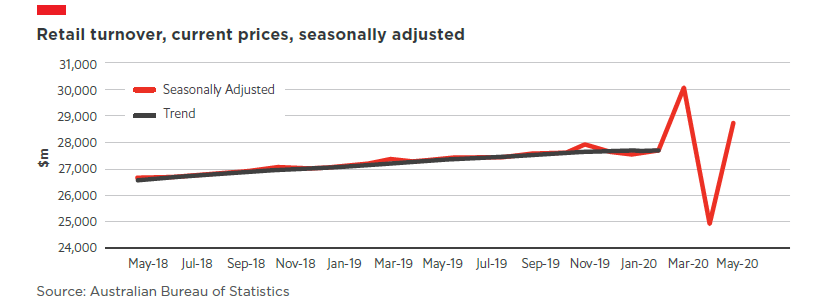

When Australian government restrictions closing non-essential services came into effect on March 23rd 2020, virtually all of the nation’s bricks and mortar stores also shut their doors as social distancing requirements saw footfall drop dramatically. The nation’s retail sector took an immediate and unprecedented hit. Seasonally adjusted, Australia’s retail trade fell 17.7% in April 2020, the largest decline since records began.1

Retail sales bounced back after restrictions were eased at the beginning of May—turnover rose 16.3% that month, another statistical record.2 However, with e-commerce emerging as a panacea to some of Australia’s covid-19 retail woes, many

analysts predict that consumer behaviour may have changed permanently.3

Australia Post—which provides postal services in Australia—estimates e-commerce in the nation grew 80% year-on-year in the two months up to May 15th 20204 and for some retailers the biggest challenge at the height of the pandemic was meeting the extraordinary spike in online demand. Yet the impact on individual companies depended on the types of products they offer online and whether a brand’s e-commerce presence was well-established prior to the lockdown.

In this interview, Chris Kinraid—group chief financial officer (CFO) at Kathmandu Holdings Limited, which manages Kathmandu, Rip Curl and Oboz Footwear—describes the evolving issues his firm has faced over the course of the pandemic. From factory closures to difficult decisions about cost restructuring and the impossibility of future forecasting, Mr Kinraid is also quick to recognise the opportunities the crisis has created and why it may have a profound impact on the shape of Australia’s retail sector in the years ahead.