Educational technology (edtech), which refers to the use of apps and tech for teaching and learning, became a key tool for governments and businesses in the wake of covid-19, attracting investors’ attention.1 The pandemic catalyzed edtech adoption, as years of digitalization and technological advances were compressed, implemented rapidly over the span of a few months.2 Investments followed this same trajectory. Between 2020 and 2021 edtech ventures raised over US$35bn dollars globally, the same amount recorded in the five years before the pandemic.3 In Latin America, investments in 2021 were sixfold the funding in previous years.4 However, edtech funding in the region remains low relative to global investments over the past decade, having raised just US$1bn compared with US$68.6bn globally.5

While edtech investments are now stabilizing after such explosive growth, they are still projected to remain above their pre-covid levels, thereby demonstrating their long-term potential.6 In order to assess this potential, this article explores which investments are working, what challenges edtech can successfully solve, where there’s opportunity, and what future edtech prospects might look like. Our analysis indicates that over the short term upskilling and workforce education, which currently represent the largest share of edtech investments, are likely to continue gaining traction. These areas address the urgent skills gap that prevails in the region and help meet the increasing demands from nearshoring, but do not face the same barriers to entry that other types of edtech innovations will have to overcome.

LatAm’s need for edtech

Latin America has just under half a billion people demanding innovation in literacy and numeracy, as well as the acquisition of 21st-century skills and knowledge. In Argentina, 73% of companies struggle to hire staff with the right skill sets. 67% of Peruvian companies report a talent shortage and difficulty hiring, while for Mexican companies that figure stands at 65%.7 66% of Costa Rican companies and 61% Colombian companies report the same.8 A 2021 OECD study found that the lack of quality jobs is a key driver of social dissatisfaction in the region, and calls for an ambitious regional agenda to increase innovation and capacity development through education and skills acquisition to tackle this challenge.9

Another factor that will drive the need to reduce the skill gap in the region is the developing trend of nearshoring in the region. Geopolitical and supply chain considerations are influencing companies, particularly in the United States, to move their operation to locations closer to their markets, that require less energy for transportation and have better political alignment. In this context, Latin America is becoming one of the most attractive options for relocation and several countries in the region are competing for these new sources of employment and investment.10 Greater participation in global value chains results in transfer of technology and knowledge and more job opportunities, and Latin America is predicted to increase exports in the auto industry, textiles, pharmaceuticals and renewable energy, to name a few.11 However, in order to take advantage of this opportunity, there is a need for technologically advanced workers who can adequately address the demands of these higher-skill jobs. This need will drive an increased demand for greater technical expertise in these areas as well as improved language capabilities, creating an even greater urgency to close the Latin American skills gap.

This represents an unmatched growth opportunity for the sector in the region. Fifty-five per cent of Latin American adults who engage in open or distance education have found it a useful tool to improve their job performance and career prospects.12 As part of their innovative offerings, edtech companies ensure instruction is aligned with the needs of each student, allowing them to customize their learning experience and adjust the pace to accelerate their program of study or take additional time to ensure mastery.13 These offerings also reduce the cost of education by reducing reliance on manual resources, making updates to learning materials simple, and introducing automation.14

A highly competitive job market further encourages students of all ages to further develop various competencies, creating a demand for educational technology, and a demand for institutions to digitally transform.15 Edtech uptake among young adults in particular is growing at a faster pace in Latin America than in other regions in the world. In a recent survey conducted by Economist Impact, we found that 86% of Brazilian youth had participated in online education or courses to improve their professional skills compared with 78% of young people in India and 74% in the US.16

