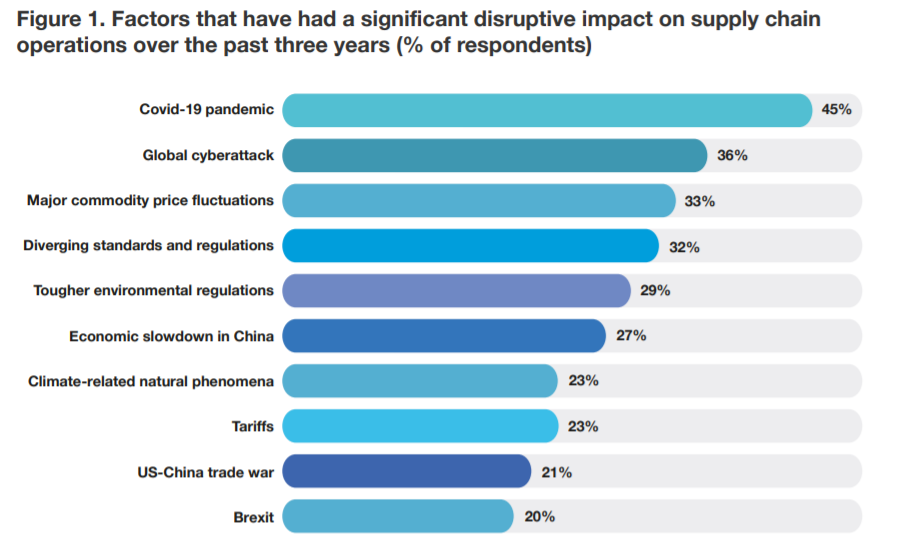

Although the havoc wrought by the Covid-19 pandemic caught most businesses by surprise in the early months of 2020, modern multinationals are by now no strangers to supply-chain shock and disruption. The concurrence of a number of disruptive forces, including trade disputes, cyberattacks, commodity price fluctuations and the increasing frequency and severity of natural disasters, are testing the complexity and interdependence of global supply chains that multinationals have built up over recent years. Executives anticipate that disruption is only set to increase in the coming decade.

To explore the business costs of such disruptions, and how firms are adapting to mitigate them, The Economist Intelligence Unit (EIU) undertook a survey of senior supply-chain and procurement executives from the US and Europe (see About This Report) and conducted in-depth interviews with experts from academia and industry.

Our research found that disruptions have incurred substantial financial costs (averaging 6-10% of annual revenues), as well as reputational costs—in terms of customer complaints and damage to brand reputation—as companies have struggled to maintain supplies of their goods. Indeed, firms were as likely to report damage to brand reputation as a consequence of supply-chain disruption as increased costs of operations.

Businesses are responding to increased disruption by exchanging efficiency for greater resilience. Some are prioritising costlier suppliers in less risky markets. Such strategies come at a cost. But firms are working to mitigate these costs through investments in technology, simplified and regionalised supply chains, and, in some cases, simplifying the design of goods to make components easier to source, as this report discovers. Key findings include:

- The Covid-19 pandemic has had a significant disruptive impact on global supply chains, with 45% of firms surveyed by The EIU reporting a significant disruptive impact.

- Recent supply-chain disruptions have given rise to a variety of business costs, including both increased costs of operations and reputational costs—in terms of customer complaints and damage to brand reputation as companies have struggled to maintain supplies of their goods. Firms were as likely to report damage to brand reputation arising from supply-chain disruption as they were to report increased costs of operations.

- Sixty per cent of firms are satisfied with how their supply-chain operations have coped with recent disruptions. US-based executives were much more likely to express dissatisfaction than Europe-based counterparts (about one-third of US respondents did so, versus 7% of European ones). US firms have been beset by a wider variety of problems, and in particular with difficulties striking long-term supply deals with Chinese companies amid a US-China trade dispute.

- Sixty per cent of respondents agree that redundancy (meaning excess capacity) and resilience in their company’s supply chain are more important than speed and efficiency (32% strongly agree), signalling a major shift in strategy.

- Supply-chain disruptions are expected to become more common. More than half of the executives surveyed (54%) say that organisations must make significant changes in order to effectively manage supply-chain disruptions in the next five years.

- Firms are pursuing a range of actions to mitigate the impacts of future disruptions, including strengthening relationships with existing suppliers, implementing permanent supply-chain risk-management teams and processes, and investing in technology.

- Some firms have regionalised or localised their supply chains to allow for rapid delivery of goods, and to avoid disruption from travel restrictions during a crisis. Regional supply chains are providing firms with a hedge against future shocks. A third of companies (31%) are simplifying their supply chains to make them easier to manage.