Latin America is facing a growing demand for agricultural production and is quickly becoming the breadbasket of the world. Agricultural exports from the region currently account for 16% of total global food and agricultural exports. Accounting for food imports, Latin America’s net exports are 4% and are projected to increase to 19% between 2018-20 and 2030.1 In order to keep up with growing demand, it is estimated that agricultural production will have to grow 80% by 2050 to meet an expected population increase of more than 35% in the same time period.2 While the region is one of the few parts of the world with significant resources of unexploited agricultural land, it needs to increase the productivity and sustainability of agricultural practices in order to meet this demand.3

One of the greatest challenges facing agriculture in Latin America is the fragmentation between large-scale farms with advanced practices and technologies, and smallholder farmers who mainly operate informally and often lack the resources and technology to improve productivity and adopt more sustainable agricultural practices. Agricultural technology (AgTech) holds great promise to address some of these challenges. However, while global investments in AgTech have soared in the last five years and a growing number of start-ups in the region have been set-up to tackle local challenges, investments in the region make up for a very small portion of the global demand.

The unique composition of Latin American agrifood systems and the wide gap separating large and small-scale farmers present challenges and opportunities for investors in the region. Through the use of new technologies large farms can continue to increase their scale and productivity while smallholder farmers can consolidate and improve sustainable practices. However the success of AgTech solutions in Latin America will depend on their uptake by smallholder farmers, to ensure their scalability and implementation. Investing technologies that are tailored correctly for Latin America’s unique agricultural landscape represent an untapped opportunity in the region.

Agriculture is one of Latin America’s largest and fastest growing economic sectors

