In the startup1 world, gaining the status of "unicorns"2 has seemingly become the be-all and end-all. The prospect of crossing the US$1 billion estimated valuation mark is a tantalising goal for firms and their investors alike. With the number of unicorns growing globally, many investors in Latin America—which to date has comparatively few unicorns—are speculating about which companies in the region could replicate these trends. Governments are also focused on the growth of the unicorn market as a key metric of success for Latin America’s development. However, the mythical figure of the unicorn is rather obscure. Is there a secret formula to spot or create a unicorn?

But focusing solely on companies that might achieve unicorn status is missing the point: There are significant investment opportunities in smaller ventures, which offer large potential returns in sectors including retail, financial services, healthcare and education. Outside of the major economies of Brazil, Mexico, Argentina and Colombia, many Latin American startups may struggle to achieve unicorn status, owing to the small size of the region’s markets and still-developing internationalisation. But investors should not be dissuaded: Unicorn status is an arbitrary one, and dynamic smaller companies bringing new solutions to old problems offer significant investment potential — while also addressing some of the region’s critical development goals.

This article analyses the environment for private startups in key Latin American markets and explores how technology, an increased focus from governments, and private sector initiatives can support the sector and power economic growth. As has been the case elsewhere, the right mix of innovative products and a strong enabling environment coupled with a motivated investor base can transform Latin America’s challenges into a source of economic growth.

The market for unicorns

An expansive lens to spot opportunity

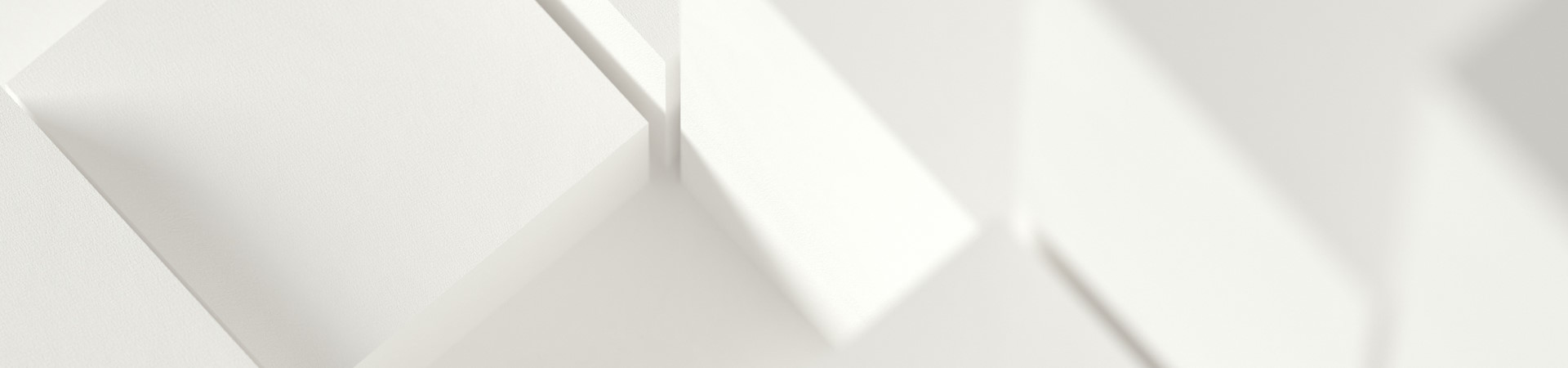

The Inter-American Development Bank has identified over one thousand private technology startups across Latin America — a number that has more than tripled since 2016.5 These companies are worth over US$200 billion and employ 245,000 people. Venture capital (VC) funding is growing in earlier funding rounds, indicating that investors seem to be growing in comfort and pursuing companies at an earlier stage of development.

