Report Summary

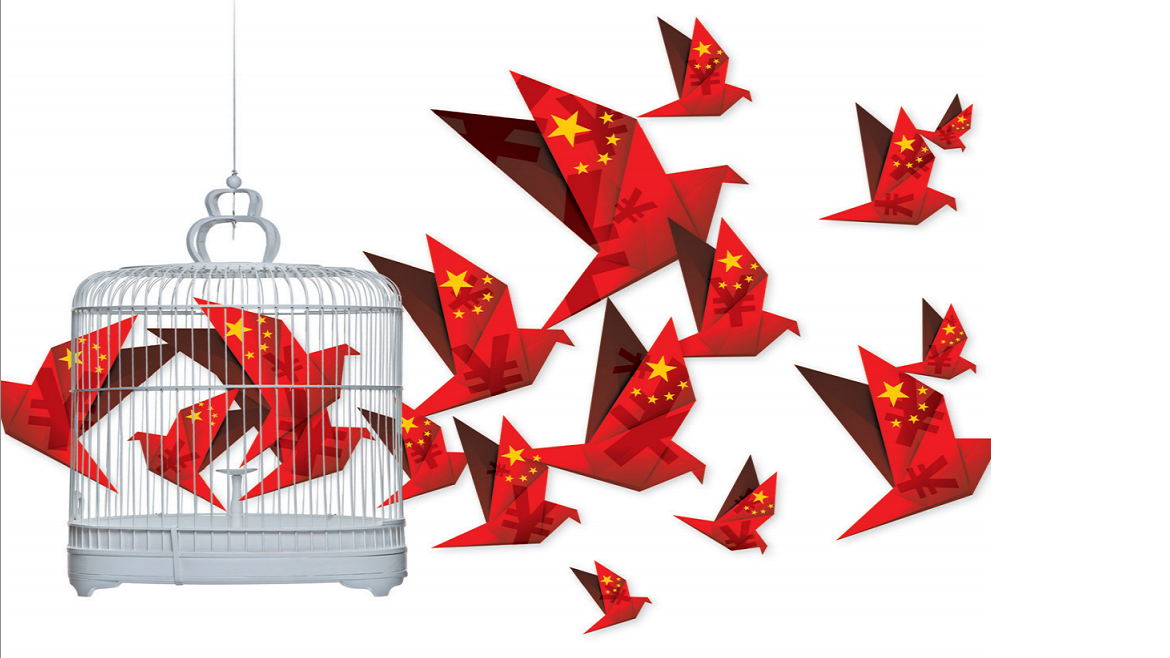

This Economist Intelligence Unit report, commissioned by State Street, examines the future development and internationalisation of China's currency and the pace, process and likelihood of financial reform in the country. It compares the views of institutional investors headquartered in mainland China (excluding Hong Kong and Taiwan) with those based elsewhere. The report is based on a survey of 200 senior executives from institutional investors with knowledge of their exposure to renminbi assets.

"Once you start liberalising [the financial sector] its very difficult to control it and to draw a line anywhere... [China's] markets are in the process of being liberalised and it is not capable of being stopped."

-Mark Boleat, Chairman, Policy and Resources Committee, City of London

Research methodology

The EIU conducted a survey in December 2013 of 200 senior executives at institutional investors with knowledge of their exposure to renminbi assets. Respondents were split equally between firms headquartered in mainland China (excluding Hong Kong and Taiwan) and those based elsewhere, and between asset managers (including institutional, retail and hedge funds) and asset owners (including insurance companies, sovereign wealth funds and pension plan sponsors). Forty-eight per cent of respondents represent firms with global assets under management in excess of US$10bn. In addition, the EIU conducted in-depth interviews with a range of senior executives and analysts.