Value of knowledge: assessing edtech investments

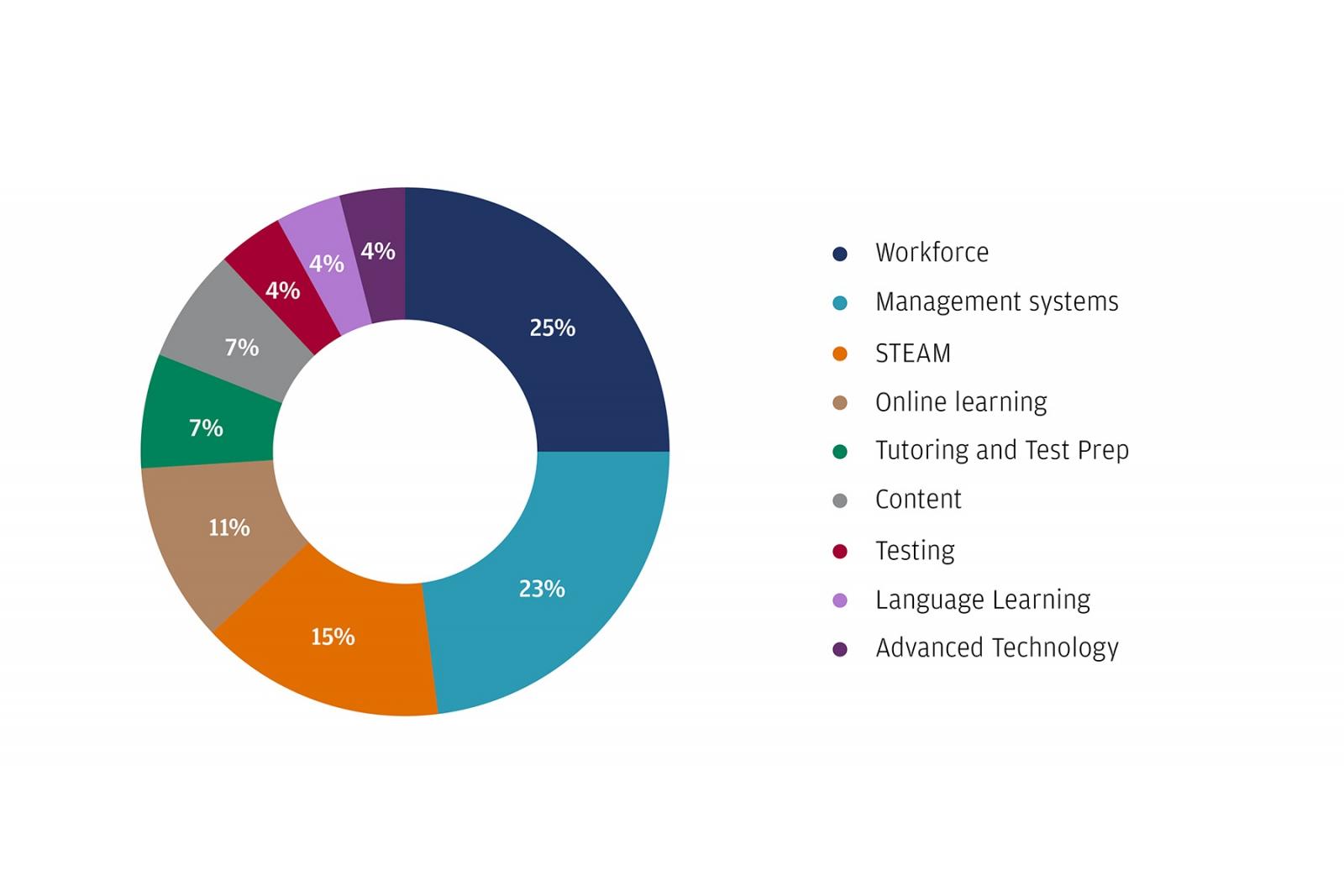

In response to this growing demand, edtechs dedicated to workforce upskilling have seen the most expansion in the region. Workforce and management systems, which are considered corporate learning ventures, comprise almost half the edtech startups founded in Latin America (See Graph 1). Workforce upskilling-focused edtechs include firms such as Coderhouse, a startup that provides a platform for LatAm professionals to take live, online cohort-based courses in topics such as data, coding, design and marketing. The classes are offered in small groups led by instructors and teaching assistants, and the curriculum is designed through partnerships with top companies. The courses are offered at an accessible price point per course.17 Similarly, Bedu, a Mexican venture, provides technical courses designed to help employees build practical skills, with a focus on upskilling to boost salaries.18

Percentage of edtechs by type, of a sample cohort of 100 start-ups in LatAm

Workforce and management systems represent almost half the start-ups in Latin America

