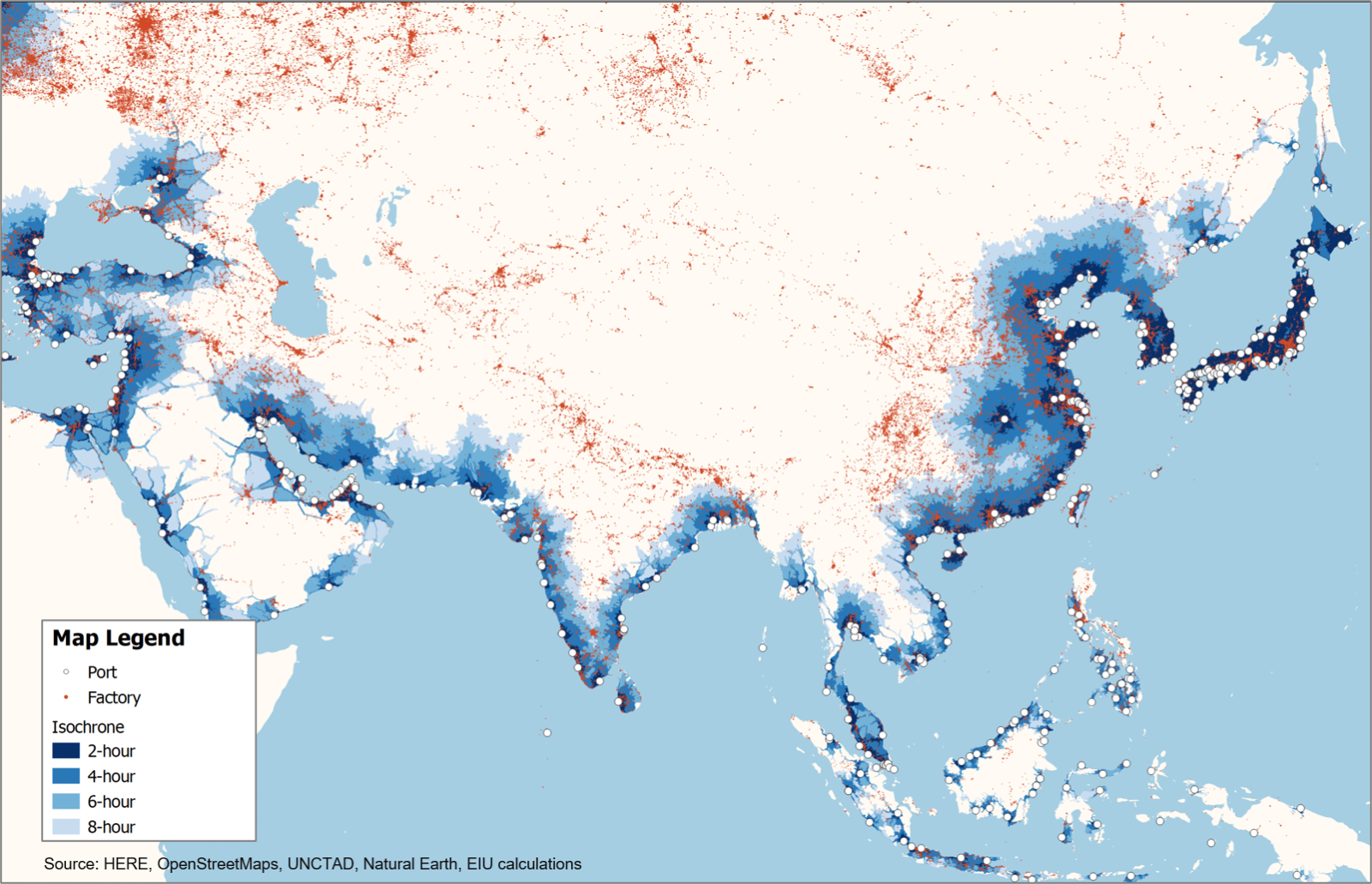

43% of factories in Asia lie beyond a 1-day drive from a seaport

Drive time to major liner seaports in Asia

Asia has made significant strides in building its physical transport network in recent decades. At the same time, businesses in the region have accelerated their integration into global value chains. However, significant infrastructure imbalances remain across the region and present obstacles for international trade to realise its full potential in boosting economic growth.

This report employs novel geospatial techniques to measure transport connectivity in AIIB member countries, focusing on road and seaport connections. These new measures give rise to the following findings:

- Highway networks are the main missing ingredient in Asia’s road networks, with most national and cross-border highways in early stages of construction. Countries with a relatively complete highway network, such as China and the Gulf states, tend to perform well in connectivity scores and on par with the best-connected countries in Europe such as Germany and the Netherlands.

- Countries experiencing lagging domestic road connectivity, such as Kyrgyzstan and Bangladesh, are challenged by either rugged terrain or the presence of large rivers. Well-targeted infrastructure projects, such as Bangladesh’s Padma Bridge, nonetheless carry significant potential to boost connectivity for these countries.

- Cross-border road connectivity between Asian countries is significantly behind that found in more developed regions such as Europe, creating headwinds for trade and economic growth. Only two cross-border highway connections are currently in place (Malaysia-Singapore and China-Vietnam) in Asia.

- Improving road connections between ports and industrial clusters has the potential to boost participation in global value chains. Landlocked countries, or those with significant industrial activity in non-coastal areas, such as Laos, Cambodia, Georgia and Bangladesh, stand to benefit significantly from reduced travel time to ports.