There has been a step-change in how companies are using Internet of Things (IoT) technology to assist with internal operations since 2017, The Economist Intelligence Unit’s IoT Business Index 2020 reveals.

The aggregate score for the application of IoT to internal operations jumped from 4.34 in 2017 to 6.82 in 2020. This means the typical company’s IoT initiatives went from “planning” three years ago to being firmly in the “early implementation” phase today.

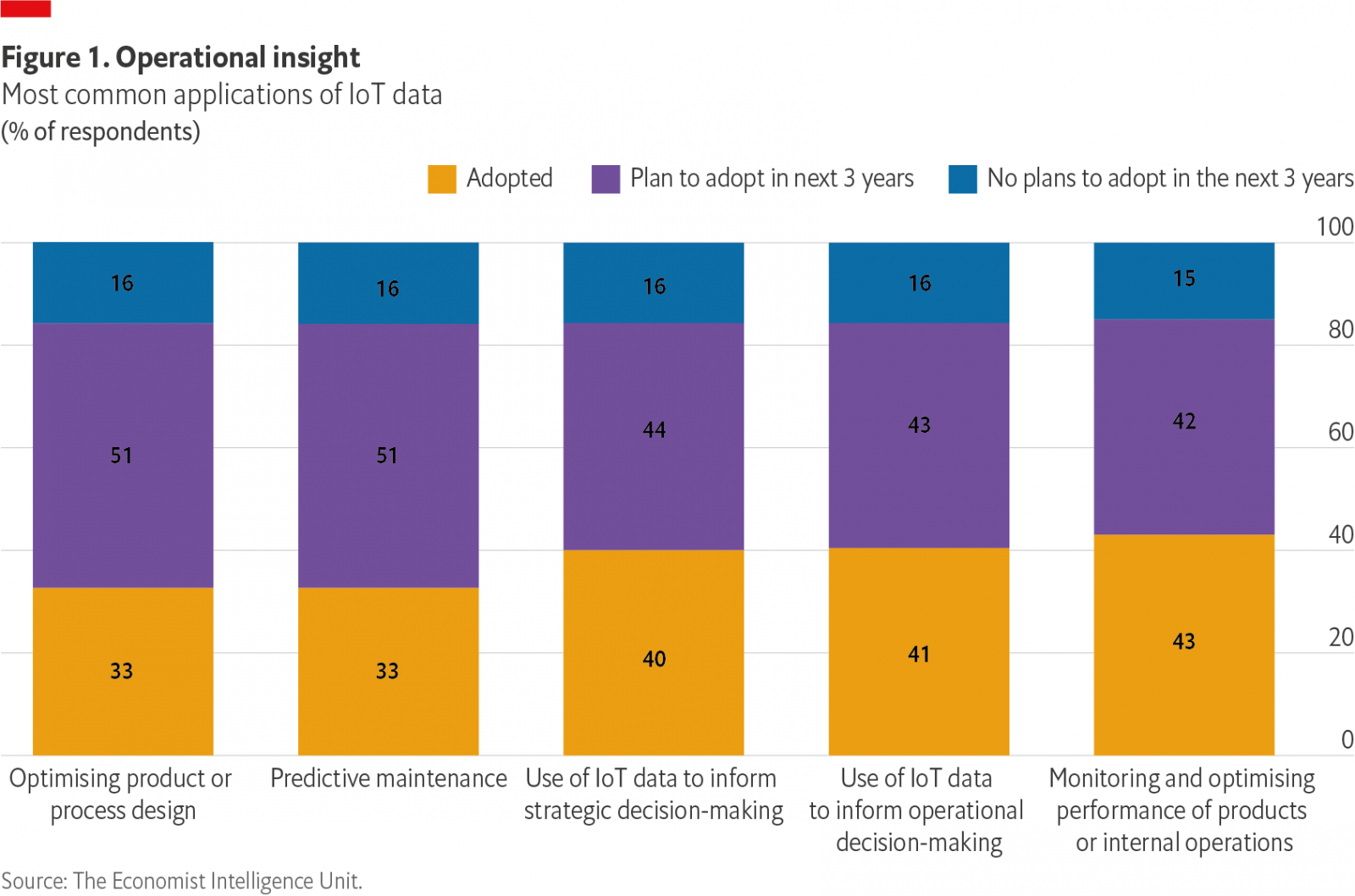

Our research also shows that the most widely adopted applications of IoT data are monitoring and optimising the performance of products or internal operations (43%) and using IoT data to inform operational decision-making (41%, see figure 1).