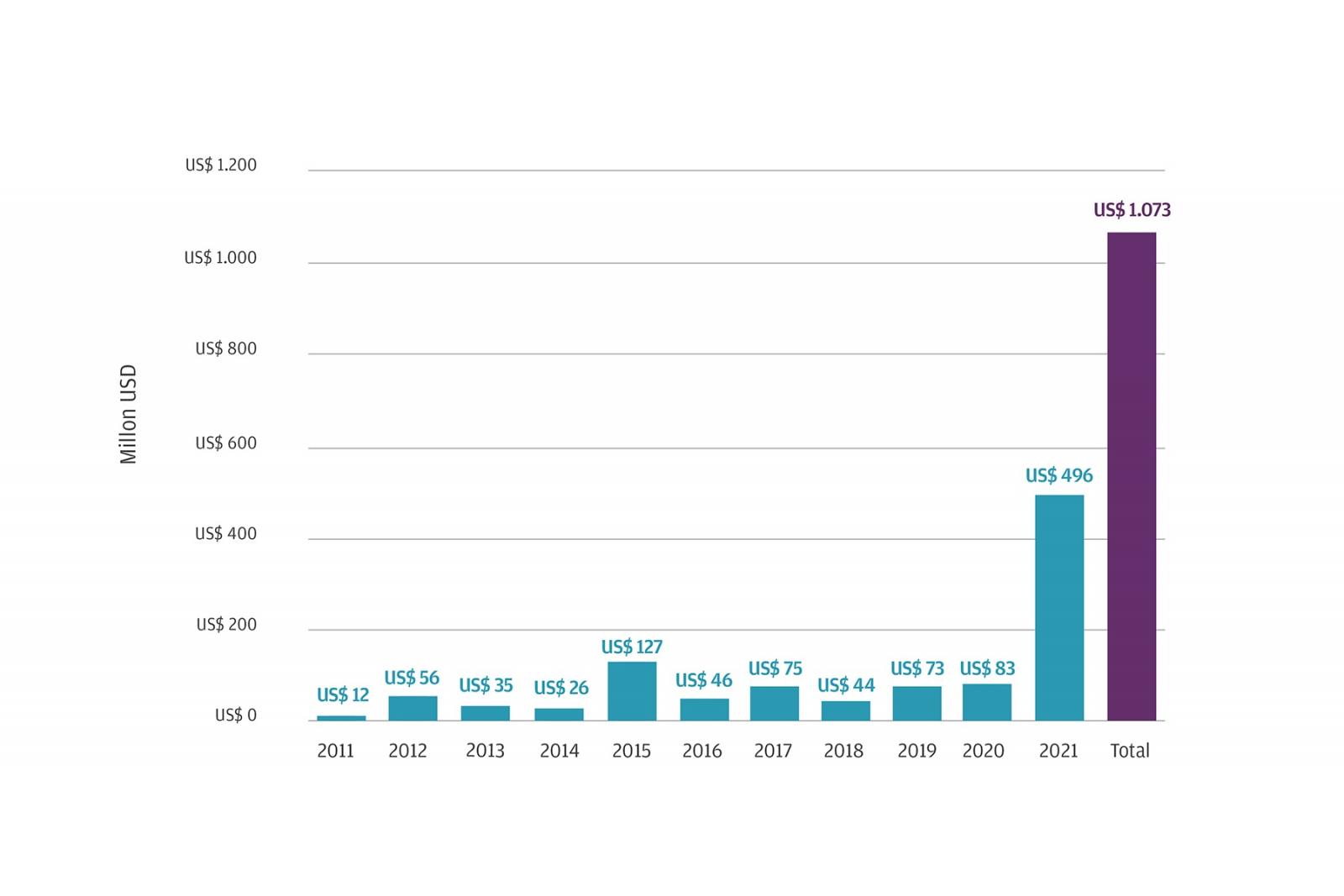

A study looking at a sample cohort of edtech ventures in the region also found that workforce-focused edtechs attract the majority of start-up funding, indicating an increasing focus on ventures oriented to learners in the workforce.19 Investments in workforce and upskilling-focused edtechs further increased as the pandemic compelled companies to rapidly scale. In 2021 alone LatAm raised 46% of the total investment amount the region had captured over the previous decade. It experienced an influx of venture capital (VC) investment totaling sixfold the amount that it received in 2020, equal to US$1bn.20 (see Graph 2)

Funding for Latin American Edtechs exploded in 2021

VC funding for LatAm Edtech ventures 2011-21 21

Comparing against global markets, in both Europe and Latin America workforce solutions are the most relevant edtech sectors receiving sizable investments. A breakdown of VC investments in Europe shows that corporate learning takes the biggest share (35%). Although Latin America lags in terms of funding value, its investments have a similar distribution.22 Over half (55%) of private funding in LatAm edtechs in the past five years has gone into the workforce sector.23

Even though Latin America’s edtech investments are behind those of global markets, its future revenue is set to grow. Latin America is the fourth-largest edtech market in the world—behind North America, Western Europe and Asia in terms of revenue—and its e-learning market is expected to generate revenue of over US$3bn by 2023.24 Globally, the edtech market is growing at a rate of 16.3% and is set to reach US$404bn in total global expenditure, suggesting an overall trend toward growth.25

