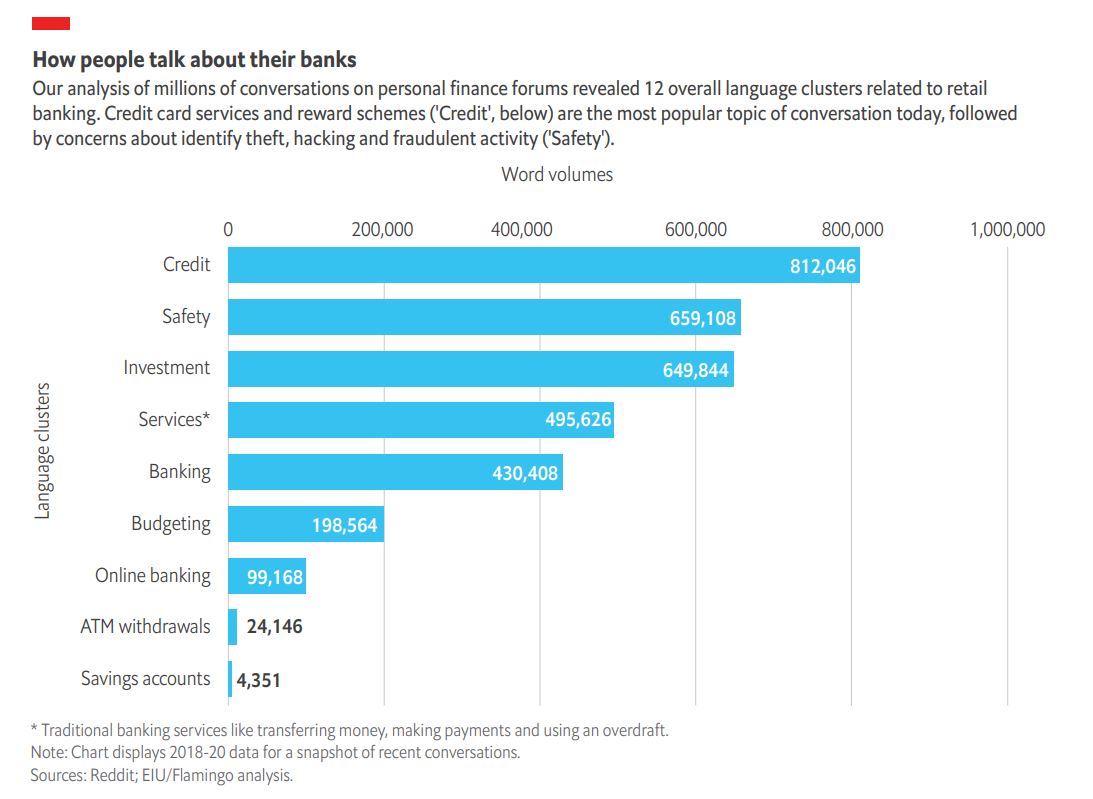

New research from The Economist Intelligence Unit, based on an analysis of over 10m conversations in public forums about personal finances, has sought to better understand consumer preferences when it comes to retail banking services. It finds that:

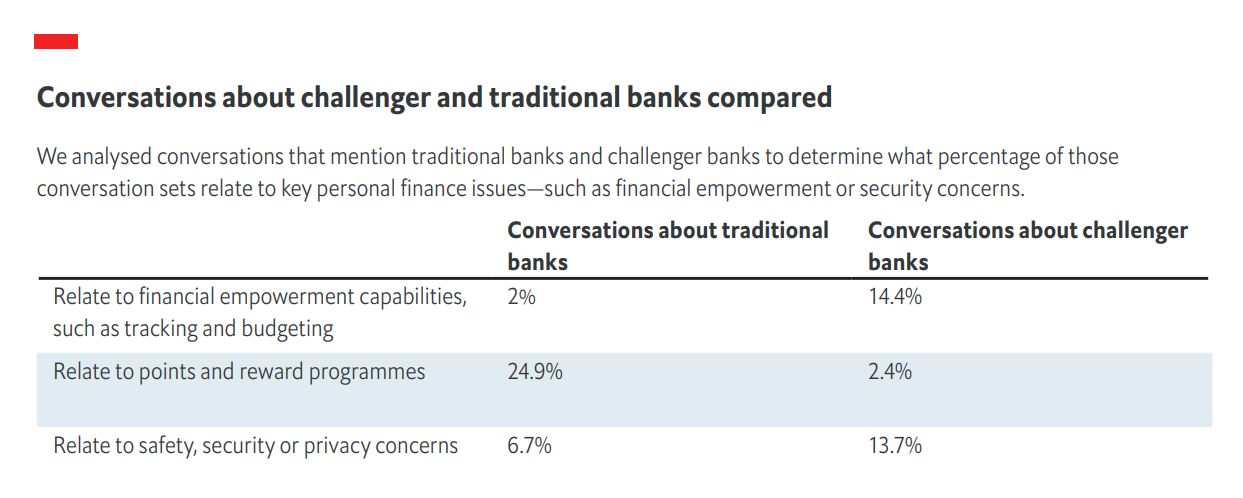

- Fintech start-ups are strongly associated with financial empowerment, but also twice as likely to be associated with security and privacy concerns when compared to traditional banks.

- Traditional banks retain strong associations with trustworthiness, a wider range of services and perks such as loyalty programmes.

In the battle for consumers, there remains everything to play for.

Digital and traditional banks are engaged in a fierce battle for customers. Start-up, digital-first banks and investment services, such as Monzo, N26 and Robinhood, have come to market promising superior customer experience and a rich array of services, such as budgeting apps and automated, low-cost investment tools. But traditional banks still benefit from trust, reliability and a wider range of services. And increasingly, spurred on by a crowded field of agile new digital upstarts, they are investing heavily in their digital capabilities—to great effect.

Key to this battle between old and new is whether innovators can scale up and broaden their appeal faster than incumbents can innovate.

A deep understanding of customer behaviour and sentiment will be essential to success for any financial player, new or old. One resource to help firms do this are the millions of conversations that consumers are having about personal finance in public online forums. What banking tools and services are customers most frequently discussing, in what terms? Which keywords relating to banking services are rising and falling in frequency over time? Which associations are there between discussions of negative customer experience and different types of bank?

To answer these questions, The Economist Intelligence Unit (EIU) developed a natural language processing model to analyse over 10m online English-language conversations about personal finance. The resulting clusters, associations and patterns show key strengths and weaknesses of traditional and challenger banks in terms of how well they are meeting customer needs.

|

Our research methodology We analysed over 10m online conversations about finance and banking dating back to 2013, drawn from English-language personal finance forums on Reddit, a social discussion website. The sample reflects a global community of English speakers, predominately from the UK and US. Using machine-learning algorithms, we sifted millions of comments into distinct word clusters to reveal which words and phrases appear most frequently, and which are most regularly associated with each other. |

Financial empowerment and customer loyalty

Largely, next-generation banks have proven popular because they have used technology to offer customers richer services than their conventional counterparts, from spending analytics to budgeting tools and low-cost investment platforms.

Discussions about “investment” have grown in frequency since 2015, and our analysis shows that 14.4% of conversations that discuss challenger banks include associations with financial empowerment capabilities such as tracking and budgeting, compared with just 2% of conversations that discuss traditional banks. In response to low interest rates being offered by conventional savings accounts, more everyday consumers have taken advantage of low-cost investment portfolio services offered by fintech firms and algorithm-driven “robo-advisors”.

According to a survey of 305 global banking executives carried out by the EIU, investments (self-executed or robo-advisory) are the number one area where new entrants are expected to gain market share in the coming years.

Jason Bates, co-founder of app-based banks Monzo and Starling, as well as 11:FS, a fintech consultancy, believes that challenger banks have done a better job of understanding customer’s financial lives and building products around them. “Banks haven’t been great at delivering services to help deal with the realities of day-to-day life. They just say, ‘great to see you, here’s your balance, here are your transactions, here is how you move money. Good luck. And if you spend more than you’ve got, we’ll charge you".

He distinguishes here between “digitisation”, where banks simply move their paper or in-person branch processes online and into apps, to truly “digital” innovation that imagines new services. Digitisation is analogous to the re-creation of a newspaper on an iPad. Digital transformation, in contrast, is exemplified in new media platforms, such as iTunes or Spotify. “The operating model here fundamentally changed. It’s not only about music—it is also about discovery and sharing.” In the financial services space, Mr Bates believes, truly digital innovations will be those that are real-time, intelligent, social or contextual.