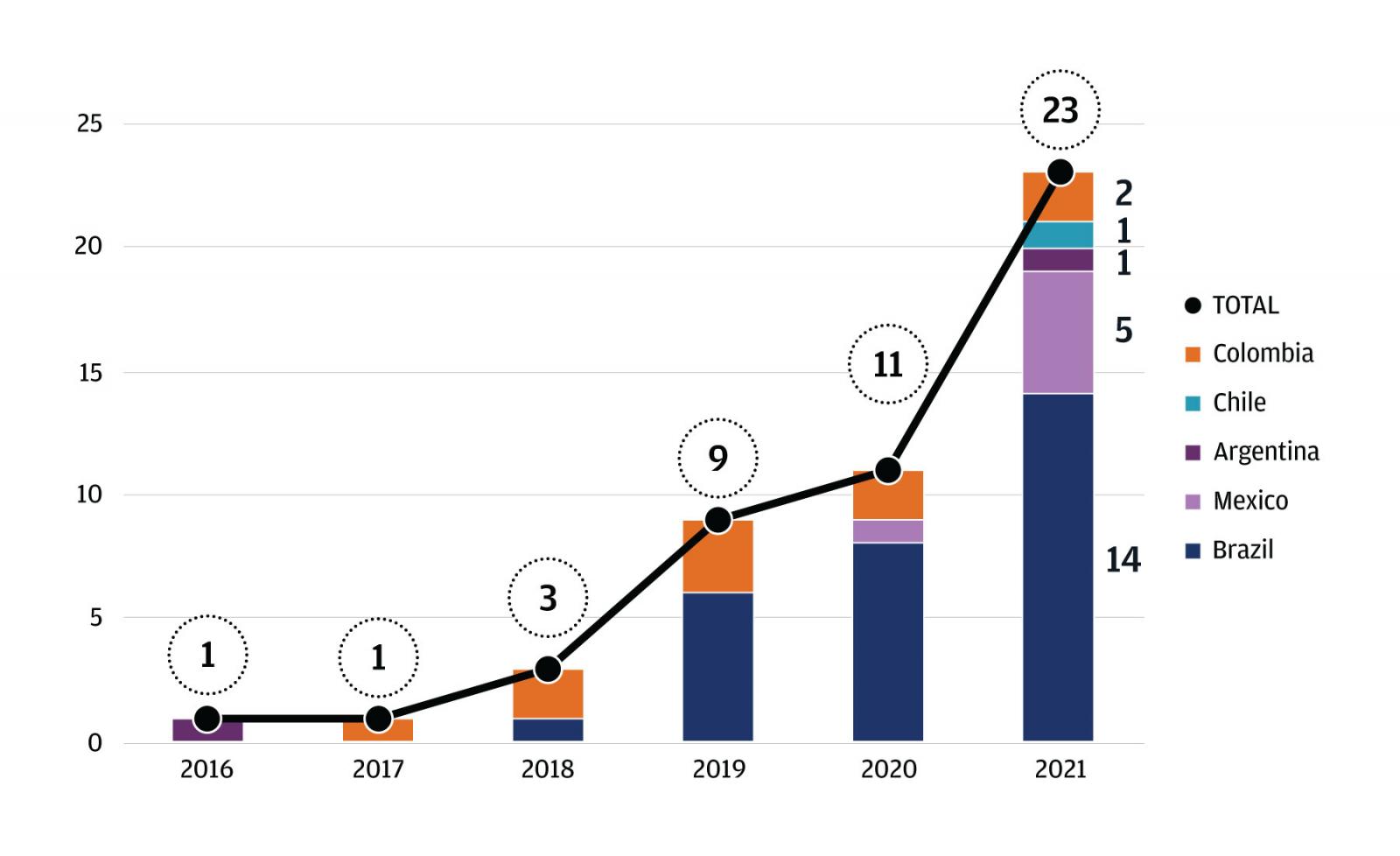

Brazil and Mexico account for around 80% of the valuation of private startups in Latin America. But fast-growing markets can also be found elsewhere, including Colombia and Chile (see Figure 3).

Note: Startups showcased are no more than 5 years old, and have received at least US$1 million in funding.

