Overview

Latin America has historically been regarded a natural sphere of influence for the United States and a key trading partner given its geographical proximity. Yet relations between the two regions are not as closely intertwined as they once were. Recent US administrations have focused on other regions, including the Middle East and Asia, and US engagement with Latin America has waned. Meanwhile, over the past ten years, China has significantly expanded its influence in the region through growing trade, investment and credit. As tensions between US and China continue to escalate, Latin America’s close ties to China raise important policy dilemmas for the Biden administration. This article explores the extent to which China has gained power in the region and whether Latin America remains firmly within the sphere of US influence. Looking ahead, is the US willing (and able) to regain influence in Latin America under the Biden administration?

The growing influence of China in Latin America

A November 2020 headline from Foreign Affairs magazine states that Donald Trump drove Latin America into China's arms; in reality, relations between Latin America and China had been developing long before Trump took office, but trade and investment ties have grown substantially in recent years. In total, the US remains Latin America's main export market, accounting for US$467bn (45%) of total export sales, but Mexico accounts for about 80% of these flows. For many other countries, China has become a key trading partner, with total exports from Latin America reaching US$126bn in 2019 (and rising further in year-on-year terms in the first three quarters of 2020, bucking global trends).

It is trickier to quantify the growing importance of China on total investment flows into the region, as some funds enter countries through third countries (a Brazilian central bank study in 2016 estimated that 80% of Chinese FDI entered the country this way). Of the direct investment from China to Latin America, most is registered as inflows in the British Virgin Islands and the Cayman Islands, but this is not the final destination for this investment, which is channelled via firms registered in these countries to elsewhere in the region.

