Infographic | Leveraging Opportunity in Change: Navigating the Trends Shaping Private Markets in 2021 and Beyond

Download InfographicFinancial Services

Infographic | Leveraging Opportunity in Change: Navigating the Trends Shaping Private Markets in 2021 and Beyond

Related content

Leveraging Opportunity in Change: Navigating the Trends Shaping Private Mar...

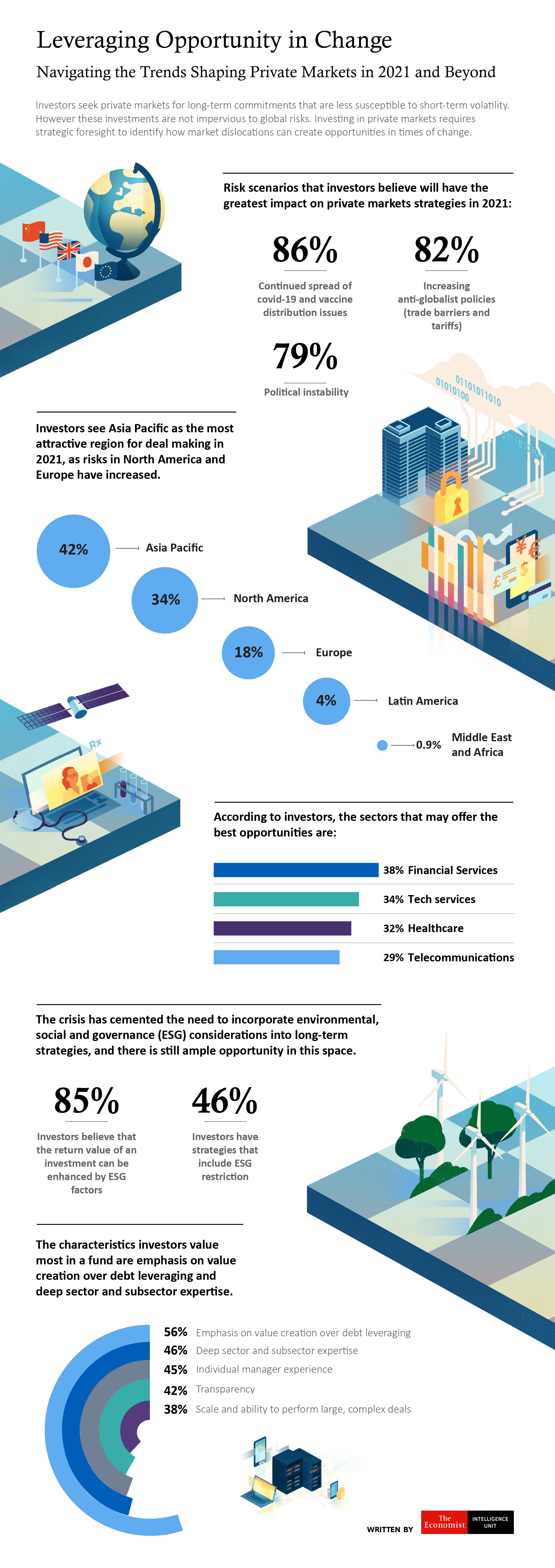

2020 brought profound change that will continue to influence financial markets for years to come. The covid-19 pandemic hampered economies and exacerbated market volatility, leaving investors to process the short- and longer-term impacts. Geopolitical tensions and growth in anti-globalist policies are also creating structural changes which investors must factor into their investment strategies. Despite increasing risks, however, investors are confident that private-market assets will continue to offer opportunities for long-term growth.

This report explores the long-term trends shaping private-market investors decisions and the strategies managers are deploying to continue generating returns despite growing global risks. The research is based on in-depth qualitative interviews and desk research, and a survey covering 110 limited partners (LPs)—specifically, investors that commit capital to private markets, including pension funds, institutional accounts, and investment and portfolio managers—in Asia, Europe and North America. The key findings from the survey include:

Eighty percent of respondents agree that private markets are less susceptible to short-term volatility than public markets.

Eighty-five percent of respondents expect private markets to continue to outperform public markets in the long term.

Respondents expect Asia-Pacific to offer the best private-market investment opportunities in 2021, followed by North America.

Respondents expect the financial services, technology and healthcare sectors to offer the best private-market investment opportunities in 2021.

Respondents plan to invest in companies with multiple growth strategies, and in funds with experienced general partners for risk mitigation.

Respondents anticipate that the following risk scenarios will have the greatest impact on their private-market investment strategies in 2021: the continued spread of covid-19 and vaccine distribution issues; and growth in anti-globalist policies, such as trade barriers and tariffs.

The shifting landscape of global wealth: Future-proofing prosperity in a ti...

In some instances the impact of this shift will be shaped by local factors, such as demographic changes. In other instances this shift will reflect shared characteristics, as demonstrated by the greater popularity of overseas investing among younger high-net-worth individuals (HNWIs) brought up in an era of globalisation. Whatever the drivers, the landscape of wealth is changing—from local to global, and from one focused on returns to one founded on personal values.

Despite rising economic concerns and a tradition of investor home bias in large parts of the world, the new landscape of wealth appears less interested in borders. According to a survey commissioned by RBC Wealth Management and conducted by The Economist Intelligence Unit (EIU), younger HNWIs are substantially more enthusiastic about foreign investing. The U.S. is a particularly high-profile example of a country where a long-standing preference for investments in local markets appears set to be transformed.

Click the thumbnail below to download the global executive summary.

Read additional articles from The EIU with detail on the shifting landscape of global wealth in Asia, Canada, the U.S. and UK on RBC's website.

Fintech in ASEAN

To better understand the opportunities and challenges in developing a fintech business in seven ASEAN markets, The Economist Intelligence Unit conducted wide-ranging desk research supplemented by seven in-depth interviews with executives in Australia and ASEAN.

Download report and watch video interview to learn more.