Economist Impact, supported by Google, conducted a survey of 1,375 employees across Asia-Pacific (APAC), including 100 employees from Japan, between November 2022 and January 2023. It also interviewed employers and industry experts across the region to understand their perspectives on skills gaps, as well as reskilling and upskilling aspirations.

The survey respondents were drawn from across 14 markets in the region, out of which 11.8% were Gen Z (born in 1997-2012), 63.2% were Millennials (1981-96) and 25% were Gen X (1965-80). They all work in a diverse mix of industries.

The research shows that across the region, common understanding is lacking between employers and employees about future skills and the best way to develop them. In some instances, there is also a mismatch between what employers want and what employees consider as being important. Understanding these gaps will be instrumental in creating a workforce that is prepared for the economy of the future.

This article—one in a series of 12 market reports—examines these issues in Japan. This series complements a research paper that looks at the reskilling and upskilling imperative across APAC.

Key findings:

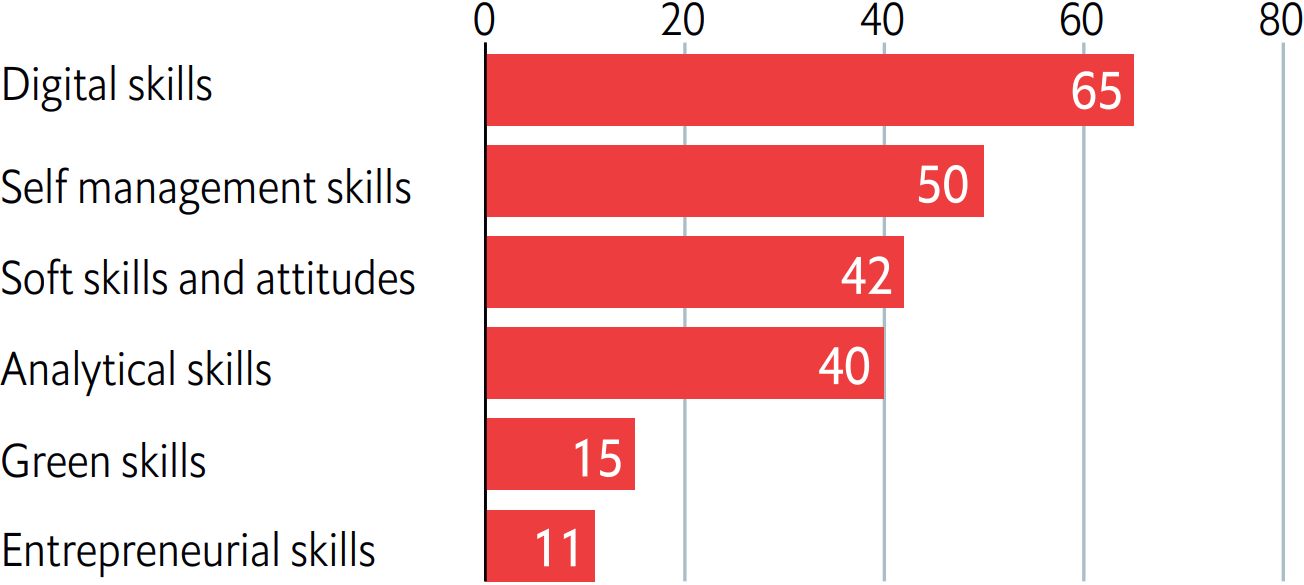

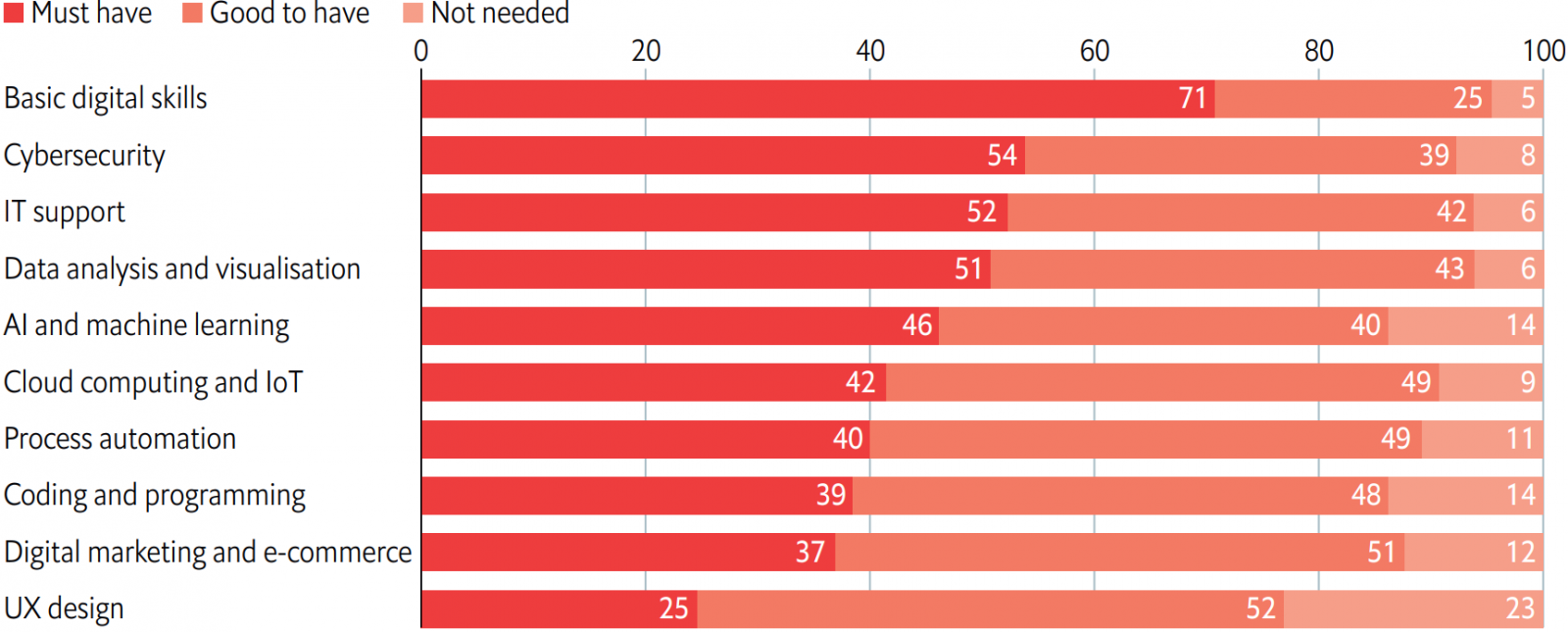

- 65% of employees in Japan choose digital skills as a top skill to acquire, with basic digital skills considered their top priority. Advanced digital skills such as cybersecurity (53.8%), IT support (52.3%), and data analysis and visualisation (50.8%) are also considered must-haves.

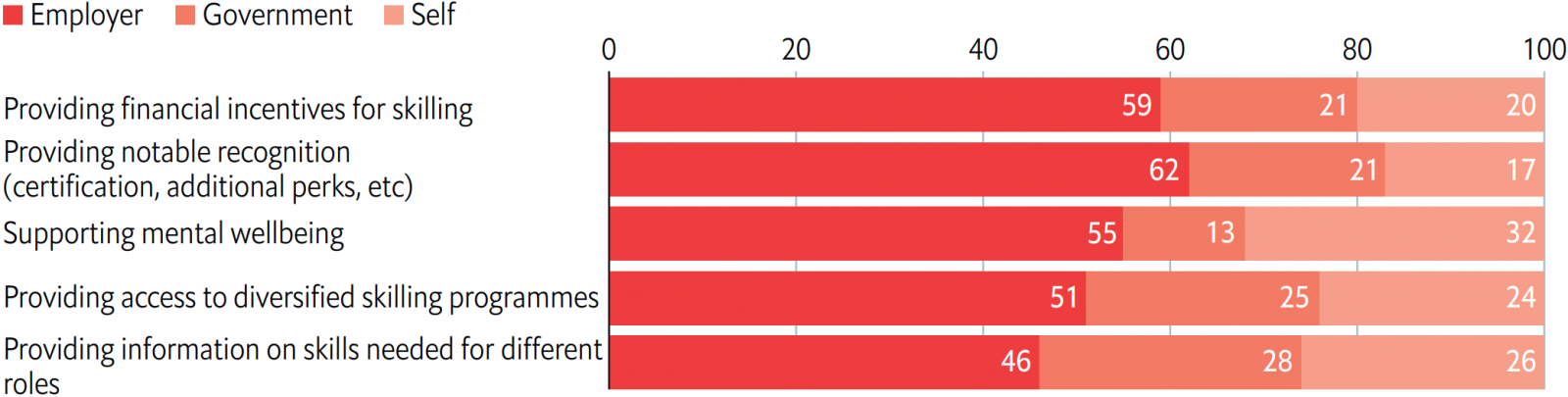

- Employees in the country mainly rely on their employers for upskilling support such as providing financial incentives for skilling (59%) and enabling the access to diversified skilling programmes (51%).