Source: Economist Impact analysis of CrunchBase data (2021), accessed on August 31, 2021.

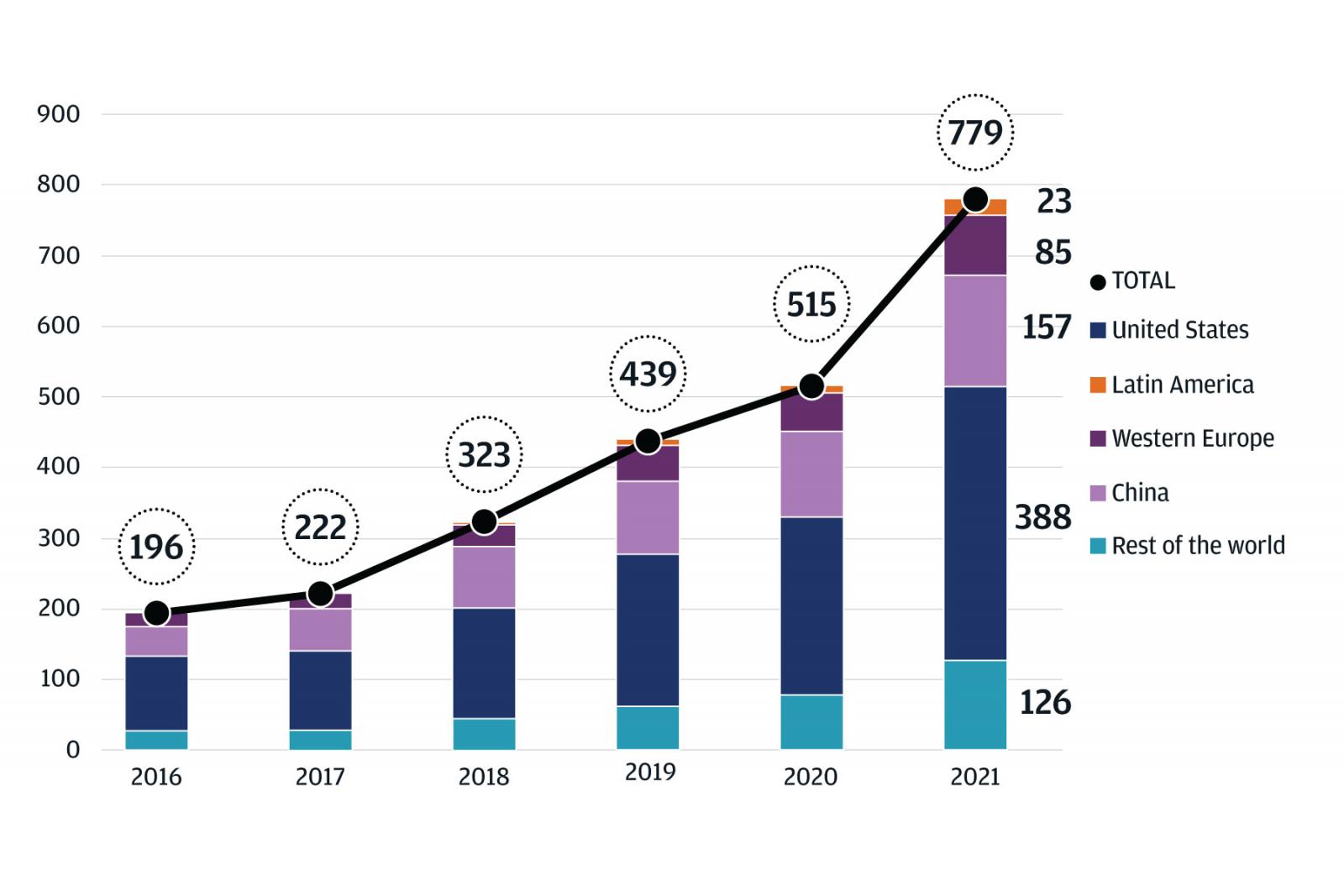

Within Latin America, Brazil is a standout. It has been successful in fostering growth of high-value startups (it hosts 14 of the region's 22 unicorns, for example), and stands out when compared with similarly-sized economies like Indonesia (home to five unicorns).8 Importantly, Brazil’s market demonstrates the opportunity beyond the unicorns. The number of startups in Brazil that have raised more than $1 million in VC funding has quadrupled since 2016.9 Brazil’s robust startup ecosystem is enabled by a large, young internet-savvy population that is highly urbanised. At the same time, global investors have been attracted to Brazil given the size of its local markets for goods and services and the government’s commitment to foster innovation. This combination of market size, demography and high levels of connectivity has well positioned Brazil as a fertile ground for VC-backed startups.

Critically for Latin America — the growth of private startups in the region has the potential to unleash positive economic spill-overs, as seen in some of the main innovation clusters around the world like the United States, India and China, where startups have driven new market opportunities and improved affordable access to key services including healthcare, financial services and education.

Fostering a vibrant startup ecosystem requires a coordinated effort between governments and the private sector to promote digital readiness and inclusiveness, as well as a harmonised policy, regulatory and economic enabling environment. Startups and startup clusters often grow organically, offering related services to customers in the same sector (thus boosting competition), or launching new products in other sectors (fuelling innovation). However, developing vibrant tech ecosystems requires a longer-term vision and coordinated strategy.

