There is a growing need to recognise disaster risk as a core element of both business strategy and economic planning. Scientific evidence validated by the Intergovernmental Panel on Climate Change (IPCC) clearly points to an increase in both the incidence and the severity of extreme weather events—a trend that is expected to worsen due to climate change. At the same time, economic growth means that societies are becoming richer, thereby increasing the value of assets at risk of these extreme weather events. Despite this, regular investment continues in disaster-prone areas (such as river basins and low-lying coastal regions), and disaster risk is often still considered a stand-alone issue—a “tail risk” that is hard to measure and therefore overlooked.

In recent years, these trends have led to an unprecedented loss of life and infrastructural damage caused by disasters in the United States, Japan, the Philippines and Thailand, among others. For instance, the Asian Development Bank estimates that losses from typhoons and earthquakes cost the Philippines—one of the most vulnerable countries in the world—around US$1.6bn each year. According to some estimates, Typhoon Haiyan alone, which struck the country in 2013, caused somewhere between US$12bn and US$15bn worth of damage—up to approximately 5% of the country’s GDP. These events have not only highlighted the importance of effective disaster risk management (DRM) strategies, but also the importance of taking disaster risk into account when making investment decisions.

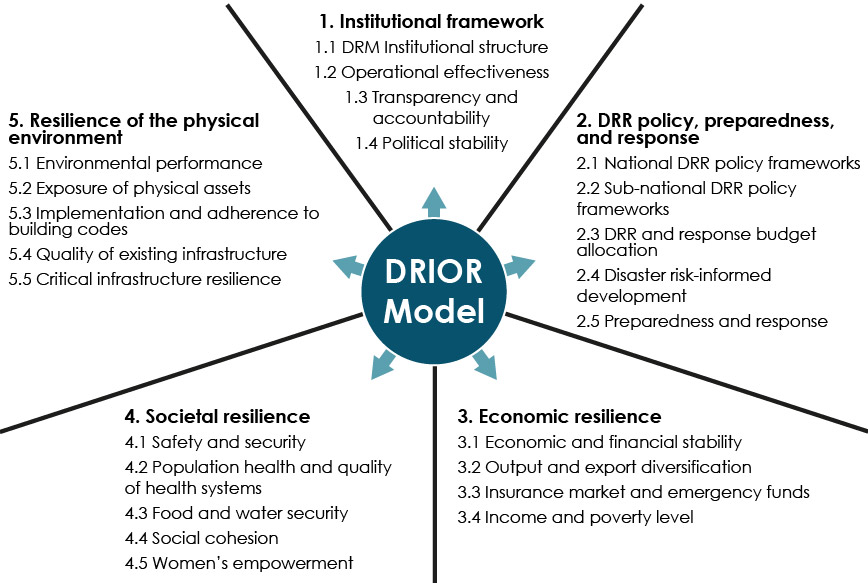

As part of the ARISE initiative, The Economist Intelligence Unit has been commissioned by the United Nations Office for Disaster Risk Reduction (UNISDR) to develop an operational risk model that can factor disaster risk into operational risk, enabling the private sector to make investment decisions that account for disaster risk. The Disaster Risk-Integrated Operational Risk (DRIOR) model provides a holistic assessment of countries’ operational risk levels, with a specific focus on disaster risk, across the following five domains: institutional framework; disaster risk-reduction (DRR) policy, preparedness and response; economic resilience; societal resilience; and resilience of the physical environment.

Three key findings emerged from our analysis.