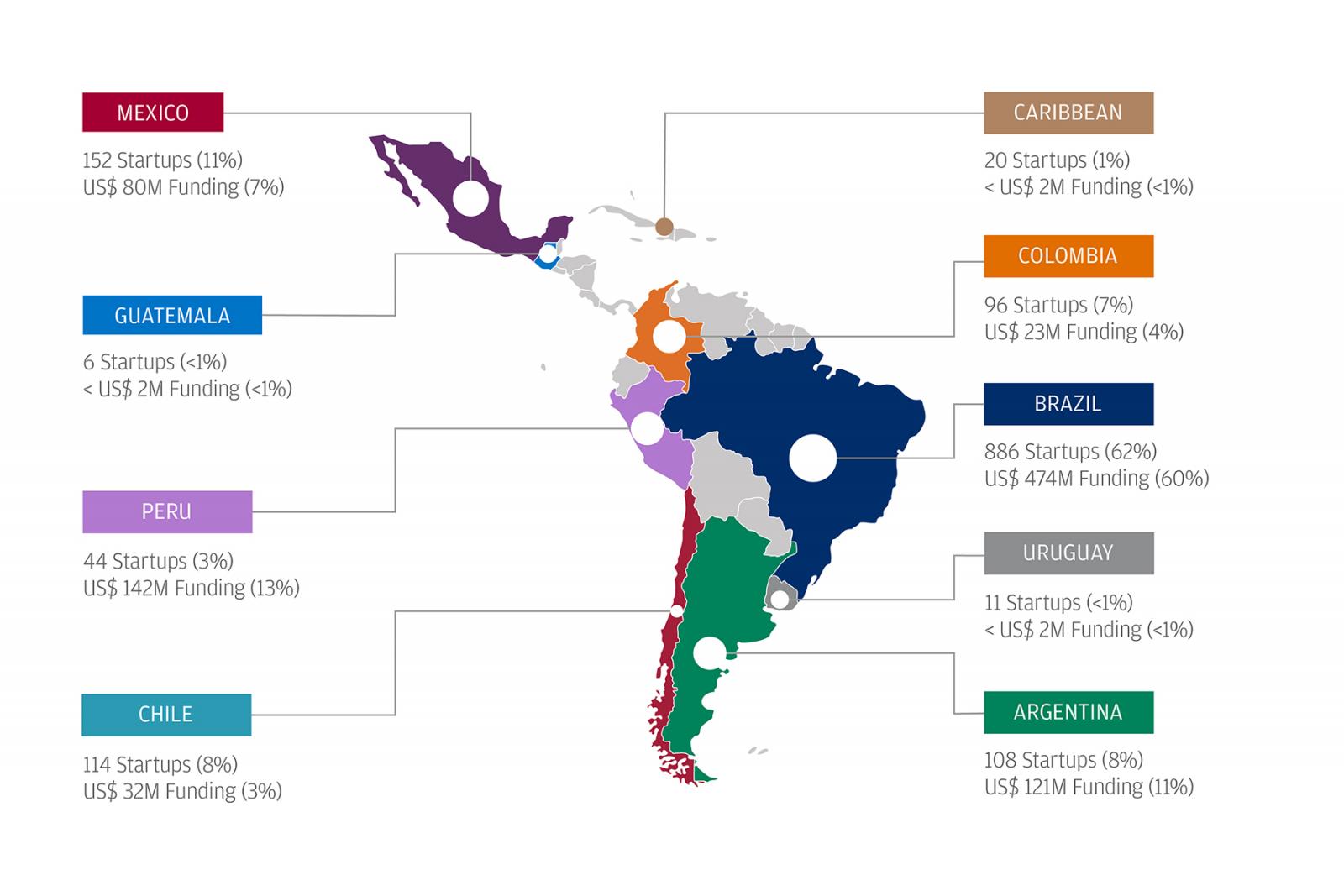

A decade of development in edtech in the LatAm region has helped the sector expand dramatically in the past 12 months. The Latin American edtech ecosystem has grown to encompass more than 1,500 companies.26 Brazil represents over 50% of all edtech VC funding in this period. Mexico follows at 19%, then Peru, Argentina, Colombia and Chile each capture 6-8% of funding.27 (See Graph 3)

Distribution of edtech startups across countries in LatAm

However, as we pointed out in our recent research on tech start-ups, there are only 15 start-ups in Latin America that are valued at more than US$1m, making up only 0.5% of the region’s start-up investment.28 Not all opportunities in edtech will have the capacity to scale internationally, but opportunities that address regional educational needs will capture a significant share of the market, and present meaningful opportunities to capitalize on the overall growth potential.