But while many consumers are turning towards disruptive fintech platforms for enriched tools and services to bolster their personal finances, traditional banks remain heavily associated with rewards and loyalty programmes—one of the most discussed subjects overall. In our analysis, a quarter (24.9%) of conversations about traditional banks were related to credit cards or reward programmes, compared to just 2.4% of those involving challengers. Here traditional banks benefit from their age and experience, having built up significant loyalty with customers (whose perks accumulate over the years), and leveraging the reputation and reliability needed to strike commercial partnerships with companies in sectors like air travel and hospitality.

But while many consumers are turning towards disruptive fintech platforms for enriched tools and services to bolster their personal finances, traditional banks remain heavily associated with rewards and loyalty programmes—one of the most discussed subjects overall. In our analysis, a quarter (24.9%) of conversations about traditional banks were related to credit cards or reward programmes, compared to just 2.4% of those involving challengers. Here traditional banks benefit from their age and experience, having built up significant loyalty with customers (whose perks accumulate over the years), and leveraging the reputation and reliability needed to strike commercial partnerships with companies in sectors like air travel and hospitality.

In the future, loyalty programmes and points schemes will be a customer experience domain that will benefit from better data and analytics about customer preferences and behaviours, leading to more tailored offerings. In this environment, it is more than possible for fintech firms to excel in points and perks services, provided that their brands are strong enough to form the right partnerships.

Fintech firms are already making in-roads. Point, a new US challenger bank whose investor roster includes backers of N26 and TransferWise, offers cash-redeemable points for groceries as well as services like Netflix and Spotify. Another US digital bank, Current, offers points on transactions at participating merchants, which include Subway and Rite Aid, although currently the cash can only be spent on upgrading to the bank’s own premium service. Some firms are flipping the entire points model on its head: US-based Tally gives users points for saving, which they can redeem for gift cards at retailers such as Amazon and Target, and services including Uber. Time will tell if non-traditional banks can sustain points systems, given their net cost, especially during the early (usually lossmaking) years.

Safety and security: favouring the tried and trusted

If challenger banks have brought to market better customer experience and enhanced services, traditional banks still have an important advantage in terms of trust and reliability. Our analysis found that 13.7% of conversations about challenger banks included associations with concerns about safety, security or privacy, compared with only 6.7% of those about traditional banks.

Privacy is a major subject, particularly for fintech services that link different institutions’ financial data. In discussions of retail banking, safety was the only language cluster to experience significant proportional growth over time, a consequence of a broader concern about digital privacy in recent years, heightened by high-profile cyber hacks and data breaches.

Many prominent challenger banks have slipped up on security and reliability, including through service outages and glitches. They have also had run-ins with regulators and faced criticism over issues such as capital adequacy ratios, anti-money-laundering protocols, audit quality, and consumer vulnerability in areas like investing. With challenger banks and fintech platforms often still in the venture-funded, pre-profit phase, there are questions about their long-term survival that could limit their ability to become primary providers of services—especially in a time of such economic uncertainty. This may put pressure on their appeal as they seek to develop from scale to profitability.

