Across the globe, many asset owners ranging from large sovereign wealth funds to small university endowments have looked for efficiencies by managing investment portfolios in-house. Globally, pension funds manage nearly half their assets in-house, according to PwC.(1)

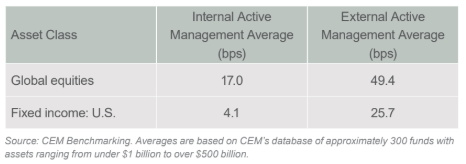

One major reason for insourcing is that asset owners are often able to achieve significant cost savings. For example, averages from CEM Benchmarking’s database reveals a 32.4 basis point difference in the amount paid to run a global equities mandate in-house versus the fees that would be paid to external managers. The difference is even more marked when comparing the costs of running US fixed income internally versus externally.

In addition to costs, bringing asset management in-house can provide asset owners with greater control and the ability to act rapidly in changing market conditions. “One of the primary factors in managing investments in-house is the ability to align interests and outcomes. Our investment horizon and expectations are more easily managed in-house,” adds Ms. Rodell.“There can be many different layers of fees between you and the investment itself. When we bring some of those management requirements in-house, we can reduce those various layers to increase returns to the fund,” says Angela Rodell, CEO of the $64.9 billion assets under management (AUM) Alaska Permanent Fund Corporation (APFC).

In order for asset owners that insource to be able to reap these benefits, however, they often need to invest upfront in significant resources to build up their capabilities. For example, in-house teams at pension funds average 51 investment professionals, finds PwC, which indicates the scope of the effort and helps explain why smaller asset owners may struggle to insource.

Tej Dosanjh, director at CEM Benchmarking, adds that many smaller funds do not have the scale, resource or internal expertise to manage large quantities of their assets in-house. “CEM datas show that if you look at the two extremes, a $100 billion-$150 billion AUM portfolio would manage 40-80% of equity in-house. For a $1 billion AUM pension fund that falls to 10%,” he says.

However, by focusing on data optimization and new technologies that help attain that goal, asset owners of all sizes can increasingly overcome these challenges and more effectively manage their portfolios in-house.

A CRUCIAL SKILL TO BUILD: DATA MANAGEMENT

Among the many capabilities asset owners that insource need, managing and making sense of the variety of data sources and quantity of information can be a top challenge.

According to Chenae White, a senior consultant at investment consultant NEPC (where she works primarily with endowment and foundation clients), organizations frequently struggle with data—the bedrock on which investment decisions are made—due to the number of technology platforms available to help manage the responsibilities of the chief information officer (CIO) or investment team.

“Data overload can paralyze investment professionals,” she says. “The CIO or investment team may not be able to digest all the data or appropriately emphasize which data points or indicators have the greatest impact on investment results and risk positioning.(2)

From order management systems (OMS) and execution management systems (EMS) for trading to risk management platforms and regulatory reporting systems, asset owners that insource often need to manage a wide variety of platforms, not all of which are interoperable. These platforms can both house and generate large quantities of data, and asset owners need to have strong data management capabilities to avoid having this information become siloed and inaccessible.

UTILIZING TECHNOLOGY ALONGSIDE TALENT

With the right mix of technology and talent, asset owners can better understand their data and therefore performance, risk and other factors that go into managing their investments.

Where possible, such as through OEMS platforms that combine the functionality of both OMS and EMS, asset owners may find that multi-purpose systems make data management easier. In other cases, they may need in-house talent that can bring disparate data sources together.

“Data challenges have to be recognized within our risk framework in terms of an operational risk and a potential business risk,” says Ms. Rodell. “Then we can take steps to figure out how to mitigate those risks, such as seeing if there are bridging systems that we can use to collate data, or use data sources that can be coded in such a way that we can have a very clean understanding of our positions.”

In addition, innovation in areas such as artificial intelligence (AI) and machine learning (ML) can both help asset owners understand the data they have and free up employees’ time to focus on more value-added tasks.

“Where we are headed technologically, by definition, will allow asset owners to do more in-house and it will really be driven by that number-one need for the alignment of data sources,” says Ms. Rodell.

Similarly, managing complex and ever-shifting regulatory demands and operational responsibilities are challenges that technological advances have the potential to resolve. Asset owners that trade derivatives, for example, need to make legal arrangements such as International Swaps and Derivatives Association (ISDA) agreements with trading partners, as well as accords to work with futures commission merchants.

Certain software platforms can automate the creation of these documents and provide relevant data analytics to quickly see where counterparties are located or what types of clauses are in organizations’ ISDA agreements.

Overall, AI/ML, data analytics and other software platforms can be key in identifying patterns and helping investment professionals respond effectively. Technology can also take on much of the heavy lifting in areas ranging from compliance to data management, allowing individuals to use their time more efficiently.

“For a fund like ours, the fact that the technology is out there and various technologies will take the place of people for some tasks means that we can really think about what resources we need. It also allows us to use in-house management in a way that we could not have even considered 5-10 years ago,” says Ms. Rodell.

BLENDING TECHNOLOGY AND BUSINESS SKILLS AMONG IN-HOUSE STAFF

While technology is part of the solution to how asset owners can effectively insource, funds—particularly smaller ones, which are often based outside major cities—also face a unique challenge in the search for talent with varied data science, IT and business skills. In many cases, asset owners may be limited by their locations and resources to find and retain staff, compared with asset managers headquartered in large cities with abundant talent pools.

“Probably the biggest challenge we have, especially with our location, is finding the individuals that can have one foot in the IT world and one foot in the business world,” says Ms. Rodell, whose fund is based in Juneau, Alaska. APFC looks for candidates such as a business analyst “who has the skills on the business side and understands the needs of the investor, but who can also write their own customized programs to utilize the data how we want and to be able to manipulate that data.”

In addition to data-related talent challenges, asset owners that insource may also find that certain asset classes such as private equity and real estate require more investment and operational expertise to manage.

“Alternative strategies generally require more research and a higher level of investment expertise to manage in-house,” says NEPC’s Ms. White. “These strategies tend to be more complex, focused on a niche market or opportunity set and may not be evergreen in nature. That means a high level of monitoring and involvement from investment staff.”

DATA OPTIMIZATION IS THE PRIORITY

The specialized needs of asset owners that insource makes data optimization a high priority. Working with third parties and external systems can help funds gain the additional expertise they may need in areas ranging from regulatory management to investment management in niche asset classes.

Improvements in data-management technologies are making life easier for investors who want to maximize control of their portfolios.

END NOTES

(1)

https://www.pwc.lu/en/asset-management/docs/pwc-awm-global-pension-funds.pdf

(2)

For more information on this issue, please see the first article in this series: http://www.eiuperspectives.economist.com/technology-innovation/data-and-transparency/article/ optimizing-data-transparent-world</p>