When emitters must pay for pollution it ceases (e.g. acid rain in the 1980s and 90s). The most economically efficient way of solving this problem is to put a high enough price on the emissions that cause climate change such as carbon dioxide(1) to lower and ultimately put an end to emissions. For many reasons (e.g. political, interest groups, mistrust in science, lack of financial “long termism” etc.) this is not happening fast enough to solve the huge challenge that climate change represents. However, there is another financial mechanism that could help solve the problem and it is through debt.

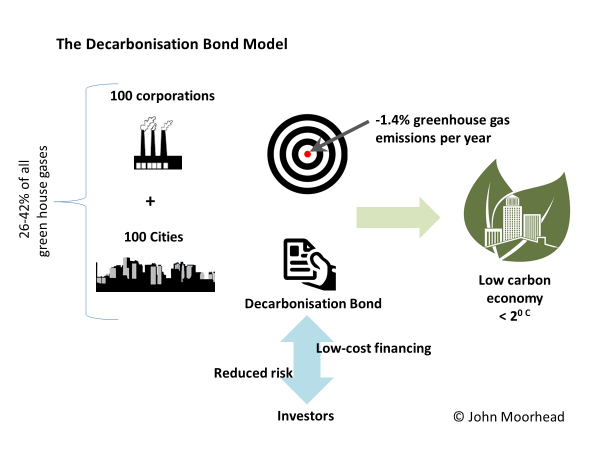

Carbon pricing, green and climate bonds are not delivering sufficient decreases in carbon emissions to stay well within 2 degrees global warming. A novel additional approach to achieve environmental objectives is needed: This is though the systematic use by the world’s biggest corporate and city emitters of a new bond- the Decarbonisation Bond to reduce carbon emissions so the world stays within 2°c warming and achieves a low carbon economy (Figure below).

Why 100 corporations and 100 cities?

Corporations and cities are nimble and responsive to their stakeholders and citizens and can take rapid action. Countries depend on their cities and corporations (including their value chains) to deliver on their current and future commitments - Intended Nationally Determined Contributions - made at the Paris Climate Change Summit in 2015. Global emissions are concentrated in 100 corporations and their value chains (20%-30%(2)of global emissions) and 100 cities account for a further 6% to 12% (3) of emissions.

The rates

The annual linear rate at which emissions need to go down by is 1.4% per year and 2.1% per year (4) from 2010 to 2050. This represents a 56% cut in annual emissions to stay within 2°c and an 84% cut to stay within 1.5°c by 2050.

Carbon smart financing

Each ton of CO2e emitted represents a risk to the emitter, its stakeholders and to the environment. The biggest risk is the change in climate caused by the over 50 Gigatons emitted each year which are currently leading us to an over 3-degree warmer world despite the Paris Agreement (5); There are many other risks including reputational, legal and stranded assets to name some of the most relevant ones.

High carbon emitting corporation and cities represent significant risks to financial capital providers. This risk is increasingly being reflected in a higher cost of capital for those cities and corporations that are big emitters (e.g. utilities, chemicals, steel and cement) or emitters that are responsible for high levels of emissions through their supply chains (e.g. retail) and the use of their products (e.g. fossil fuels, automobile/vehicle industry).

These high carbon emitters can significantly reduce their emissions sufficient to stay within 2-degrees and even 1.5 degrees, but they need further financial incentives to do so. In addition to prices on carbon and banning fossil fuel subsidies and the implementation of renewable subsidies, this could arise through issuing debt (i.e. decarbonisation bonds). Bonds have long maturities and you can link them to targets, in this case: decreasing emissions.

The decarbonisation mechanism is simple. The bond pays out a lower interest rate but only if the issuer achieves its carbon reduction objectives that are in line with the least cost reduction curves of GHG emissions (1.4% decrease annually to stay within 2°c warming). The city or corporation gets cheap financing if it decarbonises and the investor provides financing that is also de-risking (i.e. decarbonising) the investment he or she is invested in. This in turn creates a virtuous circle of lower risk and lower cost of capital for the investee. The issuing corporation or city would not need necessarily to issue many decarbonisation bonds to achieve this objective and would reap handsome reputational dividends as a green economy leader.

Acknowledgements: The author would like to acknowledge the contributions of André Chanavat, Timothy Nixon and Deirdre Dimancesco as well as Thomson Reuters, UNEP, CDP and the We Mean Business coalition for the information and analysis they provide on emissions that made this article possible.

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of The Economist Intelligence Unit Limited (EIU) or any other member of The Economist Group. The Economist Group (including the EIU) cannot accept any responsibility or liability for reliance by any person on this article or any of the information, opinions or conclusions set out in the article.