By Tensie Whelan and Dr Elie Chachoua

Investment professionals are gearing up: unlike most baby boomers, millennials and Gen Z want their investments to be aligned with their sustainability preferences and they expect to see the impact. What is more, they expect to make investment decisions conveniently and digitally.

Fintech companies are responding. Companies like Earthfolio, Motif, Ellevest or Betterment are already well-established players in the personal investment space, with each offering their own approach to sustainable investing. Change is also happening at the pension level, with companies such as Matter providing sustainable pension plans to retail investors through a combination of exclusion, thematic and ESG integration strategies. Last but not least are crowdlending platforms such as Trine, which enable retail investors to finance impact investing projects.

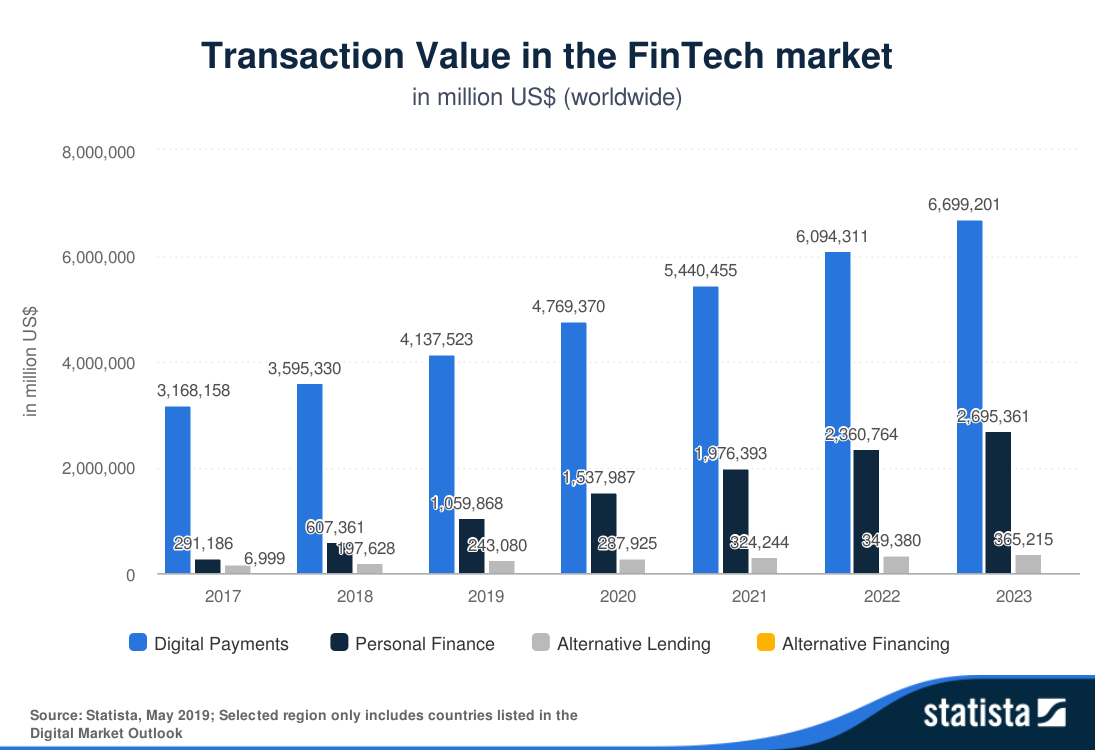

As more offers come to market, it will be important to address three important issues, the first one of which is financial literacy. Research shows that when it comes to payment – the largest segment of fintech so far (see graph below) - next gens are not always properly equipped and some tend to over-spend as a result of the ease with which payments can be made. With personal finance expected to be the fastest-growing sector of fintech in the coming years, it will be critical to ensure that consumers are equipped with the tools they need to make the appropriate investment decisions.

Some start-ups are trying to address this issue head-on. Goalsetter, which is part of the 2019 NYC Fintech innovation lab cohort, uses tech to teach saving habits to children as young as four. The app enables parents and family to deposit money into an account that children can then use to save towards goals they set. The app also uses gamification to help increase children’s financial literacy. According to their website, the quizzes they use are mapped to Jumpstart.org’s national financial literacy standards.