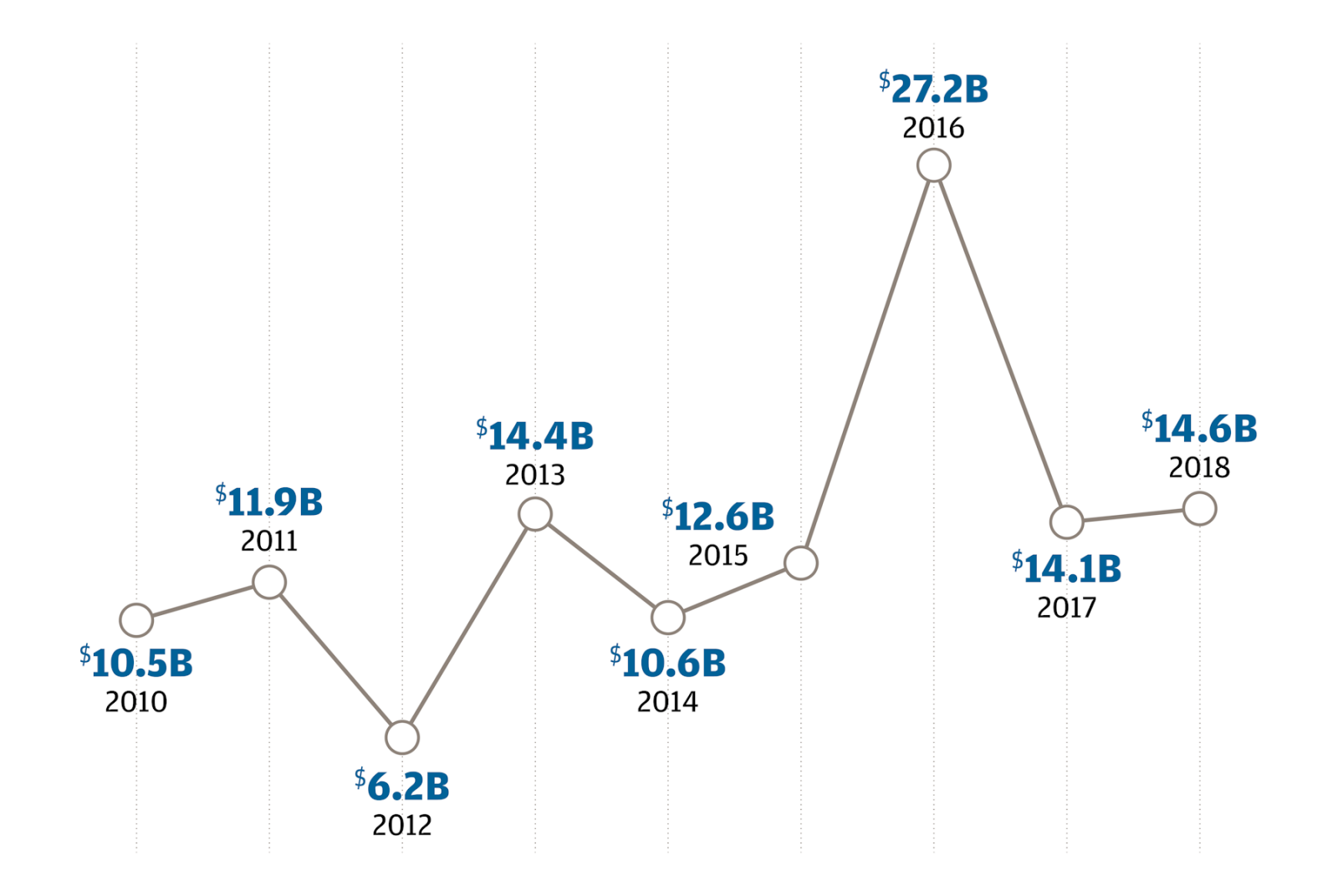

Chinese Foreign Direct Investment (FDI) in Latin America

Other data are easier to quantify and point to growing Chinese involvement in Latin America. In 2020, Chinese M&A in Latin America reached US$7.7bn – more than Europe’s and North America’s M&A in Latin America combined. Investment in infrastructure is also easier to track as much occurs via China's Belt and Road Initiative (BRI – its flagship foreign investment programme). Since 2017, 19 countries in Latin America have joined the Initiative and although the four largest economies in the region (Brazil, Mexico, Argentina and Colombia) have not done so, they all have bilateral co-operation agreements in place to facilitate Chinese investment in domestic infrastructure development.