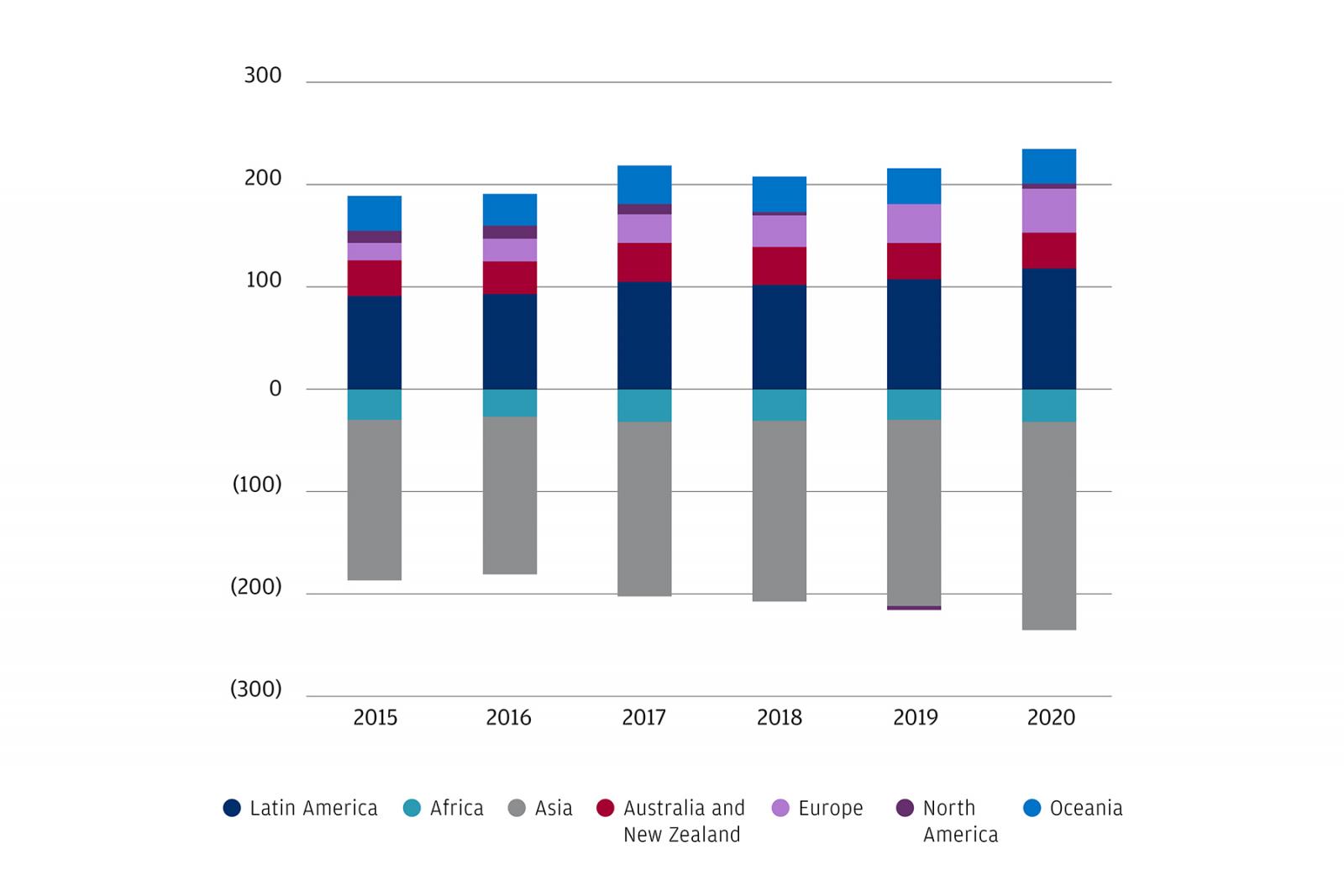

Latin America accounts for a significant share of global food and agriculture exports. (Figure 1) Brazil is the world’s third largest agricultural exporter after the United States and the European Union, producing most of the world’s sugar, coffee and orange juice, and is the largest exporter of beef, soybeans and poultry. Argentina is the largest exporter of soybean meal and soybean oil in the world, and third in bean exports. Mexico is the third largest agricultural exporter in the region producing vegetables, fruits and other agricultural byproducts.4

The disruptions in the global food supply chain as a result of COVID19 and recent geopolitical conflicts, coupled with growing local and global demand will need to be met both by small- and large-scale farms, which each play a unique role in producing agricultural goods in the region. Agricultural production in Latin America will have to grow 80% by 2050 to meet an expected population increase of more than 35% in the same time period.5

Figure 1. Latin America is the breadbasket of the world with the highest share of agricultural exports in the world

Net exports of agriculture products by region, 2015-2020 (millions of kilograms)6

Fragmentation between small and large-scale farmers limit the sector’s capacity to keep up with demand