Grading LatAm market readiness

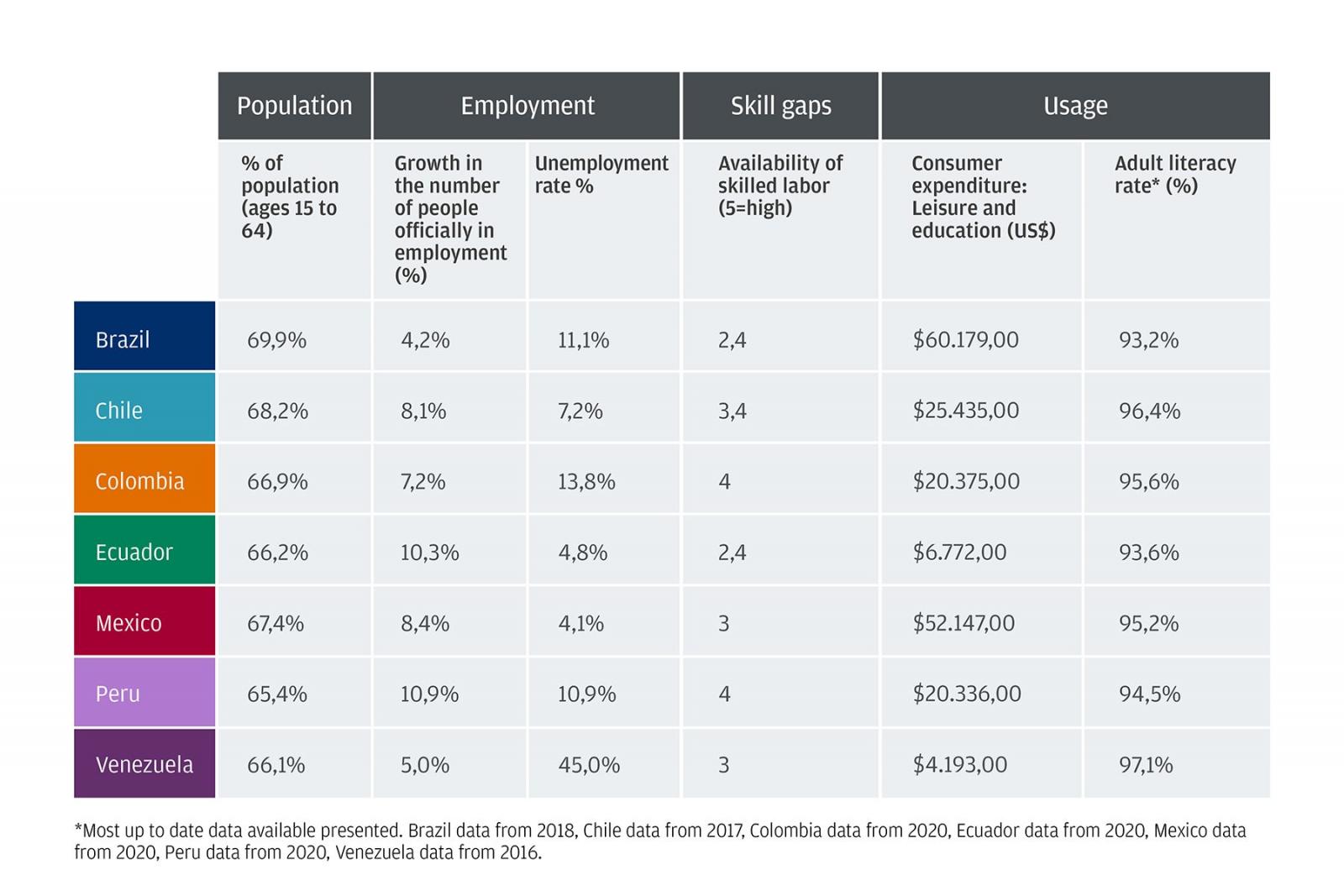

To understand the potential of edtech ventures, investors should consider the opportunities that will fulfill the most prescient need in the region. While covid-19 sparked a demand for all types of digital educational experiences, investors’ interest in ventures that support workforce upskilling is sustained as the pandemic subsides. An analysis of the population, education levels, skill gaps and current use of education tools online suggests that there is a large untapped market for workforce development solutions that will generate an enduring demand for these applications in the near future (see Table 1).

