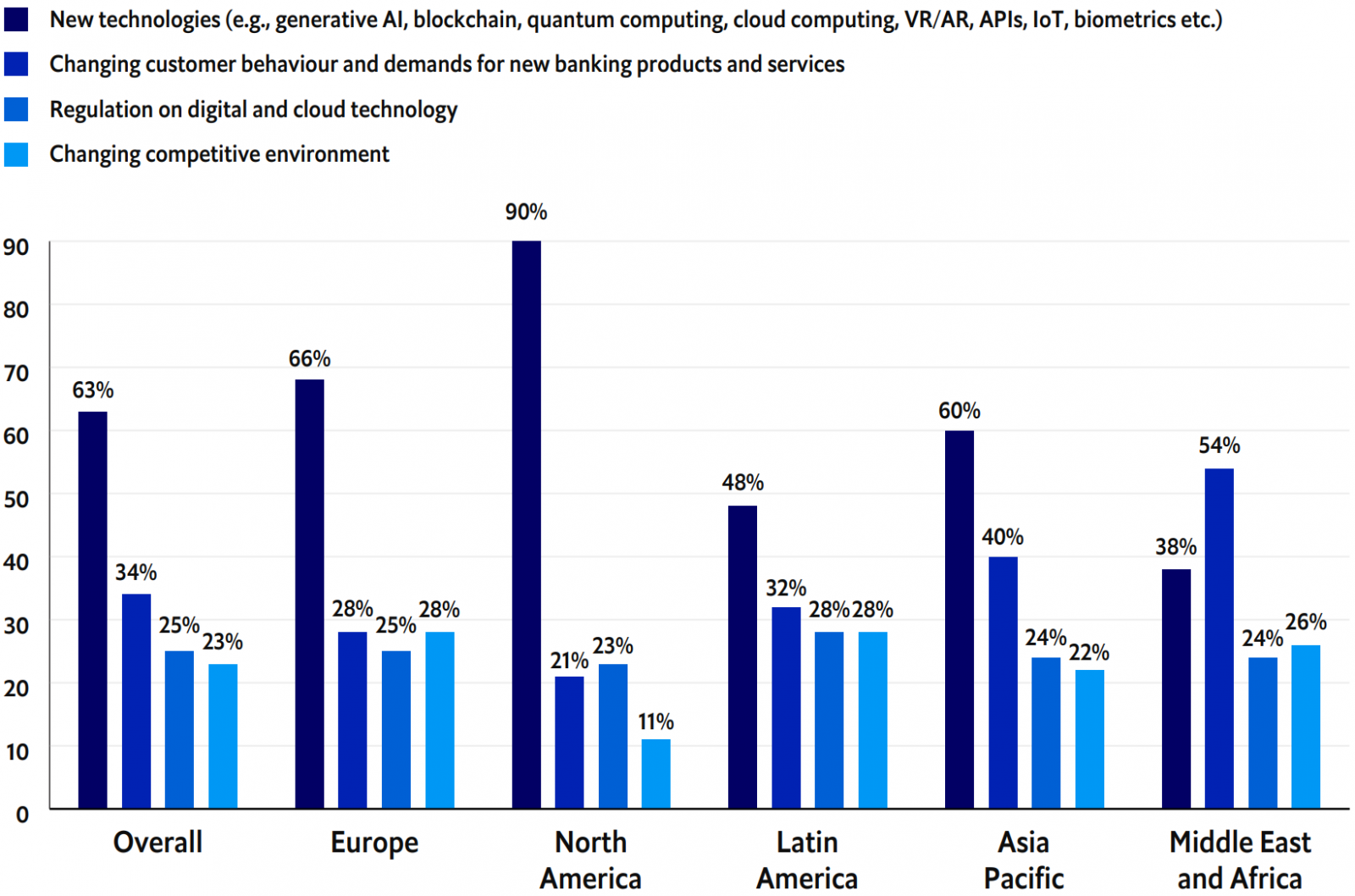

- Even more respondents in North America are convinced than those in other regions (90%, compared with 63% globally) that technology will be the trend to have the biggest impact on banks in their country in the next five years.

- Product agility and enabling embedded finance are bigger strategic priorities for North American banks than those in other regions in the next five years. Accordingly, they are investing more on agile technology delivery (DevOps) and blockchain technology.

- In order to best utilise emerging technologies and handle the exponential growth of data, banks are moving applications to the cloud. Banks in North America are prioritising moving domestic core banking much more so than those in other regions. They also have a stronger belief that a multi-cloud strategy will become a regulatory pre-requisite.

- More banks in North America see offering banking products and responsible lending to the unbanked and underbanked population as a strategic, actionable business opportunity for the next one to three years.

ABOUT THIS RESEARCH

Economist Impact conducted a study, commissioned by Temenos, to understand emerging trends in the banking industry. This report presents insights from a global survey of 300 executives in retail, commercial and private banking spanning Europe (25%), North America (23%), Asia Pacific (18%), Middle East and Africa (17%), and Latin America (17%). Respondents perform various job functions, such as IT, customer service, finance, marketing and sales, strategy and business development, and general management, among others. Half of the respondents are C-suite executives. This is the seventh year that Economist Impact has conducted this survey. The research also included interviews with industry practitioners to gain further insights.

Which trends do you believe will have the biggest impact on banks in your country in the next five years?