Customer experience: the survival imperative

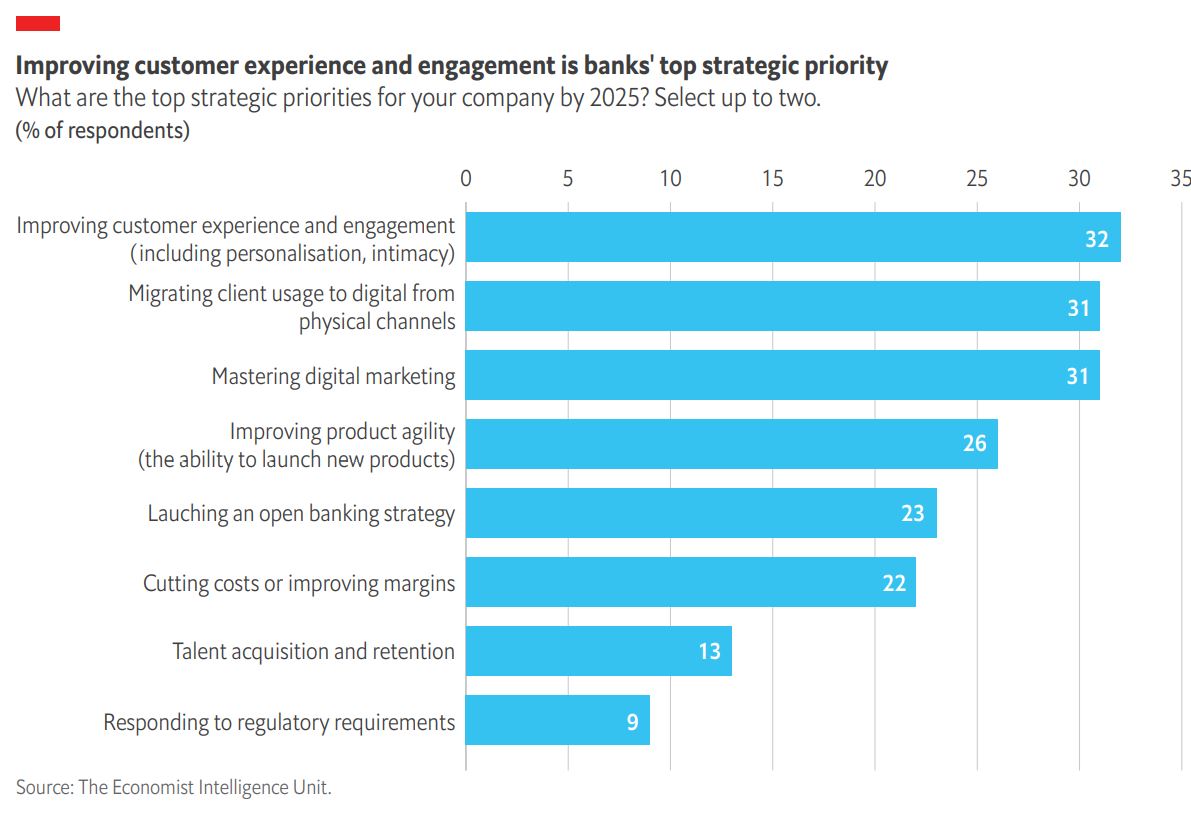

For newcomers and incumbents, customercentricity is a widely shared priority. In the global banking survey conducted by the EIU as part of this research programme, improving customer experience and engagement, including personalisation, was cited as the top strategic priority through to 2025 and a topthree factor impacting banks.

“Core financial services are becoming more commoditised, and price competition only goes so far,” says Millie Gillon, global head of retail banking customer experience at Standard Chartered bank. “If we can’t win on price alone, we need to focus on experience. That will help us to differentiate”. Some incumbents have strengthened their customer experience offering through acquisitions, such as CapitalOne’s purchase of Adaptive Path, a design and user experience consultancy.

To flourish in customer experience excellence, banks must find new ways to listen to their clients—and to understand customer trends more broadly. “There’s a heightened awareness among established companies about the importance of putting clients first and centre, and then building our offerings around them, as opposed to the old method of, ‘If we build it, they will come,’” says Ms Gillon.

Innovators are those who understand the “brutal realities” of customers’ daily lives, says Mr Bates. “We never ask customers, ‘what would you like us to build?’ because they are experts at talking about their problems and experience, not product development. Our approach to creating new digital services is to talk to customers about the issues in their daily life and then look at how you can deliver against that.”

Ethnographic research, for instance, is allowing Standard Chartered to “dig deep into customer’s psychographics”, says Ms Gillon, helping them to understand their motivations, goals and fears. “By doing this, we can start to really understand, empathise and put ourselves in their shoes”.

“We want to try to be much more empathetic, because once we have empathy, we’re more human. When we’re more human, that’s when we can truly be client-centric”.

An open thread: customer experience in transition

Amid the coronavirus crisis, customer priorities are rapidly changing. “A lot of people are just thinking ‘What’s truly important to me right now?’ Because this year, most people’s goal is just to survive,” says Ms Gillon. They’re also saying, ‘what’s important is not just me as your client but servicing the needs of my entire family.’ It’s much more familial. It’s really about getting down to the root of what’s most important now”.

Such shifting priorities threaten the business model of start-ups that have built offerings on perks such as free currency exchange services and spending analytics tools, which are losing relevance at a time of falling earnings. Incumbent banks have seen some advantages, in the form of increased saving (the US savings rate hit a record 33% in April). But additional income from fees and deposits is being more than offset by falling margins and the need to put aside large quantities to cover loan losses. In this environment, a smart “listening” strategy will not only help banks to know whether their services are hitting the mark; it will also give them insights into market changes.

More optimistically, banks are realising that the field of “financial services” is far bigger than ever before. Open banking regulations, which allow third parties to build financial products linked to customers’ payment accounts, are likely to herald a period of evolution into a broader “open finance” era that will apply the same principles to savings, insurance, mortgages, investments, pensions and credit.