A crucial source of bank credit

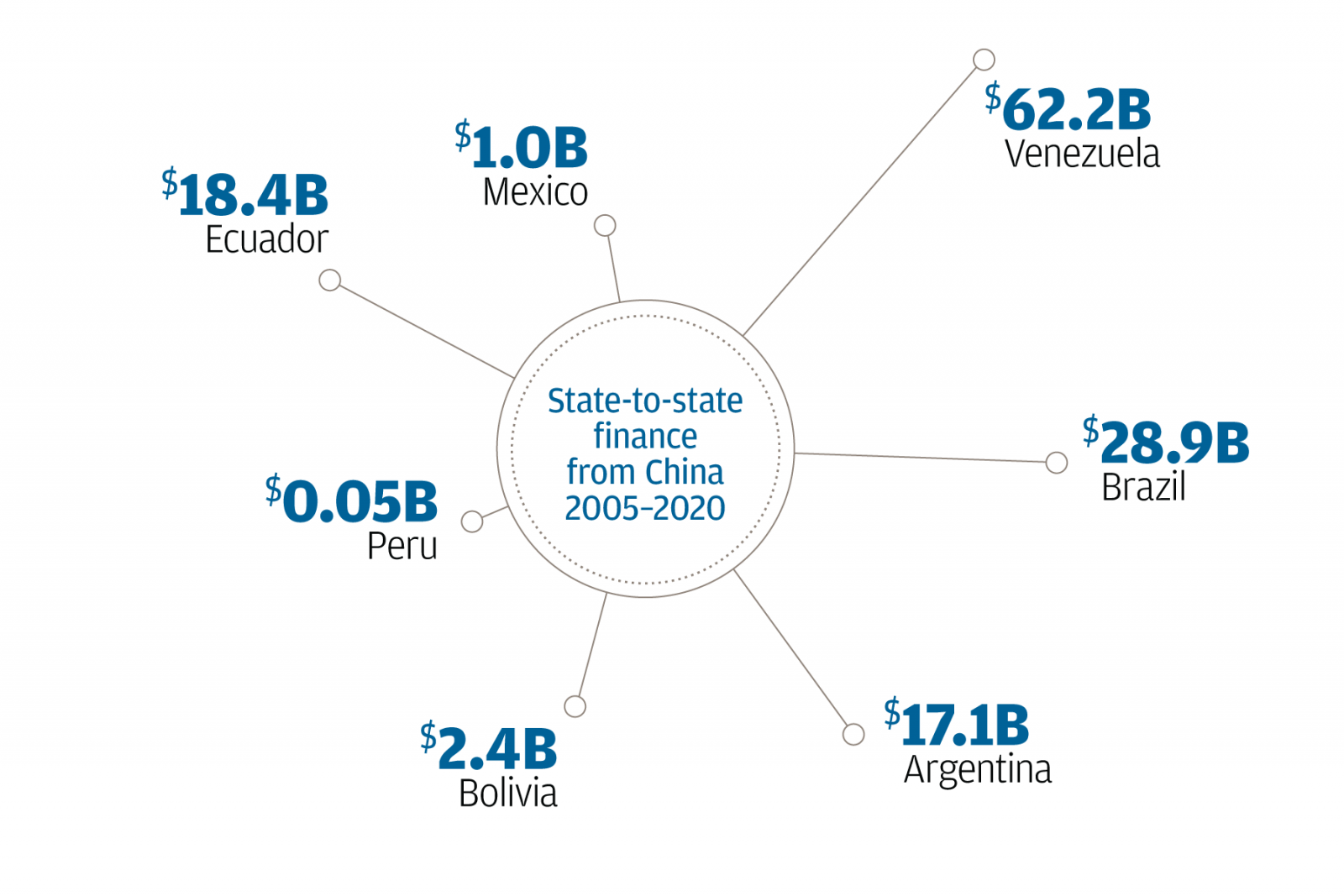

China has also expanded its influence in Latin America through extending credit lines to the region. State-owned Export-Import Bank (EXIM) and the China Development Bank (CDB) are the main sources of finance and have generally lent bilaterally to governments in Latin America, as well as directly to state-owned companies. Some of this is tied to specific infrastructure projects or to energy projects. Private-sector estimates suggest that between 2005 and 2019, the CDB and EXIM have provided more than US$137bn in loan commitments to Latin American governments and state-owned firms. For many countries, Chinese lending has been more significant than credit from institutions such as the IMF, World Bank and Inter-American Development Bank (IDB).

State-to-state finance from China (US$bn; 2005-2020)

The US attempt to regain influence in the region

The Biden administration is likely to engage more with Latin America than its predecessor. Initial signs suggest that Mr. Biden regards the region as strategically important, even if there are priorities elsewhere. The long-standing policy areas of immigration and security will continue to be important, but a new focus area will emerge, with the Biden administration likely to explore possibilities to re-shore supply chains closer to home.

In theory, some countries in Latin America are well-placed to benefit from these trends, particularly Mexico, which already exports significant amounts of mainly manufactured goods to the US. These accounted for US$371bn in 2019 and after falling in mid-2020 have been growing again firmly on an annual basis since last September. There is some evidence that the US-China trade war has boosted Mexican exports to the US, with some Chinese firms moving operations from China to Mexico in order to avoid tariffs placed on Chinese exports to the US, particularly in the food manufacturing and transport equipment sub-sectors. Preferential tariff treatment under the USMCA will also help with this, as will some of the high regional-value content thresholds under the USMCA treaty (including the requirement that 75% of auto parts must be made within North America, which will incentivise domestic manufacturing).

Aside from Mexico, Colombia and parts of Central America are better placed to take advantage of potential nearshoring. These countries already have free-trade agreements in place with the US and their supply chains are, to varying degrees, already integrated with the US. Efforts to lure firms away from China are already evident. Colombia's investment promotion agency, ProColombia, launched a campaign in September 2020 to persuade firms to relocate to Colombia, targeting its efforts at 536 firms currently operating in China. The investment promotion agency in Costa Rica, CINDE, has been pursuing similar goals, focusing its efforts on high-end manufacturing and IT services. CINDE has spoken specifically of a “China-plus-one” strategy, which seeks to appeal to firms who do not necessarily want to abandon China-based operations, but who want to diversify their operational base, opening facilities that are closer to the US market.

China’s continued growth prospects in the region

Despite US intentions to regain influence in the region, Latin American governments are unlikely to abandon efforts to court China. China's economic prospects in 2021 are significantly firmer than other major economies (including the US) and Latin American governments will hope that a rapid recovery will stimulate Chinese demand for its own exports. Around three-quarters of China's imports from Latin America are raw materials, mainly hard commodities and food from Brazil, Chile and Peru. The Chinese market is the most important export destination for all of these countries, accounting for about 30% of total export revenue. Chinese demand for all of these goods is set to strengthen, as the government in that country seeks to engineer a private consumption-led recovery. However, exports to China are also important to Argentina, Colombia, Venezuela and Ecuador, accounting for 10-20% of exports. Aside from Venezuela, whose oil exports to China have collapsed in 2020 on the back of a domestic economic collapse, recovering Chinese demand should also provide some support to these countries' exports. Trade diversification is on China's trade policy agenda, which could also work to the benefit of Latin America in the longer term.

