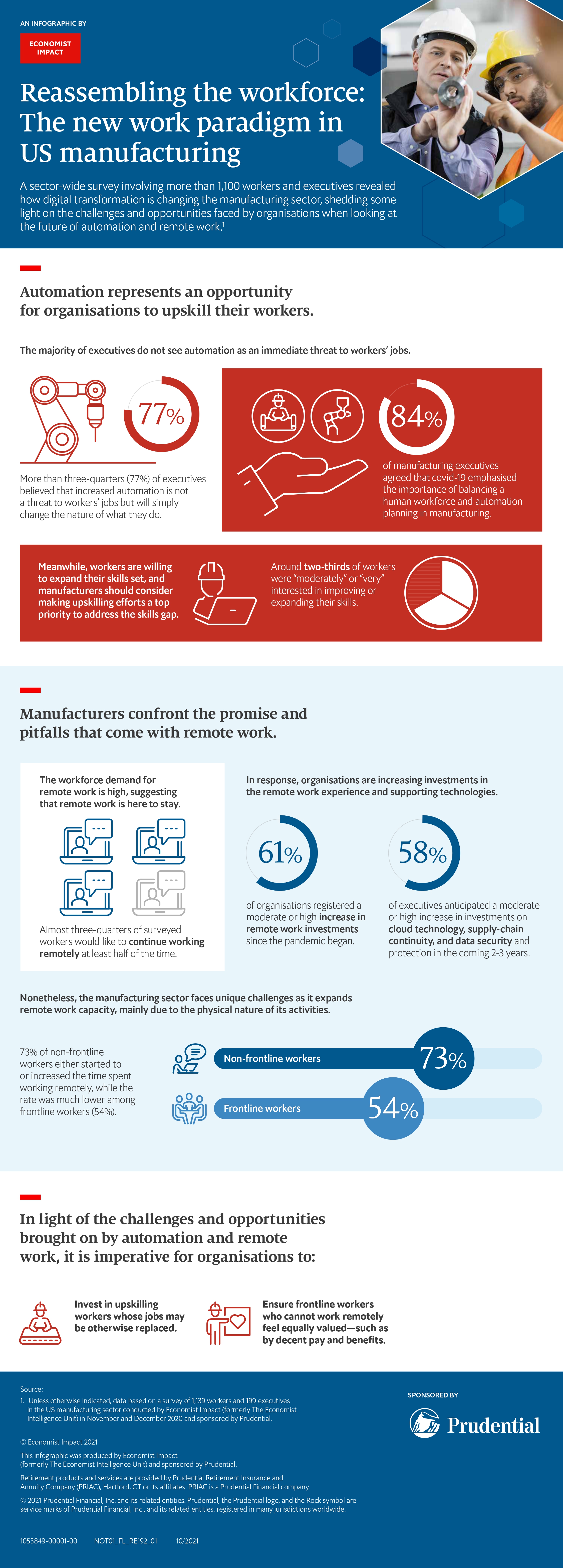

Infographic | Reassembling the workforce: The new work paradigm in US manufacturing

Download Infographic

Yuxin is a senior manager on the Policy & Insights team. She leads research and analysis projects across a range of sectors including financial services, technology and NGOs. Based in Washington DC, Yuxin specializes in international trade and finance, demographics and workforce, emerging markets, and megatrends.

Prior to joining the Economist Group, Yuxin was vice president at FP Analytics of Foreign Policy, where she consulted with governments, international institutions and companies on trade, energy and social policies and investment strategies.

Yuxin holds an MBA from McDonough School of Business of Georgetown University and a BA in Management from University of International Business and Economics.

More from this series

video

VIDEO | Recovery, Resilience and the Road Ahead - Manufacturing

Read more

article

Article | The manufacturing sector post-pandemic: Rethinking US workplace priorities to pursue short and long-term success

The US manufacturing sector was dramatically impacted by the pandemic last

Read moreRelated content

Recovery, Resilience and the Road Ahead: Rethinking US Workplace Priorities...

Waves of substantial disruption are the norm in business, not the exception. The challenges of 2020-21 have been unusual, but workers and organisations can never assume that stability will persist. The US employment landscape was already seeing substantial transformation long before 2020. That said, covid-19 has revealed the future of work faster than anyone expected. Digitalisation has accelerated; widespread working from home has left many workers eager for more; and the joint experience of navigating through immense disruption has profoundly affected workplace relations. The great unknown is how much will last and how much will be seen in retrospect as a temporary blip.

To shed light on the major shifts taking place, The Economist Intelligence Unit, sponsored by Prudential, conducted an in-depth survey in November and December 2020 of over 5,800 US workers and executives across five key industry verticals—healthcare, financial services, manufacturing, the public sector and unions—in order to explore the impact of the pandemic accelerated new work paradigm. Specifically, we asked about organisational and worker concerns, priorities, remote work experiences, digital maturity, technology investments, skills and capabilities, and likely future challenges. This executive summary reports the overall findings from the survey, while other pieces will discuss insights relevant to the specific industry verticals.

