投资创造影响

Download Infographic

Related content

To give or invest?

Many successful business people have shaped their legacy through giving. From the Carnegies and Rockerfellers to George Cadbury and George Peabody, the foundations of venture philanthropy were laid long ago. However, as the threats from global warming have become clearer and more immediate and large proportion of the world’s population subsists below the poverty line, HNWIs globally have increasingly been looking for ways to give constructively and invest with purpose. Whether it be redirecting parts of their portfolios to venture philanthropy, or investing in sustainable finance and impactbased projects, growth in these sectors has surged.

This report aims to provide background information and guidance on the sustainable finance and philanthropy sectors for HNWIs.The information is designed to help them understand the different opportunities and decide how to allocate their sustainable investment and philanthropy portfolios to achieve the best outcome for their requirements.

The key findings of the research are as follows:

Giving is growing. The Global Financial Crisis (GFC) of 2008 and the global drive to meet the UN Sustainable Development Goals is changing the way HNWIs invest. Growth in sustainable investments and venture philanthropy is strong globally and becoming established in Asia and, to a lesser degree, the Middle East and Africa. Definitions can be tricky. What one person considers sustainable investment, another can call impact investing. Regardless of the name, it’s important to set parameters and objectives for investment. Knowledge is key. Networking with people and organisations who have experience in sustainable finance and philanthropy and seeking out specialist advice helps inform investments and measurement, and ensures investors remain abreast of new developments. Use a framework. Regardless of the sector or type of investment, frameworks that specify risk-return levels and expected impact contributions for different parts of a portfolio are critical. Research the market. HNWIs need to thoroughly research any investment to ensure they have a clear understanding of the tools and options that will enable them to make the best use of capital deployment in a particular sector or contribution to a philanthropic organisation.

捐赠还是投资?可持续金融和慈善的交汇点

很多成功的商业人士通过捐赠来传承自己的遗产。从卡内基家族和洛克菲勒家族到乔治·卡德伯里和乔治·皮博迪,公益创投的基石早已被奠定。不过,随着全球变暖的威胁愈发明显和紧迫,大量的人口仍然生活在贫困线以下。全球高净值人士正在不断寻求建设性捐赠和带有使命地投资的方式。不论是将他们的部分投资资产转移到公益创投领域,还是投资于可持续金融和基于影响力的项目,这些领域的投资都在激增。

本报告旨在为高净值人士提供可持续金融和慈善领域的背景信息和指导。报告所提供的信息旨在帮助他们了解不同的投资或捐赠机会,从而决定如何分配他们的可持续性投资和慈善项目资产,以期实现他们想要的结果。

通过一系列的采访,本报告还审视了当高净值人士决定扩大投资范围,探索纯粹以经济收益为目标的传统投资领域外时,他们可能面临的机遇和挑战,并且探究了将他们的财富所能产生的影响力最大化的方法。

研究主要发现如下:

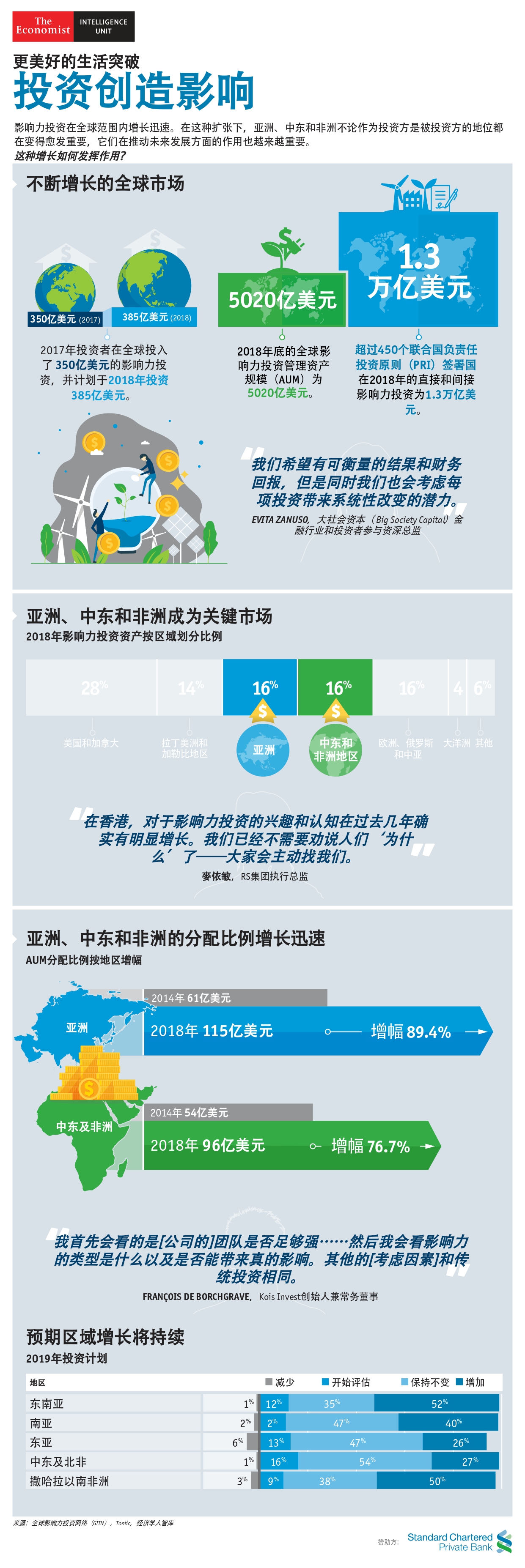

慈善捐赠在不断增长。2008年全球金融危机和全球为实现联合国可持续发展目标所做的努力正在改变高净值人士的投资方式。可持续投资和公益创投在全球增长势头正劲,在亚洲正日趋成熟,在中东和非洲发展稍缓但也在不断进步。 定义可能会比较困难。同一个投资项目一方可能认为是可持续投资,而另一方则认为是影响力投资。不论名称如何,为投资设置参数和目标都十分重要。 知识是关键。同在可持续金融和慈善领域拥有丰富经验的人和组织建立联系以及寻求专家意见,有助于为投资和衡量投资表现提供信息,并帮助投资者时刻掌握最新发展情况。 使用框架。不论在哪个行业进行何种投资,拥有能够明确投资组合中不同部分的风险回报水平,并对影响力的贡献做出预期的框架至关重要。 对市场进行调查。高净值人士对各类投资都应进行全面调查,以确保他们对投资工具和投资选项有清楚的认识。这些工具和选项可以令他们在某个特定领域实现资本分配的最优化使用,或是对某个特定的慈善组织进行帮助。