This suggests that a long-expected shift in the management of internal business operations—using network-connected instrumentation to monitor, manage and predict the future state of their physical equipment and environment—is at last coming to pass.

What does this shift mean for the practice of operations management, and how can companies ensure that IoT functionality delivers operational benefits? The experience of two pioneering organisations, with some of the largest and most complex operations in the world, offers some insight.

The new oil

Saudi Aramco is the world’s largest oil producer. In 2018, the company produced 10.3m barrels of crude oil per day.

The need to extract the maximum performance from these operations—and to monitor their environmental impact— places the IoT at the heart of Saudi Aramco’s business strategy according to the firm’s chief digital officer, Nabil Al-Nuaim. Company has introduced countless sensors to monitor the performance of its pipelines and refinery operations.

For example, sensor data are combined with image-processing techniques to monitor flares, in which excess gas is combined with steam and air and burnt off. This helps Saudi Aramco manage the environmental and financial impact of these flares more effectively.

Crucially, using sensor data to predict and pre-empt operational performance issues typically requires integration with supplementary data from third parties, such as the sensor manufacturers. Mr Al-Nuaim describes the company’s collaboration with these partners in the oil refinery pipeline as one of the building blocks of the “digital foundation” that underpins its operations, alongside technology and governance. “Different players will [represent] different parts of the value chain, but they all have to be part of this mission,” he says.

One example is monitoring the performance of the catalysts that are used in refinery processes to help convert crude oil into high-value gasoline. Saudi Aramco might use the same catalyst in a range of refineries, but the operating parameters are likely to be different from one facility to another. By bringing in data from various sources, Saudi Aramco is able to build models that help predict when the catalysts used in the refinery process need to be replaced.

“You take different parameters, and you see the performance, and then you can really detect when to replace the catalysts,” Mr Al-Nuaim explains. “This is the value chain.”

“Using sensor data to predict and pre-empt operational performance issues typically requires integration with supplementary data from third parties.”

Nabil Al-Nuaim, chief digital officer, Saudi Aramco

Although sensors are already being used across Saudi Aramco’s facilities, Mr Al-Nuaim recognises that there is the potential to add thousands more. He says further exploitation of the operational IoT must focus on how to turn data insight into business value. “We have to make sure that the data is properly cleaned up and it’s accurate, with the right verification and benchmarking,” he says. “The aim is to make sure that it is the right data [so] the AI and machine-learning platforms will give you insights.”

Port of call

Another organisation using IoT to optimise massive operations is the Port of Rotterdam, the largest port in Europe (and one of the oldest, having been founded in 1360). The port is 42km in length and covers over 100 sq km. Its facilities include 125 jetties, 1,500 km of pipelines and five oil refineries. In 2018, more than 8m containers and 469m tonnes of goods passed through it.

For the past three years, the port has been applying IoT features to smooth the logistics for incoming and departing vessels and simplify the movement of goods across the port and out into the local hinterland.

A vessel coming into Rotterdam might encounter as many as ten business-related activities, such as having to wait for a tugboat, unloading cargo and taking on fuel. CEO Allard Castelein says a lack of oversight, transparency and coordination meant some of these operational processes had become inefficient.

The IoT platform the port has developed, alongside various technology partners, processes around 1.2m data points every day. Data scientists at the port combine data from sensors—including information about the tide height, tidal stream and wind direction—with external data—such as weather patterns and government records—to create prediction models that can be used to reduce waiting times and optimise berthing.

“By applying these tools, the sequence of events is timed perfectly,” says Mr Castelein. “We’re allowing shipping lines to optimise their sailing time by knowing exactly when to arrive and can ensure the terminal is free. Confirmation from our customers suggests it saves 20% of their time in port and produces 20% less emissions.”

Mr Castelein says data analytics is core to the organisation’s business strategy. He recognises that companies that are new to the IoT can sometimes feel “overwhelmed with data” at first. Yet proof-of-concept projects build confidence in data and an understanding of the potential power of connectivity.

The port is now thinking about introducing a further wave of sensors. The objective is to create a digital twin of the port that means, regardless of weather conditions, people working in the control centre have a clear vision of operations. Mr Castelein says this project will take many years to come to fruition, but the aim is clear: optimised, costeffective performance.

“This is a long-term journey,” he says. “And for each and every application, we will review the merits and the value from a cost as well as from an income perspective. But we are preparing for the fully automated movement of vessels and goods.”