A sampling of Latin American countries reflects a sizable working population and growing employment rates. Twenty-four percent of jobs will face a high risk of automation, and an additional 35% of jobs in Latin America are likely to experience significant changes in the tasks that workers carry out daily, so a significant portion of the working population could feasibly benefit from some form of upskilling or reskilling.29 Middling availability of skilled labor in countries like Brazil and Ecuador and a lack of quality labor in countries like Peru further indicate the need for skill building across industries. On the positive side, high literacy levels across the region and overall comfort using the internet for education purposes suggest that Latin Americans have the capacity to adopt edtech innovations into their routines. For example, 42% of the population in Mexico and 34% in Colombia have taken an online course. These data point to an environment that is opportune for workforce edtechs in the short term. The need to bridge the regional skill gap, coupled with the initial uptake and spending on online education ventures in the past few years demonstrates the market potential for edtech solutions.

Table 1: Assessing workforce upskilling market readiness across LatAm countries (comparing 2021 data or most recent yearly data on employment, population, skill gaps and usage)

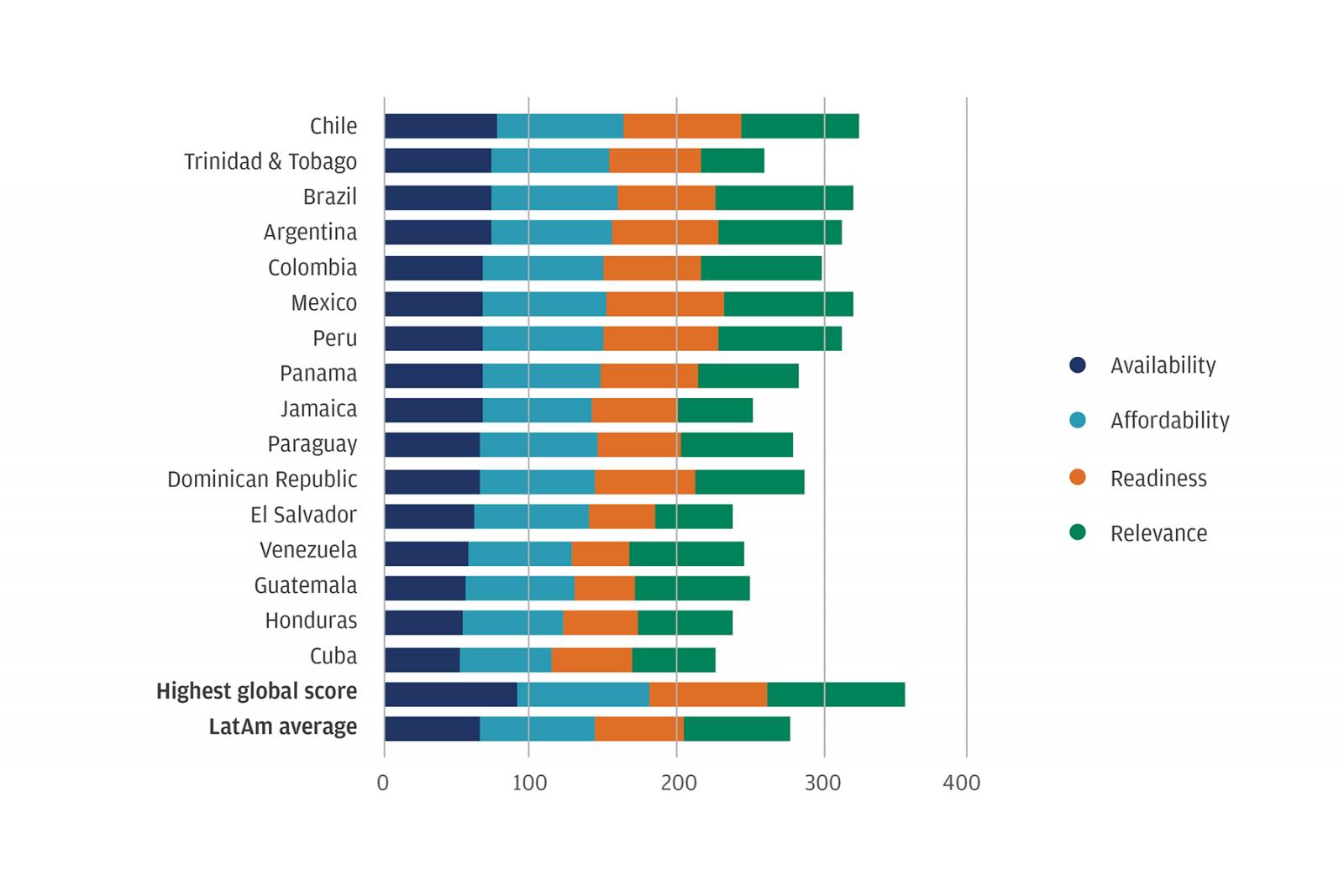

Internet penetration across LatAm countries, considering connectivity, availability, affordability, relevance and readiness

LatAm has a high degree of relevance and affordability, but experiences overall gaps in availability and readiness.

