Surprising many people, 2016 was a year when international trade shot to the fore as a leading global issue of conversation — dominating elections, commentary and dinner table debates. As a strong advocate for the benefits of an open trading system I’ve been dismayed at much of the tone of the discussion as well as the lack of data applied to many arguments. I hope that our work at the Economist Intelligence Unit has been able to add positively to the discussion and will help inform policy-makers, businesses and conscientious citizens in their efforts to think about trade and the challenges and benefits it presents.

I present here an incomplete round-up of the public work the EIU has done on trade in 2016, focusing on our largest projects and those with a public policy bent to them. The teams of editors, analysts, writers, digital experts et al, are proud of these projects as many of them, such as the Sustainable Trade and Illicit Trade Environment Indexes had never been attempted before. We are grateful to the many organizations that worked with us to create these.

The Hinrich sustainable trade index

An index’s time that has certainly come: International trade has become fundamental to economic growth and in doing so, has helped to lift hundreds of millions out of poverty. But it is not without costs and risks. The flow of goods and services across borders can disrupt labour markets, accelerate environmental degradation, and contribute to worsening inequality. With the right policies, these costs can be reduced, if not eliminated, and trade can become more sustainable. The sustainable trade index was created for the purpose of stimulating meaningful discussion of the full range of considerations that policy makers, business executives, and civil society leaders must take into account when managing and advancing international trade. This inaugural edition of the index focuses on Asia with the US included as a developed country benchmark — a rather apposite inclusion.

Full white paper and excel project data here: https://www.eiuperspectives.economist.com/economic-development/hinrich-foundation-sustainable-trade-index

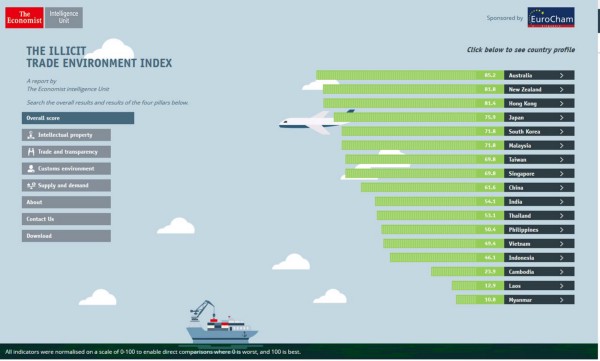

Illicit trade environment index

Continuing on the theme of looking closely at the downsides of trade and how to mitigate them, we launched this index and white paper resulting in far more media coverage than we had actually expected. Here’s the thesis: Illicit trade poses a threat to public health, the environment and innovation, and provides funds for transnational crime networks and terrorist organisations so reducing it makes sense. The Economist Intelligence Unit created the Illicit Trade Environment Index to score 17 economies in Asia on the extent to which they enable or discourage illicit trade. Economies with the best environment are those taking the most action on the issue while economies that do little score worst. We created a website where you can explore the data here: http://illicittradeindex.eiu.com/

Terms of trade: Understanding trade dynamics in the US

In no way could we leave the US unexamined in 2016 so we worked with American Express to create this project which examines key aspects of trading with the world’s largest economy from the perspective of foreign companies., found here: https://www.eiuperspectives.economist.com/economic-development/terms-trade-understanding-trade-dynamics-us We based the findings on an executive survey of roughly 500 companies (warning: pre-US election!) that trade with the US and conducted numerous interviews with that much maligned segment of the population: experts. Infrastructure (ie ports, land borders) was highlighted as an area for improvement, one that might actually get some attention in 2017. Also notable, 78% of the survey respondents expected the TPP to improve opportunities for trade with the US market moderately or substantially…

The geopolitics of supply chains

Want to understand what happens to various counties economically if Mr. Trump and Mr. Putin end up not being bosom buddies and instead go back to competing fiercely on the world stage? Enjoy exploring: http://growthcrossings.economist.com/theme/the-geopolitics-of-supply-chains/

We built this tool because emerging-market firms are finding that their supply chains are just as susceptible as those of their Western rivals to geopolitical risks. We thought a tool to anticipate challenges in a time of increasing complexity might be useful. I expect we are going to be creating a fair few more of these tools as 2017 looks set to crank up the uncertainty levels.

An essay on unraveling globalization

While it mildly pains me to highlight an essay by an IMD professor (I’m an INSEAD grad) Prof. Stephan Girod, acting as an EIU contributor, neatly summed up many of the concerns that arose in 2016 — “Globalisation could be at best on a pause but we may be soon reaching a point where it could unravel altogether.” The essay points to many of the same pressure points that the Hinrich Sustainable Trade Index examines and was a neat, although disturbing, way to encapsulate the concerns of 2016: https://www.eiuperspectives.economist.com/economic-development/part-1-end-globalisation

Did all that really just happen?

What with the presumed death of TPP, Brexit, threats by many parties to rip up or renegotiate existing deals, failure to conclude RCEP, new academic research shedding light on the those who lose out from globalization and the not-unrelated rise of populism in the Western world — 2016 has been a shocking year in trade in many respects. I hope this research shines some light on the big issues as well as the important niche matters. We look forward to continuing the conversation in 2017.

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of The Economist Intelligence Unit Limited (EIU) or any other member of The Economist Group. The Economist Group (including the EIU) cannot accept any responsibility or liability for reliance by any person on this article or any of the information, opinions or conclusions set out in the article.