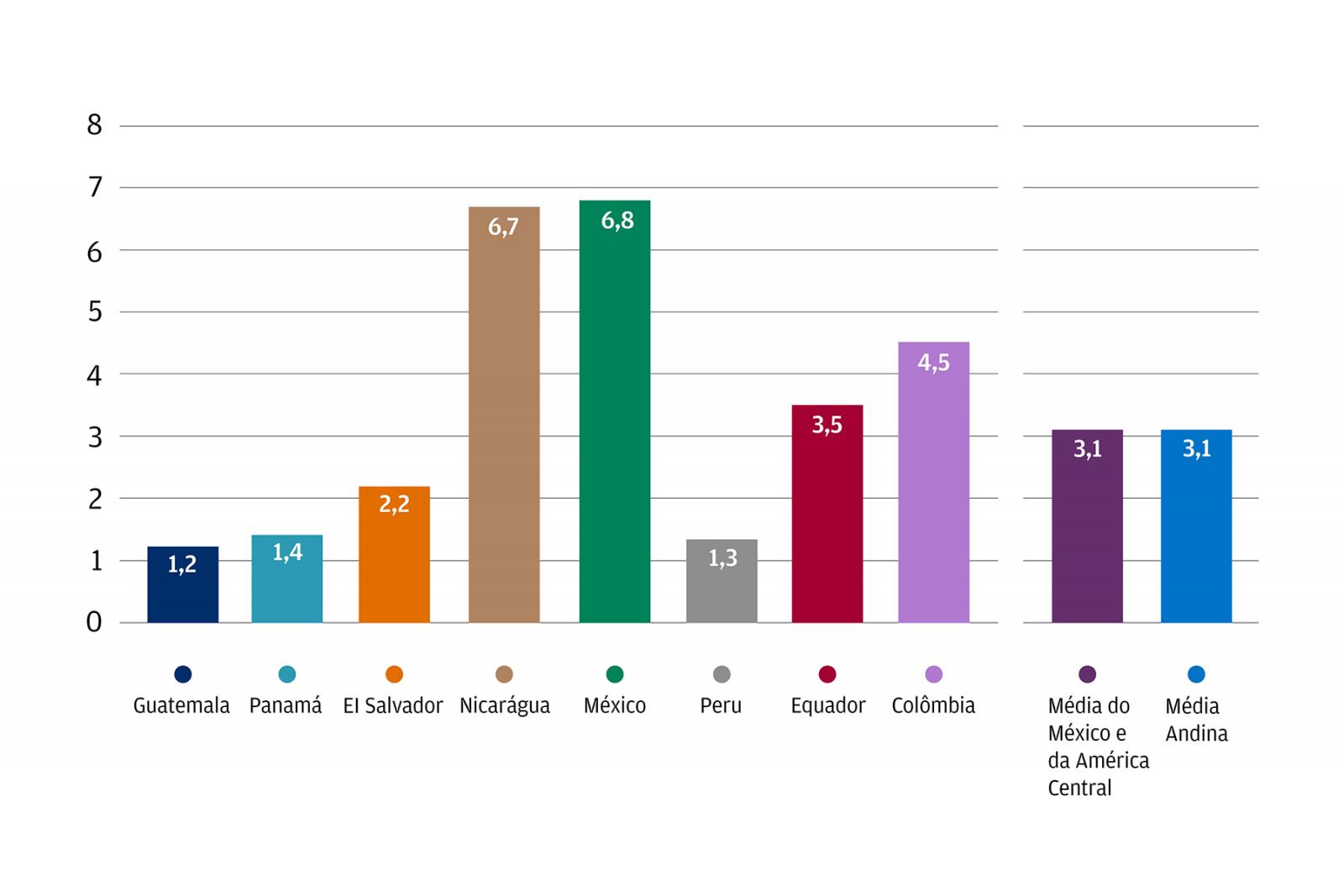

Latin America’s agriculture sector is unique as small-scale farming plays a significant role in the region's food production. The mix between small- and large-scale agriculture varies greatly across countries, leading to disparities in terms of the scale and sophistication of the agricultural sector and its contribution to economic output (Figure 2). While an estimated 50% of total production comes from the region's 14m smallholder farmers, large-scale farms play an essential role in countries like Argentina, Brazil and Uruguay.

Figure 2. Small-holder farms hold a large share of farmland across Latin American countries

Average size of small-holder farms in selected Latin American countries (hectares)

Sustained agricultural sector growth presents unique challenges to small and large-scale farms

Latin America’s agricultural sector faces productivity and sustainability challenges that need to be addressed in order to deliver on its promise. The sector uses a significant amount of the region’s natural resources, and rising demand for agricultural products will continue to strain the environment. Agriculture uses over one-third of the region’s land area, consumes nearly three-quarters of the region’s fresh water resources, and generates almost one-half of the region’s greenhouse gas emissions.9 While some farmers and ranchers have been at the forefront of adopting green technology, many Latin American food systems are dominated by production models based on unsustainable practices.10 These production models threaten the viability of Latin America’s food production capacity and will need to be replaced to ensure the sustainability of the natural resource base.