Corporate market and upskilling has been the primary destination for investment in Latin America and remains a favorable opportunity, particularly in the short term. Immediate demand for skilled labor and increasing competition propel the market, creating current and ongoing opportunities. Workforce education globally is projected to have a growth rate of 3.9%, and investments are projected to increase from US$396bn in 2019 to US$498bn in 2025.34 Since Latin America typically mirrors global edtech trends, albeit at a smaller scale, the sector's prospects in this region look optimistic for the future.

1 Matthew Lynch, The Tech Edvocate, “A 2022 Definition of Edtech”, July 31st 2020, https://www.thetechedvocate.org/a-2021-definition-of-edtech/

2 Bonny Renner, LABS, “Edtechs are poised for ascension”, September 23rd 2021, https://labsnews.com/en/articles/business/edtech-giants-are-poised-for-ascension/

3 Rhys Spence, TechCrunch, “European, North American edtech startups see funding triple in 2021”, January 27th 2022, https://techcrunch.com/2022/01/27/european-north-american-edtech-startups-see-funding-triple-in-2021/

4 Holon IQ, “Education Technology in Latin America and the Caribbean”, 2022, https://www.holoniq.com/notes/education-technology-in-latin-america-and-the-caribbean

5 Holon IQ, “Global EdTech Funding 2022 - Half Year Update”, 2022, https://www.holoniq.com/notes/global-edtech-funding-2022-half-year-update ; Holon IQ, “Education Technology in Latin America and the Caribbean”, 2022, https://www.holoniq.com/notes/education-technology-in-latin-america-and-the-caribbean

6 Holon IQ, “Global EdTech Funding 2022 - Half Year Update”, 2022, https://www.holoniq.com/notes/global-edtech-funding-2022-half-year-update

7 ManpowerGroup, “THE 2022 GLOBAL TALENT SHORTAGE”, https://go.manpowergroup.com/hubfs/Talent%20Shortage%202022/MPG-Talent-Shortage-Infographic-2022.pdf; the World Economic Forum, “In Latin America, companies still can’t find the skilled workers they need”, March 30th 2017, https://www.weforum.org/agenda/2017/03/in-latin-america-companies-still-can-t-find-the-skilled-workers-they-need/

8 ManpowerGroup, “THE 2022 GLOBAL TALENT SHORTAGE”, https://go.manpowergroup.com/hubfs/Talent%20Shortage%202022/MPG-Talent-Shortage-Infographic-2022.pdf; the World Economic Forum, “In Latin America, companies still can’t find the skilled workers they need”, March 30th 2017, https://www.weforum.org/agenda/2017/03/in-latin-america-companies-still-can-t-find-the-skilled-workers-they-need/

9 OECD, “Latin American Economic Outlook 2021”, https://www.oecd-ilibrary.org/docserver/5fedabe5-en.pdf?expires=1663178488&id=id&accname=guest&checksum=4C984F1027BB07A153CC171DAB962D3C

10 Wilson Center, “Nearshoring in the Americas,” October 18, 2022, https://www.wilsoncenter.org/audio/nearshoring-americas

11 Inter-American Development Bank. “Nearshoring can add annual $78 bln in exports from Latin America and Caribbean,” June 07, 2022, https://www.iadb.org/en/news/nearshoring-can-add-annual-78-bln-exports-latin-america-and-caribbean

12 OECD, “Making the Most of Technology for Learning and Training in Latin America”, https://www.oecd-ilibrary.org/sites/14bb093f-en/index.html?itemId=/content/component/14bb093f-en

13 Anne Olsen, Brookings, “Personalized learning: The importance of teachers in a technology-driven world”, September 27th 2017, https://www.brookings.edu/blog/brown-center-chalkboard/2017/09/27/personalized-learning-the-importance-of-teachers-in-a-technology-driven-world/

14 Sara Munoz, D2L, “How Can Technology Help Cut Costs in Education?”, May 29th 2017, https://www.d2l.com/en-eu/blog/can-technology-help-cut-costs-education/

15 Inter-American Development Bank and Holon IQ, "Education Technology in Latin America and the Caribbean”, December 2021, https://publications.iadb.org/publications/english/document/Education-Technology-in-Latin-America-and-the-Caribbean.pdf; Institute for the Future of Education, “Advances and Challenges of EdTech in Latin America and the Caribbean”, https://observatory.tec.mx/edu-news/edtech-in-latin-america#:~:text=Last%20year%2C%20educational%20technology%20boomed,experiences%2C%20and%20improved%20student%20outcomes