Building a startup ecosystem from the bottom up

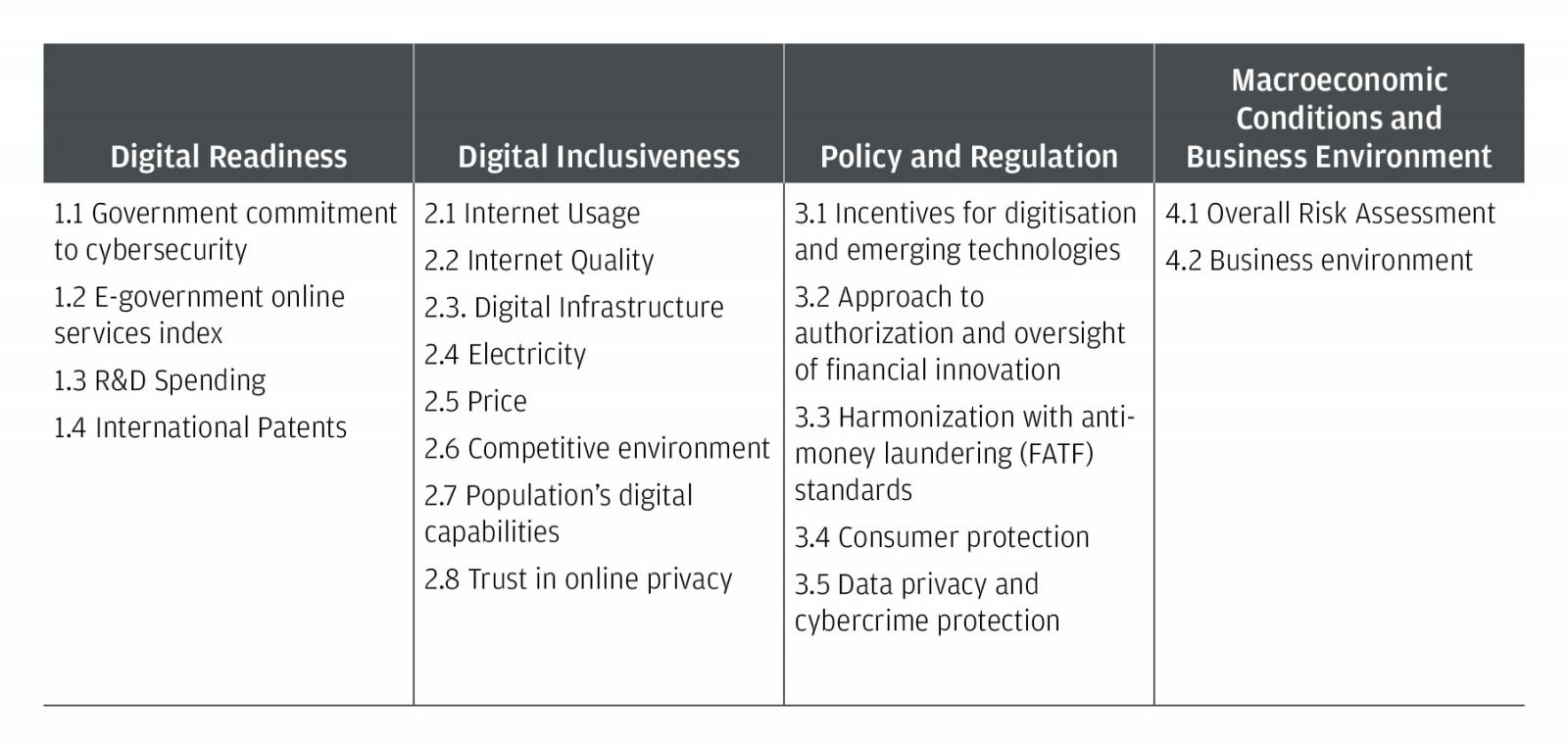

Economist Impact has identified 19 indicators across four key areas that reflect the strength of a country’s enabling environment for startups, in order to support investor decision-making (see Figure 4).

Economist Impact has analysed seven Latin American markets (Argentina, Brazil, Chile, Colombia, Costa Rica, Mexico and Peru) according to the above 19 indicators, alongside four international countries for comparison (US and China — major startup market — and Indonesia and South Africa — similarly sized economies).

Digital readiness

Digital readiness is a critical enabler of the startup ecosystem, requiring investments ranging from infrastructure to cybersecurity. In Latin America, strengthening e-government services and cybersecurity are key opportunities. The COVID-19 pandemic made stark the importance of robust digital infrastructure. In countries where the financial sector or the government had previously invested in digital financial infrastructure, policymakers were able to use digital distribution channels to quickly disburse cash transfers and other supports to beneficiaries in need. In Brazil, for example, around 67 million individuals received at least one cash transfer starting in April 2020. By August, beneficiaries had used around 40% of the funds to make digital payments to utilities and businesses, and for the internet. This robust digital infrastructure signals a large opportunity.

However, cybersecurity is an area of concern for startups in the region and rightly so. According to the ITU’s Global Cybersecurity Index10, all seven countries analysed have significant room to strengthen protections and promote the growth of key markets including e-commerce.

Similarly, research and development (R&D) spending is another area of opportunity to foster a stronger startup ecosystem in Latin American countries, particularly in smaller Latin American markets. Peru’s R&D spending, for example, represents just 0.1% of its GDP, compared with 1.2% in Brazil, 2.1% in China and 2.8% in the United States.