The extent to which US efforts will be successful will depend, in part, on the attractiveness of countries’ underlying business environments. It is broadly accepted that supply-chain diversification away from China had already begun prior to the outbreak of the coronavirus pandemic, and that it will continue as tensions between the US and China persist. However, what is much more uncertain is who will benefit. So far, firms have diversified manufacturing bases away from China but other Asian countries (including Vietnam and Taiwan) have benefitted more extensively than Latin America.

Export destinations

Click through the interactive map below to find out more.

Hovering over each of the Latin American countries listed provides a side-by-side comparison of the percentage of exports to China versus the United States with arrows indicating a related increase or decrease.

Choosing its battles

Instead of attempting to influence all areas of Latin America’s relation with China, the Biden administration will likely focus on areas of critical importance. The question of 5G development for example will be a particularly thorny issue, as Latin American governments continue to partner with China's telecommunications giant, Huawei, to develop the technology. The US has expressed clear concern that such a development represents a security threat and would compromise the future of US-Latin American relations, but many countries in the region have looked to Huawei to provide low-cost solutions and have partnered with the company on rolling out fourth-generation (4G) networks. The dilemma will be particularly acute as telecoms infrastructure is a weak area of the operating environment in many countries and governments are keen to secure investment in this area in order to improve provision. We do not expect Huawei to be frozen out of 5G development in the region, but the debate could open the door for other global players to participate more than would otherwise be the case.

The US is also likely to continue paying close attention to Chinese lending and investment practices. There has traditionally been much more conditionality attached to US loans (either bilaterally, or via pressure exerted through multilateral institutions such as the IMF) than Chinese lending to Latin America. Meanwhile, US investment in the region requires certain disclosures and quality standards that are less evident in Chinese investment projects. While President Biden looks set to adopt less aggressive rhetoric towards China, there is little indication that his government will be less concerned about China's trade and investment practices. Latin American governments are therefore likely to continue to come under pressure from the US on this front; we do not believe that pressure will be significant enough to interrupt trade or investment ties with the US, but it could be a factor that prohibits a deepening of relations between Latin America and the US.

A delicate balancing act

Many countries in Latin America have extensive trade and investment links with both China and the US, and will be seeking to cultivate ever-closer ties with both sides. To date, this balancing act has been possible, partly because relations between Latin America and China, on the one hand, and the US on the other, have focused on different areas. Latin America has tended to export raw materials to China, but mainly manufactured goods to the US, while investment from China has centered on infrastructure projects. There has been little overlap, avoiding direct competition between the US and Chinese markets.

Our baseline forecast is that most countries will be able to retain this balance, facilitating some growth in exports and inward investment for Latin America. However, there are some signs that China and the US might increasingly exert leverage over their trade and investment partners, making it impossible for third-party countries to remain neutral. This would be less problematic for countries with much closer ties with either China or the US (Mexico, for example, would not be hit significantly if it had to realign more demonstrably with the US). However, countries with a more equal reliance on both China and the US, such as Peru, Argentina, Colombia and Ecuador, would be affected more noticeably if they were pulled into the trade war and forced to side with either China or the US.

Conclusion

China has expanded its influence in Latin America in recent years by virtue of closer trade, investment and finance ties. However, for many economies – particularly Mexico and Central America – the US remains a crucial trade partner, while corporate ties between the US and Latin America also remain close. In the coming years, Latin America will remain caught between two powers as US-Chinese relations remain fraught. Governments in the region will do their best to maximise any potential opportunities that arise, mainly in terms of diversification of supply chains as firms reduce their reliance on China. Some countries in the region may benefit, but these will mainly be countries that are close to the US and with an established track record of manufacturing for export (mainly Mexico). However, low-cost Asian economies such as Vietnam will represent fierce competition and will limit the extent to which Latin America can substantially gain market share. Still, already-established trade relationships with China will help the region recover from a particularly sharp coronavirus-induced recession and the prospect of renewed Chinese investment in Latin American infrastructure projects bodes well for medium-term prospects. There are difficult waters to navigate, with issues such as 5G development posing particular difficulties to policy-makers in Latin America, but our baseline forecast is that while the United States might attempt to increase its influence in the region, China will continue to be a close trading and investment partner for most countries in the region.