16 Economist Impact, “Entrepreneurial Dreams”, https://impact.economist.com/projects/young-voices/

17 Natasha Mascarenhas, TechCrunch, “As edtech evolves, LatAm reskilling platforms raise millions to bring outcomes into the mix”, August 5th 2021, https://techcrunch.com/2021/08/05/as-edtech-evolves-latam-reskilling-platforms-raise-millions-to-bring-outcomes-into-the-mix/

18 Crunchbase: Bedu, https://www.crunchbase.com/organization/bedu; Lavca Venture Investors, “EDTECH STARTUPS IN LATIN AMERICA

2021 SURVEY RESULTS”, https://lavca.org/2021-startup-survey-edtech/

19 Holon IQ, “2021 LATAM EdTech 100”, September 21st 2021, https://www.holoniq.com/notes/2021-latam-edtech-100

20 Institute for the Future of Education, “Advances and Challenges of EdTech in Latin America and the Caribbean”, https://observatory.tec.mx/edu-news/edtech-in-latin-america#:~:text=Last%20year%2C%20educational%20technology%20boomed,experiences%2C%20and%20improved%20student%20outcomes

21 Inter-American Development Bank and Holon IQ, "Education Technology in Latin America and the Caribbean”, December 2021, https://publications.iadb.org/publications/english/document/Education-Technology-in-Latin-America-and-the-Caribbean.pdf

22 Juan Manuel Pico, K12 Digest, “EdTech in Latin America: An “Education Renaissance” Tale”, March 31st 2022, https://www.k12digest.com/edtech-in-latin-america-an-education-renaissance-tale/

23 https://publications.iadb.org/publications/english/document/Education-Technology-in-Latin-America-and-the-Caribbean.pdf

24 Inter-American Development Bank and Holon IQ, "Education Technology in Latin America and the Caribbean”, December 2021, https://publications.iadb.org/publications/english/document/Education-Technology-in-Latin-America-and-the-Caribbean.pdf

25 Holon IQ, “Sizing the Global EdTech Market. Mode vs Model”, February 23rd 2021, https://www.holoniq.com/notes/sizing-the-global-edtech-market; Cision, “Latin America E-Learning Market Expected To Generate Revenues Over $3 Billion By 2023”, February 9th 2022, https://www.prnewswire.com/news-releases/latin-america-e-learning-market-expected-to-generate-revenues-over-3-billion-by-2023-301478296.html

26 Inter-American Development Bank and Holon IQ, "Education Technology in Latin America and the Caribbean”, December 2021, https://publications.iadb.org/publications/english/document/Education-Technology-in-Latin-America-and-the-Caribbean.pdf

27 Ibid

28 J.P. Morgan, “Beyond the unicorns: Smaller companies also hold great promise In Latin America”, October 14th 2021, https://privatebank.jpmorgan.com/gl/en/insights/planning/beyond-the-unicorns-smaller-companies-also-hold-great-promise-in-latin-america&sa=D&source=docs&ust=1661444590657639&usg=AOvVaw3HENMtS0rq0Wwtr3ygQ43K

29 OECD, “Effective Adult Learning Policies : Challenges and Solutions for Latin American Countries”, https://www.oecd-ilibrary.org/sites/0dd92af0-en/index.html?itemId=/content/component/0dd92af0-en

30 ITU, “About International Telecommunication Union (ITU)”, https://www.itu.int/en/about/Pages/default.aspx

31 Institute for the Future of Education, “Advances and Challenges of EdTech in Latin America and the Caribbean”, https://observatory.tec.mx/edu-news/edtech-in-latin-america#:~:text=Last%20year%2C%20educational%20technology%20boomed,experiences%2C%20and%20improved%20student%20outcomes

32 The World Bank, “Individuals using the Internet (% of population) - Latin America & Caribbean”, https://data.worldbank.org/indicator/IT.NET.USER.ZS?locations=ZJ ; Economist Impact, “The Inclusive Internet Index”, https://impact.economist.com/projects/inclusive-internet-index/ ; https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx

33 OECD, “Latin American Economic Outlook 2021”, https://www.oecd-ilibrary.org/docserver/5fedabe5-en.pdf?expires=1663178488&id=id&accname=guest&checksum=4C984F1027BB07A153CC171DAB962D3C

34 Holon IQ, “Sizing the Global EdTech Market. Mode vs Model”, February 23rd 2021, https://www.holoniq.com/notes/sizing-the-global-edtech-market