By Tensie Whelan and Dr Elie Chachoua

In New York State alone, the economic lost opportunity is estimated to be around US$17bn per annum. To put this in perspective, this is more than a third (36%) of the construction’s sector contribution to NY State’s economy.

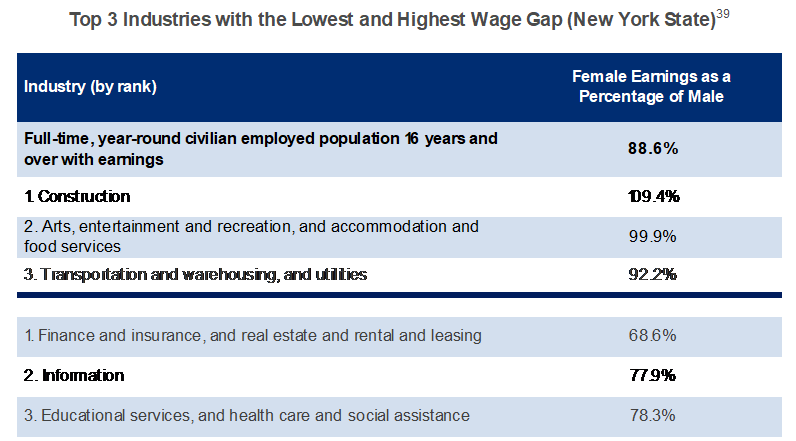

Oddly enough, this sector is actually the top performing one in NY State when it comes to the wage gap, with female workers earning slightly more on average than their male counterparts. The bad news is that the largest sector in the state’s economy, finance, is also the worst performer (see table below).

Source: “Closing the gender wage gap in New York State. Pay Equity and Advancement”, NY State Department of Labor, April 2018. Figures measure the gaps between median annual earnings.

Citibank, which is headquartered in New York City, was the first financial institution in the US to publicly disclose its wage equity metrics in 2018, demonstrating a gap of 1% after adjusting for job function, level and geography. Early this year, Citibank took the brave step of disclosing its unadjusted “raw” median gender pay gap, finding a gap of nearly 30%. This difference between mean and median matters, as the latter provides important insights on the distribution of opportunities in the workplace.

Measuring and disclosing the gender pay gap as Citi has done is a critical first step and investors have a key role to play in advocating for disclosure and action. Impact investor Arjuna Capital, for example, has introduced shareholder resolutions at large US companies in the financial and tech sector, asking them to measure and disclose their median gender wage gap as well as their policies and strategies to close it. While Citi agreed to disclose as a response to the resolution, Bank of America and Wells Fargo tried to prevent the vote by appealing to the Securities and Exchange Commission. The latter declined their request last February and the resolution proceeded to a vote at their latest shareholder meeting. While the proposals were voted down, they gathered more votes than previous pay equity attempts (26% vs. 15% in 2017 for Bank of America and 23% vs. 16% in 2017 for Wells Fargo). “Citi has more than 200,000 employees across the globe. When you get a company like that to undertake this type of exercise, it proves that it is doable and a reasonable request” says Natasha Lamb, managing partner at Arjuna Capital, adding that “measuring the median pay gap is actually much simpler than doing a whole statistical analysis of an ‘equal pay for equal work’ peer-to-peer comparison”.

The Bloomberg Gender Reporting Framework also provides companies a way to disclose all gender-related metrics, including pay, and the Bloomberg Gender Equality Index ranks 230 self-reporting companies. Their 2019 report found that “60% of firms conduct compensation reviews to identify gender-based variations in pay to close their average 20% pay gap.”

Tools are increasingly being made available to investors as well. As You Sow, a non-profit leader in shareholder advocacy provides a gender equality screen that investors can use to assess their fund holding performance on gender equality, for instance. State Street’s Gender Diversity ETF, interestingly, only received a score of 48 out of 100; some non-gender specific State Street funds perform better on the issue.

Clearly, more can be done. According to Just Capital, only 8% of the Russell 1000 have conducted gender pay equity analyses. However, 69% of highly ranked companies on Just Capital’s “America’s Most JUST Companies” list had done so and, interestingly, had a higher return on equity (23% vs 18%).

At a global level, information on the gender pay gap remains scarce. Of the 13 stock exchanges reviewed by the UN’s Principles for Responsible Investment (PRI) in 2017 (including the New York Stock Exchange), none had information on the gender pay gap across issuers. One jurisdiction where this is no longer the case is the UK, which, along with Denmark and few others, now requires all companies—above 250 employees for the UK and above 35 for Denmark—to disclose gender pay data.

Recent empirical research on the Denmark case suggests that such mandatory disclosure not only reduces the gender pay gap but also does so in a way that does not affect company profitability. According to Bennedsen et al, companies responded by reducing wage growth for male employees. This reduced productivity but also lowered the wage bill, leaving profitability unchanged. Importantly, the research found positive spillover effects in terms of the promotion of female employees.

NY State, which is among the states with the lowest gender wage gap, currently has requirements for gender pay disclosure in place for public contractors. State Comptroller Scott M Stringer has also been engaging healthcare and insurance industries on the issue. As a result, eight major US companies, including Metlife, Aetna and Abbott Laboratories, have agreed to evaluate and disclose their gender pay gap.

However, as the UN PRI study notes, "at the current rate of progress, the gender pay gap will not close for over 100 years, and the global average of women on boards will not reach 30% until 2027." The Equal Pay Act was introduced in 1963; women have been waiting long enough.