Technology alone will not be sufficient to improve financial literacy, however. In a pilot study performed at the University of California Irvine (UCI), researchers at the School of Social Sciences had 27 participants use one of five fintech applications for five weeks. They found that while fintech helped increase awareness of personal finances, it did not necessarily lead to improvements in investments or saving behaviours. "During the exit interviews, many participants mentioned that the focus group conversations were as valuable to them as using the app itself because, for many, it was the first conversation they've ever had with people about how to manage their personal finances" notes Melissa Wrapp, one of the researchers in the pilot study.

The second challenge with fintech apps is whether their targeting of specific market segments of the population might lead to bias selection and inequities in financial inclusion. “A lot of fintechs use alternative forms of data to push various products to people”, notes Bill Maurer, Dean of the School of Social Sciences at UCI. “This is not an area that the regulators are paying much attention to at the moment. If they are, it may might be lumped into the general category of targeted marketing, so not specifically in relation to fintech but more generally on digital products”, he adds.

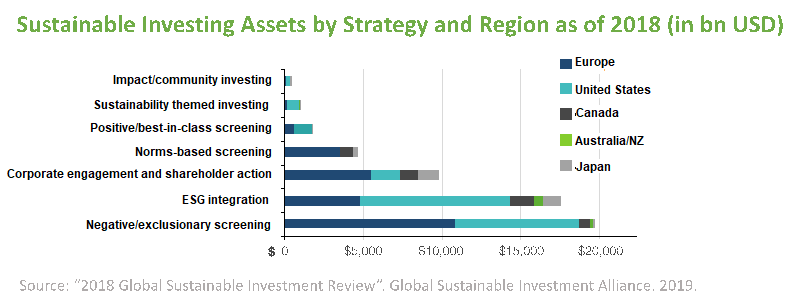

The third issue to be addressed is that even when they have a positive impact on their users (e.g. helping them save or learn), fintech solutions do not always mobilize that money for impact investment purposes. To be fair, some personal finance fintech solutions provide financial exposure to Environmental, Social and Governance issues (ESG) by integrating them into investment decisions, engaging in thematic investing (e.g. providing exposure to companies or sectors advancing specific sustainability issues) or via exclusion strategies (e.g. no coal or guns).

This, however, is not the same as an impact investing approach, which requires intentionality of achieving a measurable, positive and additional contribution on the social, economic or environmental issue through the investment. And as the figure below shows, there is plenty of opportunities to mobilize investment towards the latter.

One reason for the lack of options might be scale. “Early-stage start-ups and robo-advisors tend to focus on listed equities or bonds as opposed to direct investments. This makes it easy to provide ESG exposure but harder to qualify impact per se” notes Niels Fibaek, co-founder of Matter. Christoffer Falsen, co-founder of TRINE, agrees. “You need to put a lot of effort into sourcing the necessary volume of impact investment opportunities, and that’s extremely hard for early-stage fintech companies. It’s much easier to go to your backyard and that’s not where you usually find triple-bottom-line impact business models” he notes.

While retail investors are demanding more, they are also willing to pay for it. Work by both Morgan Stanley and 2° Investing Initiative suggest that retail investors interested in sustainability have a higher willingness to accept a trade-off on returns. To be clear, this does not mean that impact investing automatically results in lower returns. It means that there is a margin to be captured if the product can clearly demonstrate the impact that its underlying investments are having.

Faced with new interest from the next generation, even governments are starting to innovate. Last summer, Indonesia used celebrities and Instagram to promote a sovereign bond issuance. Half of the investors were millennials. While this issuance was focused on creating more domestic economic stability, not ESG issues, it demonstrates appetite. The Central Bank of Kenya (CBK) and the Monetary Authority of Singapore also held a Fintech Festival focused on sustainable digital finance in Nairobi.

All of this is pointing to increased interest by major key stakeholders, as reflected by the United Nations Secretary General’s TaskForce on Digital Financing of the Sustainable Development Goals. In its interim report, the TaskForce points to three waves of disruptions at the retail level: greater citizen engagement in their financial decision through easier and cheaper access to data; disintermediation of the supply chain of capital through the arrival of new digital service providers; and the opportunity for citizens to act collectively by aggregating their investments via digital finance solutions.

The results of these transformations could be a dramatic “shift the centre of gravity of the financial system towards the citizen”, according to the report. Delivering that promise will require innovations in governance, something that the TaskForce is currently exploring through its work. The final report and recommendations will be delivered early next year. Expect more entries in the digital impact investing space soon!

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the views of The Economist Intelligence Unit Limited (EIU) or any other member of The Economist Group. The Economist Group (including the EIU) cannot accept any responsibility or liability for reliance by any person on this article or any of the information, opinions or conclusions set out in the article.