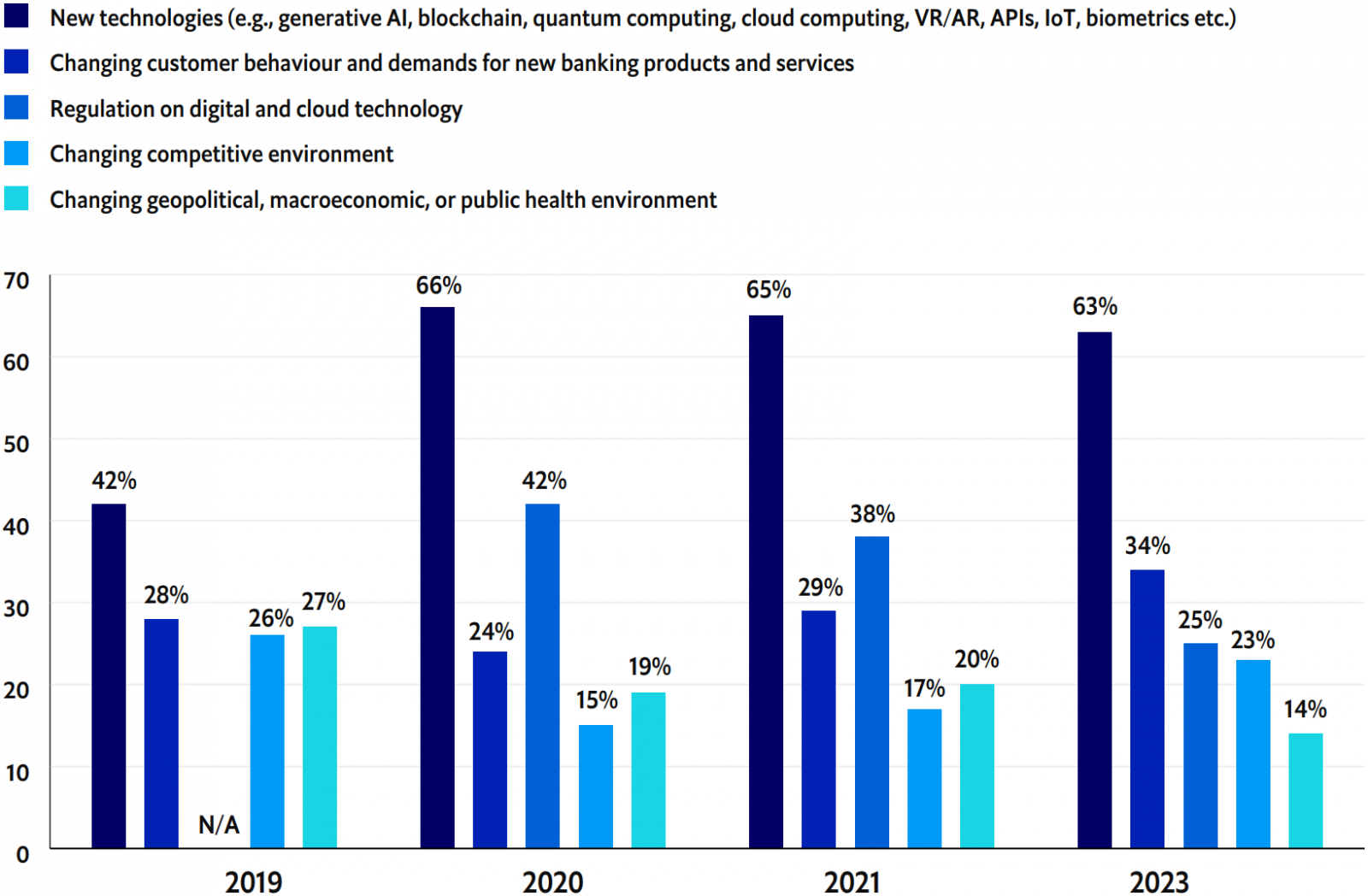

- New technologies will have the biggest impact on banks in the next five years—more than changing customer demand and evolving regulation. Generative artificial intelligence (AI) in particular is expected to impact banking, according to 75% of respondents to a survey conducted by Economist Impact. More than 70% of survey respondents see unlocking value from AI as a key differentiator between winners and losers.

- Collaboration with fintechs or other technology providers is key to access expertise in emerging technologies as openbanking initiatives multiply across the world.

- Banks see their business model evolving in the next 12-24 months, offering bankingas-a-service to brands and fintechs, and enabling embedded finance within their own products and services—79% of survey respondents agree that banking will become “embedded” in consumers’ lives and businesses’ value chains.

- Nearly two-in-five banks (38%) foresee acting as a true digital ecosystem offering own and third-party banking and non-banking products and services.

- Improving personalised and embedded customer experiences remains a top strategic priority. Three-quarters of survey respondents agree that banks will seek to differentiate on customer experience rather than products in the next five years.

- Customer centricity is driving banks to offer more embedded environment, social and governance (ESG) propositions to their customers (73%), as well as providing capital to environmentally friendly projects (74%).

- With the focus on lowering their carbon footprint, as well as the increasing use of data-intensive AI, banks are inevitably moving to the public cloud—51% of respondents agree that banks will no longer own any private data centres in the next five years after moving to the public cloud.

ABOUT THIS RESEARCH

Economist Impact conducted a study, commissioned by Temenos, to understand emerging trends in the banking industry. This report presents insights from a global survey of 300 executives in retail, commercial and private banking spanning Europe (25%), North America (23%), Asia Pacific (18%), Middle East and Africa (17%), and Latin America (17%). Respondents perform various job functions, such as IT, customer service, finance, marketing and sales, strategy and business development, and general management, among others. Half of the respondents were C-suite executives. This is the seventh year that Economist Impact has conducted this survey. The research also included interviews with industry practitioners to gain further insights.

Which trends do you believe will have the biggest impact on banks in the next five years?

Source: Economist Impact survey.