Digital inclusiveness

The quality and inclusiveness of digital infrastructure is another important factor that is often left out of the conversation. The level of inclusiveness in Latin America presents a mixed picture. According to Economist Impact’s Inclusive Internet Index11, Costa Rica, Mexico and Argentina have the highest levels of internet usage of the Latin American countries in our sample, falling only slightly behind China. Strikingly, China, Mexico and Argentina are also the countries where people have the most favourable perceptions (e.g greater trust) of online privacy.

However, the quality of internet services, measured through a composite indicator that assesses broadband speed, latency and capacity, is weaker in Latin American countries than in global leaders like China and the United States, which may explain, in part, why the region has room for growth in tech-dependent startups.

Policy and regulation

A policy and regulatory environment that is conducive to investment in innovation must balance several short- and long-term priorities, including the need for regulation against creating space for innovation. The Global Microscope, an index by Economist Impact that assesses the enabling environment for financial inclusion, has identified the importance of regulatory “proportionality” —that is, regulation should be proportional to the risk to the financial system. It should also be proportional to the type or function of a product, meaning that a bank that lends all types of financial services and products, for example, will be regulated differently than an e-money wallet that can only be used for payments. A qualitative indicator measuring whether countries have a proportionate legal framework for emerging services like peer-to-peer lending and crowdfunding, suggests that Chile and Costa Rica are lagging behind when it comes to proportional regulation in the fintech sector.

