The automotive industry has operated a fairly consistent model for the best part of 100 years. Car makers designed, built and marketed their products; they were sold through a network of dealerships and maintained by local and independent mechanics.

Hyperconnectivity – the increasing interconnectedness of people, places and things - is putting this established model through the wringer, as digital technology permeates not only the process of choosing and buying a car, but also the very experience of driving itself.

The industry is adapting, experts say, driven by strong customer demand for hyperconnected products and services. But so pervasive is its impact that there is much more adaptation required of them yet.

The received wisdom in the automotive industry is that a typical customer visits a car dealership five or more times in the course of buying a new car. They might visit once with their family, once for a test drive, and again if the desired model was not in stock on a previous occasion.

The amount of information that customers can now access online means the average number of dealership visits is decreasing. According to a global survey by consultancy Accenture, 37% of car owners believe it is likely that they would buy a car through online channels alone (this compares with just 13% in India).

However, customers still believe that car makers could do more. In the same survey, 82% of respondents said improved online marketing is a must for manufacturers. Christina Raab, Accenture’s global digital lead for the automotive electronics sector, expects the industry to move towards having a few, highly impressive showrooms located in central locations and to invest heavily in online customer contact.

“The auto industry is very slow to change compared with the electronics industry. But the connected car is now bringing the two industries together.”

This will change the dynamics of the industry, playing into the hands of new market entrants. In the past, the cost of setting up a dealer network across continents was enough to dissuade smaller brands from global expansion. The prevalence of online sales channels reduces the barriers to entry. But the impact of e-commerce on the car industry is only the tip of the iceberg. Now, cars themselves are becoming digital products.

This shift is being driven in part by customer demand. Accenture’s survey found that for 66% of respondents the in-car technology is a more important influence on their car purchasing decision than the performance of the vehicle on the road.

Every customer is now “used to a digital life”, Ms Raab says. This means they expect to be connected to the Internet by a host of digital products, of which their car is just one.

The industry is therefore trying to provide its customers with the same level of digital connectivity they enjoy from their smartphones and modern cars fitted with ever more sophisticated navigation systems and digital entertainment centres.

Meanwhile, the mechanical components of the car itself are increasingly permeated with digital functionality. “For premium-end cars, 50% of the value is in electronic components, not just the engine-management system but software to deliver live information,” says Professor David Bailey of the Aston Business School in Birmingham, England, who studies the car-making industry. He cites his own Nissan Leaf, an electric car with a permanent Internet connection, as an example of how the drivers’ relationship with the vehicle is changing.

The hyperconnected car has huge ramifications for the automotive industry’s manufacturing processes– not least by growing the complexity of the product itself. A typical saloon car can contain up to 30 computing devices, and these have to be embedded at the company’s own plant.

However, this is counterbalanced by the ability of car makers to use digital connectivity to manage their supply chains more effectively. “Cars are becoming more complicated and connected, but car companies are co-operating with new suppliers as the Internet itself breaks down transaction costs,” explains Professor Bailey.

Dutch semi-conductor company NXP, one of Europe’s largest chip manufacturers, has recently launched a joint venture with China’s Datang Telecom, aimed squarely at the Chinese car industry’s demand for connected components.

Drue Freeman, a senior vice-president at the chipmaker, notes that while NXP has sold into the car industry for 27 years, his sector is historically very different from motor making. “The auto industry is very slow to change compared with the electronics industry, it’s a very hierarchical value chain,” he says. “But the connected car is now bringing the two industries together.”

Customised cars

The next level of complexity will arise when the digitisation of the sales process combines with the growing sophistication of the manufacturing process. Professor Bailey believes the next frontier is highly customised cars, designed by customers themselves through online shop fronts. Building a car to order in this fashion would allow car makers to command higher prices for their products. “The web will allow the personalisation of each car to go a long way,” he says.

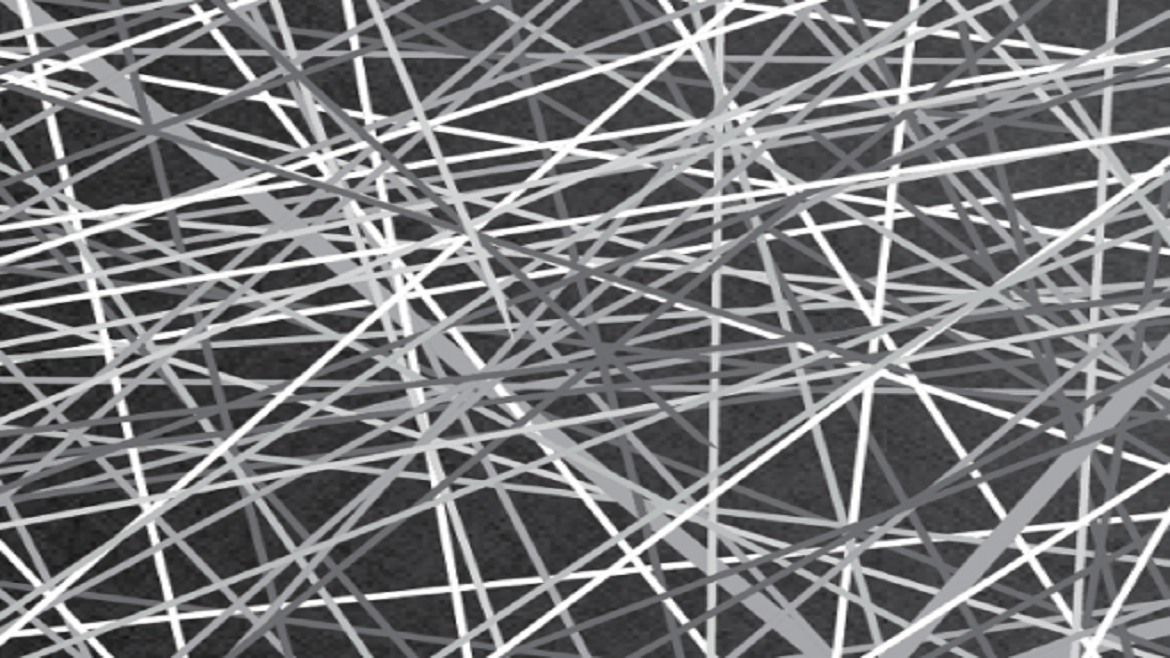

Highly customised car manufacture will itself benefit from hyperconnectivity: by adopting manufacturing equipment with more sophisticated sensors and more agile user interfaces, and by analysing the data this produces in greater detail, manufacturers hope to be able to execute shorter production runs at ever decreasing costs.

However, as noted in the Economist Intelligence Unit’s report on The Hyperconnected Economy, while there are ample reasons to adopt so-called “smart manufacturing”, the technical challenges are not inconsiderable, and some companies are struggling to make the shift. The automotive industry is no exception. “The big challenge is to cut these new processes down into digestible pieces,” says Ms Raab.

Unsurprisingly, the skills requirements of the car makers are changing. “We see an increasing search for more IT-related trades and a lot of hiring from hi-tech industries,” explains Ms Raab. In that regard, however, the automotive industry will have to join the queue. Hyperconnectivity is affecting all industries, and the high demand for digital skills is a universal problem.

Click here to download this article as a PDF