- Skills-based hiring is becoming popular in Japan. 60% of employees report that employers are shifting to new hiring practices such as skills-based hiring while 54% agree that their employers value online certificates.

The challenges of Japan's demography are impacting its labour market. With a rapidly ageing population, Japan’s share of working age people (15-64 years) is expected to shrink by roughly 20%, to 57.1 m by 2050.1 An ageing workforce will stress the country’s access to labour in the future. A tight labour market will particularly affect small to medium sized enterprises (SMEs), which are foundational to Japan’s economy and employ about 70% of the workforce .2

Overall, the shortfall is especially acute in the information technology services sector, which is now at a two-year high with 1.35 vacancies for every job seeker in Japan.3 4 5 By 2030 the government estimates that the country will be short of 450,000 IT professionals.6 This shortage will hit SMEs significantly, given that they represent 99.7% of all companies in Japan.

A shortage in digital skills could complicate Japan’s long-term competitiveness and productivity. The shortfall will also inhibit the country’s ability to enable a digital transition. One estimate suggests that Japan must produce 250,000 data and AI (artificial intelligence) professionals every year to fill the 12m new jobs it needs to meet the growth that technological advancements bring.7

Digital upskilling considered most important

According to the Economist Impact survey, 65% of employees in Japan consider digital skills as a top skill to acquire—which is higher than the regional average (57.6%). This could reflect the fact that Japan lags many developed economies in digitalisation due to its persisting reliance on legacy IT systems and paper-based procedures.8

“A big part of the demand for digital skills is also in response to meeting the digital transformation in businesses and it covers diverse skills from digital marketing to specific areas like how to apply blockchain for the legal department”, says Mr Muneaki Goto, representative director, Japan Reskilling Initiative. Our survey shows the importance of multiple digital skills. Among those who prioritise digital skills, basic digital skills are a must-have for 70.8%, but there’s also strong demand for advanced digital skills, including cybersecurity (53.8%), IT support (52.3%), and data analysis and visualisation (50.8%).

Figure 1: Digital skills are prized by employees in Japan

Which skill categories do you think are the most important for the workforce in your sector to acquire today? (% of respondents)

Source: Economist Impact, 2023

Figure 2: Skills in cybersecurity, IT support and data analysis are considered must-haves

Indicate which specific types of skills are must have, good to have or not needed for the workforce in your sector today? (% of respondents)

Source: Economist Impact, 2023

A lack of cybersecurity skills is a particularly pressing concern for Japanese companies, which rely on external vendors to make up for the shortfall.9 According to one study, within APAC, Japan has the largest deficit of cybersecurity professionals, hovering at around 55,800 people.10 A shortage of cybersecurity literacy may prove detrimental to SMEs which are unlikely to have the same finance to buy this skill-set and are often viewed as easier targets by cybercriminals.

IT support skills–providing technical assistance to customers and end-users– are the third most popular skills in our survey. This could be a result of the growth potential of Japan’s software-as-a-service (SaaS) industry—a market worth US$210bn in 2022.11 12 Data analysis and visualisation skills are highly sought after as well. Japanese companies heavily invest in big data tools that can extract information from complex data types.13

In addition to digital competencies, self-management (50%), and soft skills and attitudes (42%) are considered skills of importance by the Japanese employees surveyed.14 The rising significance of these skills could be a result of the increase of hybrid working, with demands on managers and teams to navigate working online more adeptly. “This is especially true in Japan because the trend of remote work that picked up after the pandemic is very new in the country where the norm has always been to physically attend meetings”, says Mr Goto.

Despite the growing importance of sustainability and environmental, social and governance (ESG) considerations, only 15% consider green skills an important category at present. Mr Goto suggests their relevance will grow with time, especially when Japanese industries pivot to more sustainable businesses. Currently, most green upskilling is driven by employees’ personal interest (29%), although the country’s pledge to invest US$16bn into the green economy will likely drive efforts.15

Employers support upskilling, but challenges remain

Although most employees acquire digital skills through workplace training (52%), online courses (44%) are emerging as a key resource. However, the impact of such training may be blunted by a lack of clarity on what skills are in demand—61% of respondents say they generally have a poor understanding of what the market needs, pointing to an information gap. Currently, most employees get information about valuable future skills from news articles (59%) as well as in-office events and their employers (47.4%), suggesting the role of these mediums to provide more information.