The global AgTech market is soaring as investors recognise the opportunity that tech solutions offer to transform agricultural systems

Global investors recognise the need of bringing farming from the industrial age into the digital one, in order to increase food yields, reduce the burden to the environment, maintain farm viability and respond to consumer demand for quality foods.11 Investments in AgTech and FoodTech focus on efforts to address food waste and improve food traceability, environmental-friendly business models, and enhancement of crop yields sustainably.12 At the pre-farm stage, technology can, for example, help farmers conduct barter negotiations in a more efficient manner, on-farm tools can help detect irrigation deficiency, identify dead plants, project crop yields, and determine and pinpoint productive or non-productive areas, and finally post-farm tools can help create more competitive marketplaces to buy, trade, and sell agricultural products and by-products.13

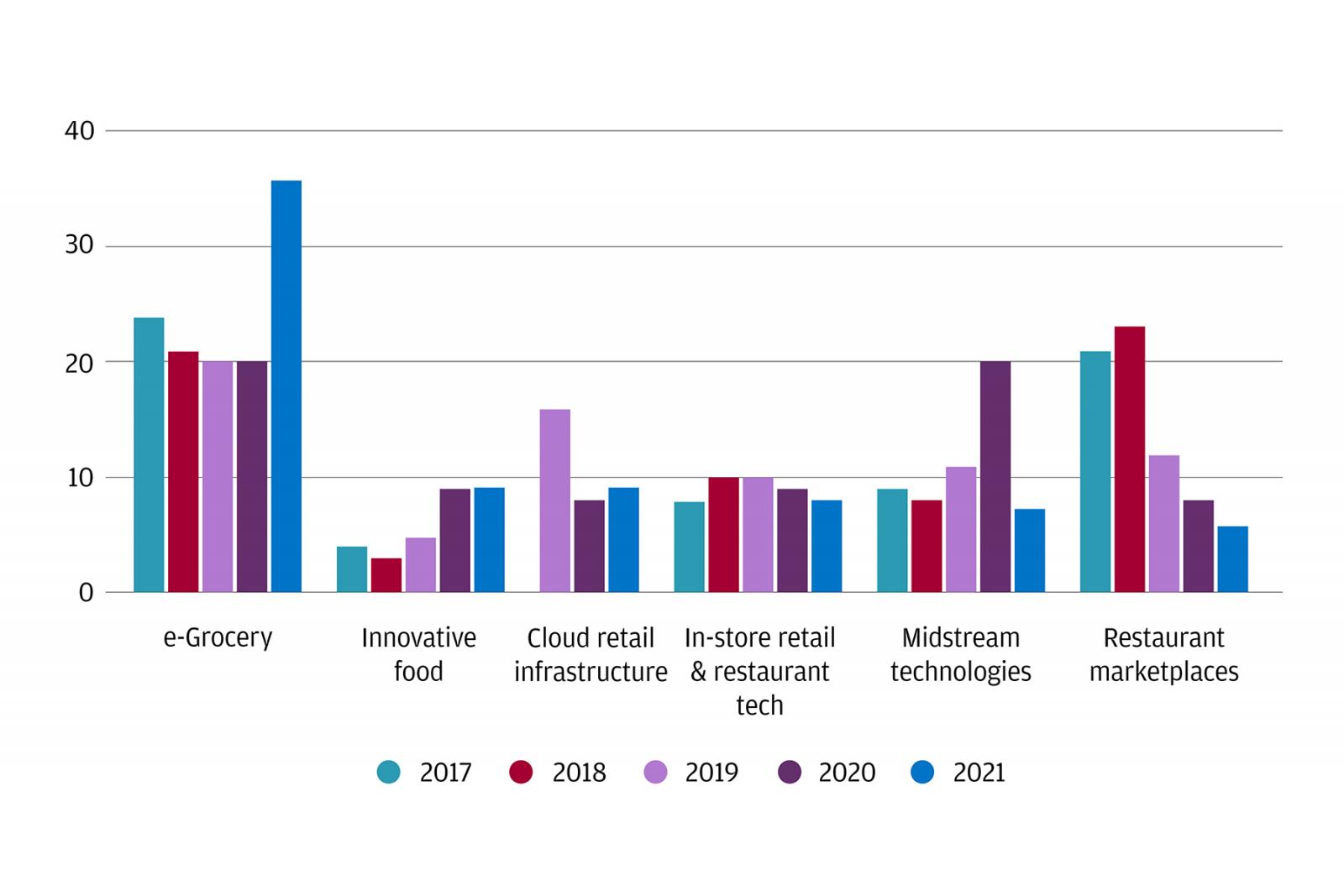

In addition to the analog AgriFood investments concentrating in genetics, pesticides and fertilisation, supply chain disruptions derived from COVID19, geopolitical instability and labour force shortages have increased investors’ focus on digitisation, data science and alternative farming. Downstream investments which include eGrocery, restaurant marketplaces and home cooking have had the highest rates of growth in the AgriFoodTech sector as they become deeply entrenched in consumer habits.14 Eighteen percent of consumers now purchase groceries through digital channels more often than in stores.15 (Figure 3)

Figure 3. Investment deals in eGrocers have the greatest share of the market as consumers shift to online stores

2021 Main annual AgriFoodTech investment, by category (% of total investment)

Latin American investments in AgriFoodTech trail behind despite its importance for the region’s economic growth