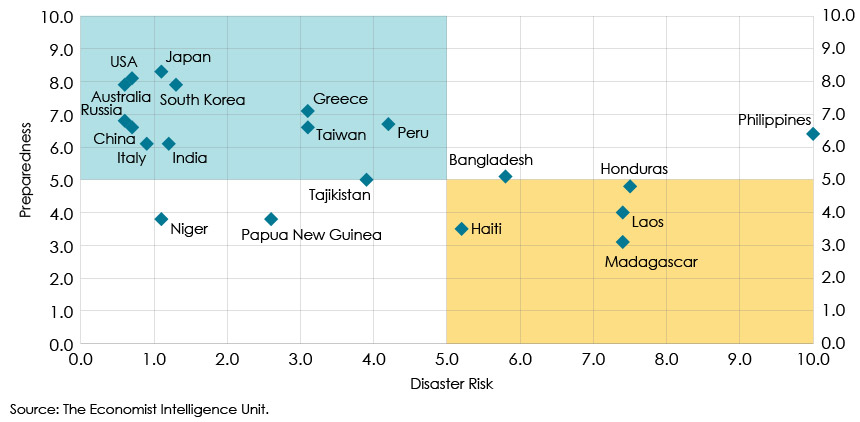

1. Disaster preparedness and disaster risk are negatively correlated.

Our findings clearly demonstrate that countries with better preparedness (i.e., higher quality DRM structures) face lower levels of disaster risk, irrespective of their exposure to extreme weather events. (Disaster risk is measured as the average annual loss as a share of capital stock, or the predicted economic loss due to a disaster, relative to the size of an economy.) This carries an important message for the investment community: a disaster-prone region with appropriate DRM capabilities and measures can be just as attractive an investment destination as a region that is not disaster-prone but has no measures in place. Gaining a clear understanding of countries’ disaster risk management capabilities should therefore be considered as important as understanding other risk factors, such as macroeconomic stability and political risk.

2. Policy emphasis is shifting from disaster response to disaster preparedness.

Governments are increasingly recognising the critical role disaster preparedness plays in protecting countries against the effects of extreme weather events. Although engineering solutions and post-event response mechanisms remain vital, most of the countries in our analysis are also adopting new technologies, education campaigns and other non-structural measures to protect at-risk populations and physical assets. Disaster risk reduction (DRR) measures are often complex, and their benefits are not always obvious until a disaster strikes. However, the majority of countries in our study now have a national agency tasked with monitoring natural hazards, as well as national contingency measures enshrined in their laws or strategic plans—a sign that more and more countries are taking disaster preparedness seriously.

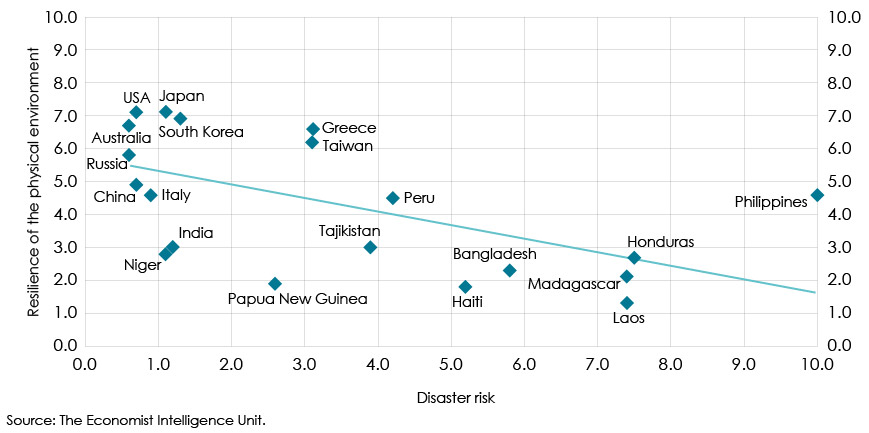

3. The resilience of the physical environment dictates much of a country’s overall disaster risk preparedness.

Of the five domains in our analytical framework, “resilience of the physical environment” is the most strongly correlated with countries’ overall disaster risk preparedness. In particular, the DRIOR model underlines the importance of investment in infrastructure, steps to protect ecosystems and human health, preventive and corrective measures, and contingency planning. However, in more than half of the countries we analysed, infrastructure was found to be inadequate, with a documented lack of measures such as dykes, levees, drainage and snow nets, all of which can protect countries against some of the worst effects of extreme weather events. Land-use allocation emerged as an even more critical issue: over 80% of the countries in our sample have extensive human settlements in areas that are at risk of disaster. For these countries, a critical step towards ensuring a more encompassing DRM framework involves creating policies and regulations that aim to minimise the exposure of physical infrastructure, promote ecosystems vitality, enforce building codes and incentivise building retrofitting, and ensure the resilience of critical infrastructure assets.

What does this mean for governments and the private sector?

Countries will always have varying levels of exposure to extreme weather events. However, for those countries that are more at risk of such events, DRR can go a long way towards ensuring that losses from disasters are minimised. Indeed, with the right DRR measures in place, countries can be attractive investment destinations regardless of their levels of exposure. This highlights the need for greater emphasis on DRM, along with a greater understanding of disaster risk metrics. Business leaders make decisions on investments, risk management and supply chain management on a daily basis, and accounting for disaster risk should be a critical part of the decision-making process. A clear understanding of the interplay between risk and preparedness is also essential for effective planning, and it can unlock new opportunities in markets where perceptions of risk exceed reality.