Figure 3: Workplace training is the main source of digital upskilling in Japan

How do you acquire digital skills? (% of respondents)

Source: Economist Impact, 2023

Another upskilling challenge in Japan is the country’s long working hours, which prevent employees from investing time in acquiring new skills.16 Our survey findings align to show that a lack of time is the top barrier to respondents acquiring new skills of all kinds.

More collaboration and public-private partnerships spur upskilling

According to the Economist Impact survey, employees believe employers are chiefly responsible for providing upskilling programmes across nearly every aspect such as providing notable recognition–through certification and additional perks –(62%), the offering of financial incentives (59%), supporting mental well-being (55%) and making them aware about different skills (46%).

As the implications of Japan’s labour shortages have become clearer, the government has made commitments to drive reskilling, most notably through a US$7.5bn in investment over five years into reskilling resources.17 The government could particularly support SMBs, which have fewer resources to invest with and are slower to digitalise than larger companies.18 Public-private partnerships could also be effective, says Mr Goto. For example, through the Japan Reskilling Consortium, the government partners with private sector companies to provide access to a wide variety of training programmes to suit workers’ specific needs. There are both free and paid courses across various formats, levels and purposes.19

Collaboration also exists between industry, government and educational institutes. For example, the Kyoto Alliance fosters upskilling connections between university students and local businesses, while the Nippon Telegraph and Telephone (NTT) Corporation partners with local universities to develop cybersecurity researchers and professionals.20 Meanwhile, the government is driving efforts to build a pipeline of data skills via university programmes21.

In addition to working with stakeholders outside the organisation, Mr Goto underscores the importance of collaboration between teams within an organisation, particularly to develop skilling taxonomies to clearly map in-demand skills. Once there is clarity, organisations can use that information for hiring, as “skills-based hiring is becoming very important” in Japan, notes Mr Goto. Survey findings support this as 60% of employees report that employers are moving to refocus on skills-based hiring while 54% agree that their employers value online certificates.

Figure 4: Japanese employees rely largely on their employers for upskilling support

In your opinion, is the government, your employer or yourself responsible for supporting employees regarding the following issues? (% of respondents)

Source: Economist Impact, 2023

Moving forward, while digital technologies such as cybersecurity solutions, cloud computing and automation will be key to facilitating growth in Japan, upskilling and reskilling is critical to maximising the potential of these technologies. Both government and employers will continue to play an important role in shaping the direction of the labour market. As our survey shows, employees in Japan consider employers primarily responsible for upskilling who could start by mapping the skills in demand clearly. Employers could also ensure continued support for the employees to make skilling a workplace activity. Government can continue to partner with the industry and universities to create an overall ecosystem that fosters learning.

References

1 https://www.un.org/en/development/desa/population/publications/pdf/ageing/replacement-chap4-jp.pdf

3 https://english.kyodonews.net/news/2022/11/fbc691d031c4-over-half-of-japan-companies-suffering-from-labor-shortage-survey.html

6 https://asia.nikkei.com/Business/Technology/Analog-Japan-sinks-to-record-low-in-global-digital-ranking

7 https://www.mckinsey.com/~/media/mckinsey/locations/asia/japan/our%20insights/future%20of%20work%20in%20japan/the-future-of-work-in-japan_v4_en.pdf

8 https://asia.nikkei.com/Business/Technology/Analog-Japan-sinks-to-record-low-in-global-digital-ranking

9 https://asia.nikkei.com/Spotlight/Datawatch/Cyberattacks-on-Japan-soar-as-hackers-target-vulnerabilities

10 https://www.isc2.org/News-and-Events/Press-Room/Posts/2023/05/19/70-percent-of-Japanese-Respondents-Face-Skills-Shortages-within-Security-Teams

13 https://asia.nikkei.com/Business/Technology/Japanese-universities-rush-to-set-up-data-science-departments

14 Self-management skills are a category of skills which encompass time management skills, active learning, resilience, stress tolerance and flexibility. Soft skills and attitudes, on the other hand, include skills such as leadership, interpersonal or intercultural communication, ethical decision-making and English literacy.

17 https://www.hr-brew.com/stories/2023/02/17/world-of-hr-japan-invests-in-reskilling-to-accommodate-a-changing-population