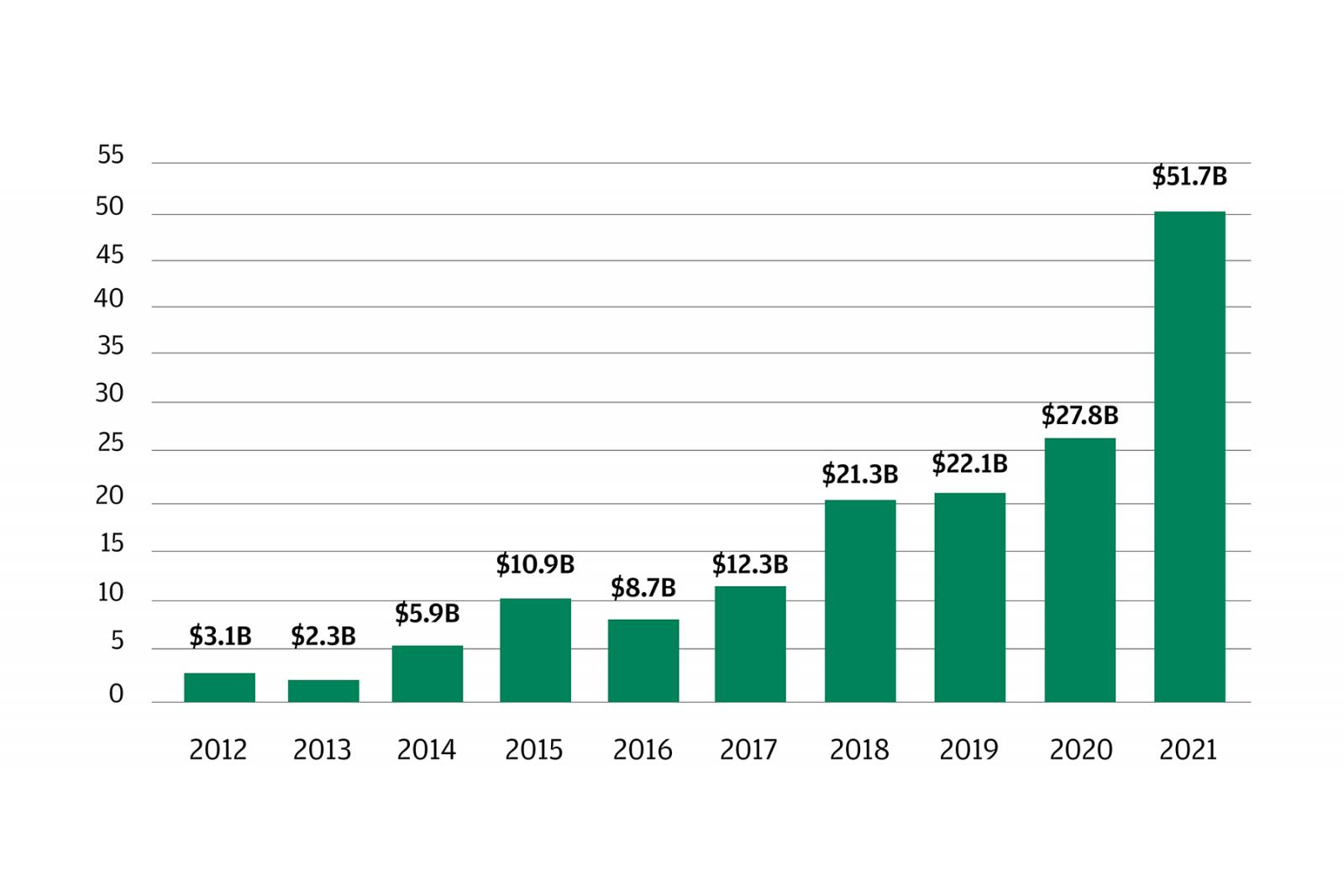

The global AgriFood Tech sector has seen a steady stream of funding over the last decade, reaching a record high of global investments of $51.7bn in 2021. (Figure 4) The US dominates the sector as the world’s biggest AgriFoodTech investment market, with US-based startups raising 41% of all capital and accounting for 34% of deals in 2021. Despite the importance of agriculture in the region and the need for solutions that allow Latin American farmers to deliver on the rising demand for agricultural production, investment opportunities in AgriFood Tech are being overlooked in Latin America. The region ranks last in AgTech investments with just $440m being invested in 152 deals over the last 5 years.17

Data from the Association for Private Capital Investment in Latin America (LAVCA) shows there was only $35.4 million in venture capital invested in agtechs across 15 disclosed rounds in 2021, leaving ample room for additional investment, which could considerably scale up the market.18 The only Latin American country that appears among the world’s top-15 is Colombia, in eighth place, with investments of $359 million. The sector raised $70 million last year in Brazil.19

Figure 4. The AgriFoodTech sector has seen a steady stream of investment over the last decade

Upstream and Downstream AgriFoodTech funding (USD billions)

The unique challenges of Latin America’s small-holder farmers calls for investments in local-grown solutions