Another leading practice in the regulation of innovation is harmonisation with international standards. Anti-money laundering (AML), consumer protection and data privacy policies and regulations are particularly important for a thriving startup market. This is an area where Latin American countries are relatively strong compared to some global peers, although Brazil and Costa Rica lag behind in AML regulation, according to Microscope data.

Macroeconomic conditions and the business environment

Lastly, investors should always take into account the overall country risk and business environment, which has direct impact on consumer demand and the viability of long-term investments. Here the regional picture is a mix of opportunity and uncertainty.

Brazil’s large economy is showing improved resilience to a “second wave” of COVID-19 infections, and is expected to recover sooner than expected to pre-crisis levels in 2021.12 Argentina continues to face economic volatility, currency pressures, and awaits an IMF package to help restore stability. Smaller markets are displaying promise – for example Costa Rica. Despite its small size, Costa Rica has one of Latin America’s most attractive business climates, according to Economist Impact's Business Environment Rankings, reflecting political stability, a skilled workforce, and low taxes.

Accelerators targeting startup growth

To complement efforts to improve the enabling environment, a range of governments across Latin America have launched programmes geared towards startups more broadly (incorporating SMEs as well as faster-growing firms). The Colombian government has sought to develop metropolitan areas as startup hubs, for example through its INNPulsa partnership with HubBog in Bogota and its Ruta N incubator in Medellin.13 Chile has had a successful public accelerator programme for new startups in place for a decade, including a seed investment division that offers a range of benefits (both financial and non-financial).14 Costa Rica also has programmes in place to stimulate innovation in areas such as cybersecurity.15

It is not just governments that are pursuing such efforts: Companies in the region are also taking a much more proactive stance to boost innovation. In early 2020, Grupo Bimbo, a Mexican multinational food company, launched two accelerator programmes—Eleva and BakeLab—which invite proposals from startups for new product ideas that have the potential to scale globally, either through investment from Grupo Bimbo or a commercial alliance.16 AB InBev, a Brazilian brewing company, has also been active, launching the 100+ Accelerator in 2018, which aims to find startups with interesting and viable market solutions.17 In the first two years of the programme, AB InBev scaled up 23 out of the 39 startups that enrolled, including firms in Argentina and Uruguay.

Much of the existing literature that looks at potential growth in startups in Latin America focuses heavily, if not exclusively, on fintech (unsurprisingly, given fintech firms represent about one-third of startups in the region). Innovative digital solutions offered by new fintech providers target a large, underserved area of the financial services market. There is additional potential given the thin penetration of traditional banking services in the region, which stands at less than 50% in most of Latin America, and is even lower in some, such as 40% in Mexico.18 The rapid growth of this sector is now being met with new regulation. Mexico was one of the first countries to pass legislation to regulate fintech. Other countries, including Peru and Argentina, are likely to soon follow suit.

However, other sectors, such as education and healthcare, which are comparatively under-developed by international comparison, could also be poised for rapid growth. Successful startup propositions in Latin America often focus on providing localised solutions, which for Latin America often involve catering to sectors at the bottom of the pyramid in areas where public-sector provision has been weaker, including healthcare and education. By contrast, e-commerce was more developed prior to the onset of the pandemic — and has since only accelerated, with both new and existing firms alike growing their e-commerce offerings.