Key findings:

Workers and their organisations were largely on the same page as they addressed the workplace implications of dealing with covid-19-related disruption in 2020. The economic turmoil that the pandemic unleashed had uneven results with, perhaps surprisingly, more workers saying that their company culture and workplace relations improved rather than deteriorated. Although workers are currently optimistic about their employment, there are widespread concerns about longer-term financial security. Talent largely values better pay and job security, but organisations may be prioritising other factors and some risk focusing insufficiently on worker engagement. Digitalisation will continue to reshape the workplace but also intensify the competition for digital talent. A lasting legacy of the social response to the pandemic will be retaining remote working as a mainstream option.

A strategic playbook for navigating the pandemic-accelerated new work parad...

The covid-19 pandemic has reshaped the US employment landscape in drastic and long lasting ways. A variety of pre-existing trends affecting organisations and workers have been accelerated by the historic crisis: digital transformation, remote work and automation, to name a few. The new normal that emerges from the pandemic has profound implications for how and where work gets done, and—more fundamentally—how organisations and workers relate to each other. To remain competitive, organisations will need to skillfully navigate both near-term business challenges and longer-term talent, technology and workplace culture issues.

To understand how the pandemic has affected workers and organisations, and surface important sector-specific and broader trends, Economist Impact, sponsored by Prudential, surveyed more than 5,800 US workers and executives in late 2020. Respondents were in five key industry verticals: healthcare, financial services, manufacturing, the public sector and unions. Complementing the Recovery, Resilience and the Road Ahead report, which summarises the overall findings from the survey, this playbook presents key findings for specific industry verticals, insights gleaned from expert interviews, and discusses their implications for organisations moving forward. While revealing cross-vertical trends, it sheds light on unique or prominent findings in specific verticals.

Key Findings:

Overall, many workers said their wellbeing had improved in various ways during the pandemic. However, the survey has revealed its disproportionate impact on certain groups, including older workers and women. These disparities, particularly seen in the healthcare and public sector verticals, with high levels of their workforce deemed essential to critical social and physical infrastructure, incites a deeper observation. Covid-19 has been a multidimensional public health and economic crisis. Health and safety concerns have been significant among essential workers, but the survey results make clear that financial concerns remained prominent. In that vein we have observed verticals—across the board—fall short of providing or raising awareness of tools and resources to address this need. While digital transformation has become an urgent requirement during the pandemic, rather than a business goal for organisations, executives are increasing investments in new technologies, as well as grappling with disproportionate digital divides, evident in the public sector and manufacturing. Competition for information technology talent will also intensify, especially in the financial services sector. The unpredictable disruptions presented by covid-19 have underscored the importance of stability for workers on edge and exhausted. For some, the crisis has highlighted how unions empower members to advocate for their wellbeing and safety, exemplified by the investments seen in the public sector. Accordingly, there may be a lesson there for organisations across all sectors as they emerge, transformed in a number of ways, from the pandemic: an empowered workforce can also be more engaged and resilient.

Steering through collaboration: CFOs driving new priorities for the future

It is well established that the modern CFO has a more strategic role to play in a business, but a clear action plan to achieve this is lacking. A key element of this is helping the business to deal with change. Some changes are planned: launching a new product or service, setting up operations in a new region or acquiring a competitor. Others may be unexpected: a major disruption to supply-chain operations, the emergence of new regulation and legal reporting requirements or the unpredictable impacts of global economic uncertainty.

Either way, when asked about the biggest challenges they face in executing their day-to-day activities, change is a recurring theme, according to a new survey of 800 CFOs and senior finance executives, conducted by The Economist Intelligence Unit. Managing unexpected changes to financial forecasts and adapting finance processes to rapidly evolving business models are top of mind.

Managing unexpected changes to financial forecasts and adapting finance processes to rapidly evolving business models are top challenges finance executives face in executing their day to-day activities.

Finance executives are also concerned with identifying how to align strategic, financial and operational plans towards common objectives and meaningfully analysing data across business units and regions. “All functions are working to meet these challenges and, as a finance head, we have to have visibility across all functions, how they are progressing [towards meeting goals] and ensuring that their direction is in line with overall strategic goals,” says Lalit Malik, CFO of Dabur, an Indian consumer goods manufacturer. It is incumbent upon CFOs therefore to be prepared not only to help their own function navigate uncharted territory, but the rest of the business too. That means breaking down the silos that commonly exist in organisations, in order to collaborate closely across functions, sharing information and data in the pursuit of common objectives.

All functions are working to meet these challenges and, as a finance head, we have to have visibility across all functions, how they are progressing [towards meeting goals] and ensuring that their direction is in line with overall strategic goals - Lalit Malik, CFO of Dabur, an Indian consumer goods manufacturer.

The clear custodian of collaboration

There are a number of reasons why the role of leading cross-company collaboration around steering should fall to the CFO and their team. First, through the activities of budgeting, the finance function is the custodian of the clear, quantitative expression of management expectations and determines how resources such as cash and people will be allocated in order to achieve them. In our survey, 90% of respondents say that finance should facilitate collaborative enterprise planning to ensure that operational plans are aligned with financial and strategic plans.

Second, through performance management, the finance function is the gatekeeper for critical data that illustrate how well—or otherwise—the company is rising to the challenge of change. That includes data relating to sales, supply chain and delivery, which need to be reported back to the business in ways that help drive improved decisionmaking. Our survey reveals that companies in which finance executives feel empowered to drive strategic decisions across business functions are more likely to report a higher financial performance in fiscal year 2016/17 and 2017/18 and anticipate higher growth rates for 2019/20.

Download Complete Executive Summary PDF