One of the factors that is holding back Latin American investors is the need for the development of solutions that are viable in the highly fragmented agricultural landscape in the region. AgTech innovators in the region face unique challenges derived from the prevalence of small-scale farms including scalability, affordability and limited implementation capabilities. This fragmentation split the regional AgTech investment landscape into two segments. While large-scale farmers might benefit from tech innovations that are being adopted in other parts of the world to improve sustainability and increase crop yields, the small size and lack of production consistency of small-holder farms make it difficult to scale up technology adoption in a big part of the region’s agricultural sector.

The biggest challenge for Latin American startups serving small-holder farmers will be scalability. Innovators will need to promote consistent adoption of technology solutions across a wide variety of actors, with limited resources. In this segment, experts predict that the internet of things (IoT) and the use of APIs to connect very cheap sensors and satellite information that generate intelligent information will be one of the key ways to scale AgTech in the next few years.21

Improving farmers’ access to financial services could be another growth opportunity at the intersection of AgTech and FinTech, to ensure farmers are able to access the credit needed to modernise their operations. Greater access to financing, through affordable innovative private sector partnerships such as mutual guarantee funds, factoring and other receivables securitization facilities, would help to ease the credit constraints faced by small farmers in Latin America, enabling them to increase their investments and market participation, while introducing new products and technologies to improve their productivity.