Conclusion: Chase business propositions, not investor buzz

Governments, investors and startups in Latin America have been seduced by the rise of unicorns across the world, which has influenced how investment opportunities in the region are assessed. Looking ahead, some new ventures will undoubtedly succeed in crossing the US$1bn valuation mark, probably in a greater variety of countries than the current limited number. An explosion of unicorns is unlikely in the region, since many countries remain constrained by small market size, a digital infrastructure that is growing only slowly, or a developing regulatory backdrop—and, in some cases, all three. To take this pessimistically, however, would overlook the larger picture: There are significant opportunities in smaller ventures, which offer large potential returns in sectors such as retail, financial services, healthcare and education – and importantly, can unlock economic growth and help the region achieve its development goals. Countries that have been proactive in fostering startups, mainly through reforms to improve the underlying business environment, are best-placed to benefit from future investment growth.

Appendix: Methodology

This section contains the data and methodology underlying the rapid assessment of the key enablers of Latin America’s start-up ecosystem.

Definition of unicorns

Within this article, a ‘unicorn’ firm is defined as any private start-ups with an estimated market value of at least US$1 billion.

Framework for the rapid assessment of start-up ecosystem enablers

Based on desk research and expert input, The EIU has identified 18 indicators to support investor decision-making in Latin America. These 18 indicators span four broad categories:

- Digital readiness

- Digital inclusiveness

- Policy and regulation

- Macroeconomic conditions

Data from additional sources, defined below, were also utilized in this analysis.

Seven Latin American countries were assessed (Argentina, Brazil, Chile, Colombia, Costa Rica, Mexico and Peru), alongside four international countries for comparison: US and China (major start-up markets) as well as Indonesia and South Africa (similarly sized economies).

Data sources and definitions

All of the quantitative and qualitative data in this assessment were collected and analyzed by the EIU project team. Data were gathered from reputable international, national and industry sources, including the EIU’s proprietary databases. Key data sources include:

● Gallup

● Ookla

● United Nations

● World Bank

● The Economist Intelligence Unit

● UNESCO Institute of Statistics

● World Intellectual Property Organisation

1 In this article we use the term “start-ups” to refer to technology-based companies in the early stages of operations, typically 3-5 years old, with high costs and limited revenue.

2 Definitions of unicorns vary across sources. In this article, we define unicorns as privately-held companies with an estimated valuation of $1 billion or more based on funding rounds. This is consistent with the definition used by CrunchBase, the primary data source on private funding markets used in this article. Companies that have migrated to public funding markets are excluded from this definition.

3 Calculations from Economist Impact based on company-level data from CrunchBase. All valuations are made in current US dollars. Accessed 31 Aug 2021.

4 Calculations from Economist Impact based on CrunchBase data. Accessed 31 Aug 2021.

5 See https://publications.iadb.org/en/tecnolatinas-2021-lac-startup-ecosystem-comes-age. Note that the IDB analysis is based on additional datasets, estimations, and media scans outside of CrunchBase.

6 See https://publications.iadb.org/en/tecnolatinas-2021-lac-startup-ecosystem-comes-age.

7 Companies were cataloged by the main industry they operate in to avoid duplicates. Sectors competing in similar industries were combined for consistency purposes.

8 Calculations from Economist Impact based on CrunchBase data. Accessed 31 Aug 2021.

9 Calculations from Economist Impact based on CrunchBase data. Accessed 31 Aug 2021.

10 ITU Global Cybersecurity Index 2020 Report. United Nations.

11 The Economist Impact's Inclusive Internet Index measures the extent to which the Internet is not only accessible and affordable but also relevant to all, allowing usage that enables positive social and economic outcomes at the individual and group level. See: https://theinclusiveinternet.eiu.com/

12 All insights from The Economist Intelligence Country Analysis.

13 See https://www.rutanmedellin.org/es/ and https://hubbog.com

14 StartUp Chile, https://www.startupchile.org/

15 See https://innovation.mit.edu/assets/MIT-GE-EPIC-final_April-2021_FINAL-2.pdf

16 See https://grupobimbo.com/en/innovation-grupo-bimbo/bimbo-ventures

17 See https://www.ab-inbev.com/sustainability/100-accelerator/.

18 World Bank Findex. See https://globalfindex.worldbank.org/ Accessed 31 Aug 2021.