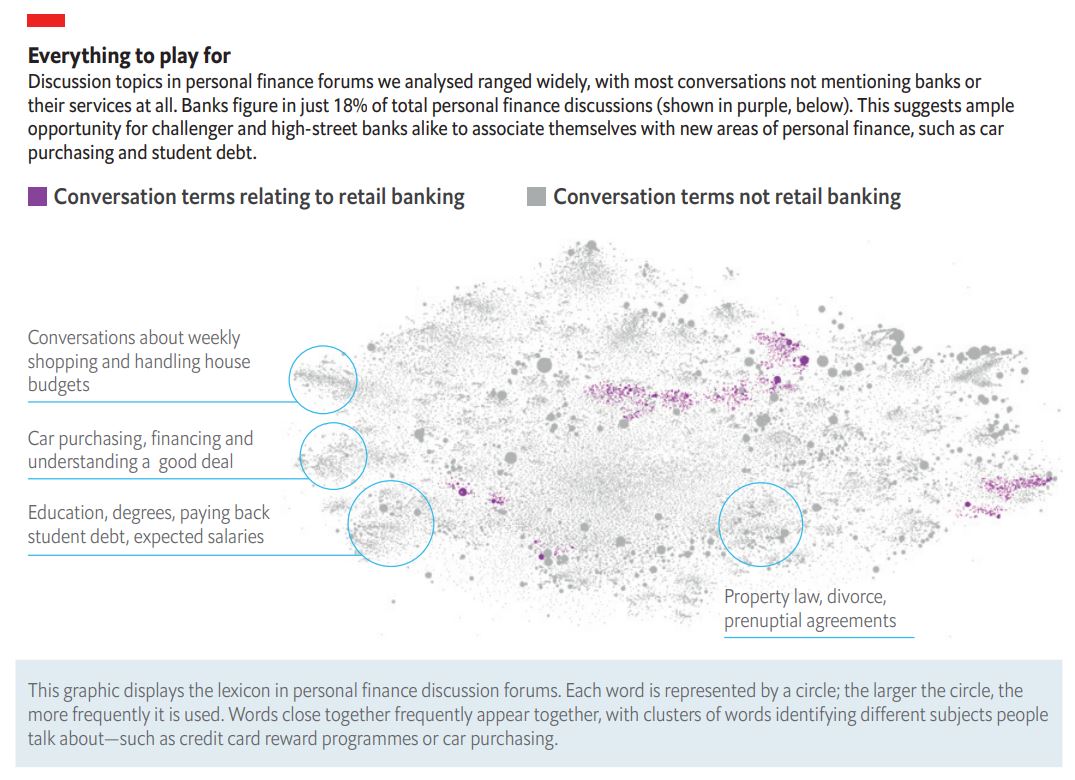

This could see fintech become ubiquitous in areas far beyond core banking. Our analysis shows many domains in which consumers discuss personal finance with no associations with their banks at all: the entire class of retail banks (incumbents and challengers) are only associated with 18% of total personal finance discussions, with the rest covering everything from divorces and wills to car buying (see graphic). This suggests there is room for banks to assist customers in many more areas of their personal finances.

The EIU’s survey also backs evidence of banking shifting towards becoming an ecosystem of interlinked services: the most commonly cited business model transformation, by 45% of respondents, was “acting as a true digital ecosystem (offering own and third-party banking and non-banking products and services to own customers, as well as to other financial services organisations)”.

Incumbent banks will move at different speeds in capturing new markets; some may deploy new offerings while others will remain the infrastructure “pipes”, as with telecommunications companies in the 4G transition, who facilitated, but were not innovators in, breakthroughs like streaming. We will also see more partnerships between fintech firms and established players. Accelerators, direct acquisitions and service agreements are all ways that big banks are already working with rather than against newcomers to leverage the strengths of each party, and the commercial logic of cooperation will grow as banking expands its service offering.

“In an ideal world,” says Ms Gillon, “there will be a combination where fintechs and established banks can play together. Then you have the winning combination of speed, drive, innovation, a willingness to experiment, sound risk management, trust and the learning that comes from more established companies.

While every effort has been taken to verify the accuracy of this information, The Economist Intelligence Unit Ltd. cannot accept any responsibility or liability for reliance by any person on this report or any of the information, opinions or conclusions set out in this report. The findings and views expressed in the report do not necessarily reflect the views of the sponsor.