Investments in R&D are needed to enable rapid scaling up of local solutions. Spending by the private sector could add significantly to the overall commitment to research and development in Latin America, as well as speed important gains in yield and drought tolerance, pest-resistance, and the potential for improving health by improving nutrient value of crops.22 Other forms of private sector agriculture investment include research for better irrigation systems, mechanisation for crop production and post-harvest processing and storage, as well as innovation in animal health and nutrition.23 However, the need for more robust IP protections might also be hindering R&D efforts. The system for establishing intellectual property (IP) protection for the companies that are developing these technologies are too slow or almost non- existent in Latin America leading to a withholding of these beneficial technologies from those countries that could benefit farming operations of all sizes.24

21st century challenges demand 21st century solutions

The viability of Latin America’s agricultural sector depends on its ability to keep up with growing demand and the growing threat of climate change. Transitioning agricultural systems to the digital era can help farmers implement solutions for challenges like waste reduction, increased crop yield and resource consolidation. Latin American investors have the potential to capitalise on the region’s fastest growing sector despite the growth of global investments in AgTech solutions. However, instead of looking outside the region to identify technology innovations and new business models, investors should look inwards and place their bets on solutions that tackle the region’s unique challenges. Technologies that are affordable, scalable and consistently implemented, are more likely to succeed in an industry that is highly fragmented and led by small-holder farmers.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

2 https://lavca.org/2017/05/03/record-year-agtech-latin-america/

3 https://economics.rabobank.com/publications/2015/september/latin-america-agricultural-perspectives/

4 https://economics.rabobank.com/publications/2015/september/latin-america-agricultural-perspectives/#:~:text=Argentina%20is%20the%20largest%20exporter,70%25%20of%20total%20agricultural%20exports.

5 https://lavca.org/2017/05/03/record-year-agtech-latin-america/

6 https://blogs.worldbank.org/latinamerica/sustainable-future-agriculture-latin-america-and-caribbean-our-hands-lets-make-it

7 https://www.fao.org/faostat/en/#data

8 https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2020/11/Landscaping_the_agritech_ecosystem_for_smallholder_farmers_in_Latin_America_and_the_Caribbean_1.pdf

9 https://blogs.worldbank.org/latinamerica/sustainable-future-agriculture-latin-america-and-caribbean-our-hands-lets-make-it

10 https://documents.worldbank.org/en/publication/documents-reports/documentdetail/942381591906970569/future-foodscapes-re-imagining-agriculture-in-latin-america-and-the-caribbean

11 https://www.weforum.org/agenda/2019/02/why-the-agtech-boom-isn-t-your-typical-tech-disruption/

12 https://news.crunchbase.com/news/agtech-startups-vc-funding-data/

13 Agtechs disrupt farming in Latin America

https://capria.vc/wp-content/uploads/2021/09/LABS-collection-9.pdf

14 https://www.pymnts.com/news/ecommerce/2022/first-party-fulfillment-enables-positive-unit-economics-for-egrocer/

15 https://www.pymnts.com/news/ecommerce/2022/first-party-fulfillment-enables-positive-unit-economics-for-egrocer/

16 https://research.agfunder.com/2022-agfunder-agrifoodtech-investment-report.pdf

17 https://www.supplychangecapital.fund/blog2/agtech-innovation-and-investment-opportunities-in-latin-america

18 https://capria.vc/wp-content/uploads/2021/09/LABS-collection-9.pdf

19 https://capria.vc/wp-content/uploads/2021/09/LABS-collection-9.pdf

20 https://research.agfunder.com/2022-agfunder-agrifoodtech-investment-report.pdf

21 A record year for Agtech in Latin America? https://lavca.org/2017/05/03/record-year-agtech-latin-america/

22 https://publications.iadb.org/en/next-global-breadbasket-how-latin-america-can-feed-world-call-action-addressing-challenges

23 https://publications.iadb.org/en/next-global-breadbasket-how-latin-america-can-feed-world-call-action-addressing-challenges

24 https://publications.iadb.org/en/next-global-breadbasket-how-latin-america-can-feed-world-call-action-addressing-challenges