Investing for impact

Download Infographic

Related content

To give or invest?

Many successful business people have shaped their legacy through giving. From the Carnegies and Rockerfellers to George Cadbury and George Peabody, the foundations of venture philanthropy were laid long ago. However, as the threats from global warming have become clearer and more immediate and large proportion of the world’s population subsists below the poverty line, HNWIs globally have increasingly been looking for ways to give constructively and invest with purpose. Whether it be redirecting parts of their portfolios to venture philanthropy, or investing in sustainable finance and impactbased projects, growth in these sectors has surged.

This report aims to provide background information and guidance on the sustainable finance and philanthropy sectors for HNWIs.The information is designed to help them understand the different opportunities and decide how to allocate their sustainable investment and philanthropy portfolios to achieve the best outcome for their requirements.

The key findings of the research are as follows:

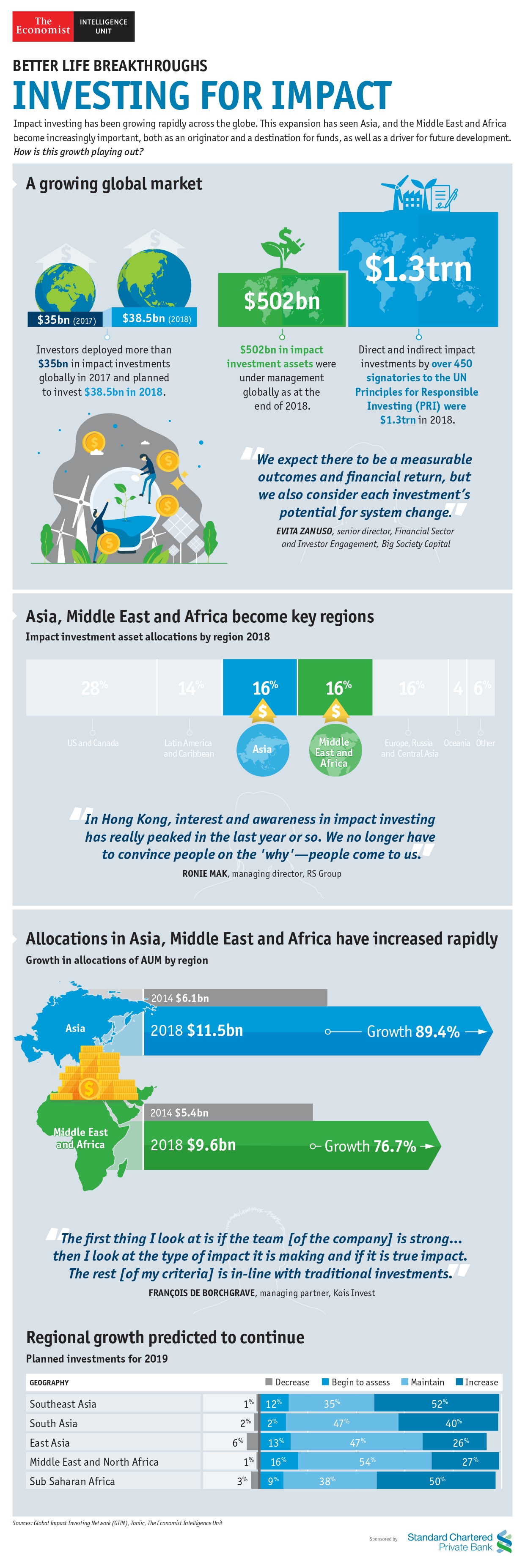

Giving is growing. The Global Financial Crisis (GFC) of 2008 and the global drive to meet the UN Sustainable Development Goals is changing the way HNWIs invest. Growth in sustainable investments and venture philanthropy is strong globally and becoming established in Asia and, to a lesser degree, the Middle East and Africa. Definitions can be tricky. What one person considers sustainable investment, another can call impact investing. Regardless of the name, it’s important to set parameters and objectives for investment. Knowledge is key. Networking with people and organisations who have experience in sustainable finance and philanthropy and seeking out specialist advice helps inform investments and measurement, and ensures investors remain abreast of new developments. Use a framework. Regardless of the sector or type of investment, frameworks that specify risk-return levels and expected impact contributions for different parts of a portfolio are critical. Research the market. HNWIs need to thoroughly research any investment to ensure they have a clear understanding of the tools and options that will enable them to make the best use of capital deployment in a particular sector or contribution to a philanthropic organisation.

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.