When Russia invaded Ukraine in early 2022, the global economy had barely recovered from the covid-19 pandemic. With global supply chains already vulnerable, the latest shock to hit the economy sent inflation soaring. Global inflation reached almost 10%, its highest rate in 26 years, and a cost-of-living-crisis had set in. As these economic shocks subside, many companies hope for a return to pre-pandemic normalcy. That is wishful thinking. The relationship between supply chains and inflation is far from over, and its ripple effects are set to define globalisation.

Globalisation now hinges on three fundamental drivers: shifting geopolitics, climate change and an AI-driven industrial revolution. This convergence will result in more shocks, greater uncertainty and an increasingly complex business environment. Companies face a new reality with costly supply-chain strategies that will keep inflation and interest rates elevated. Here are three reasons why price pressures will remain high, further challenging the business environment.

Supply chain strategies are costly

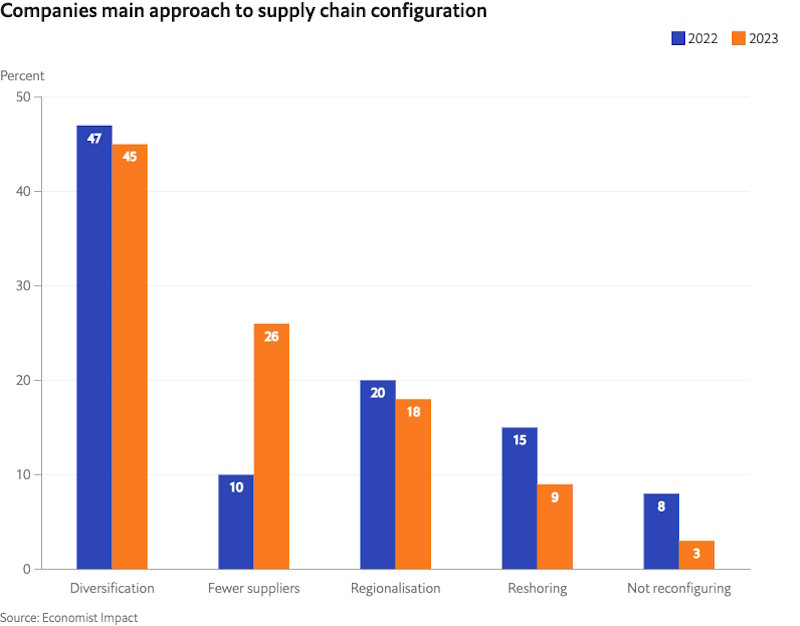

“Minimise costs and maximise efficiency”— this just-in-time approach used to drive supply chains, where parts of the production process would arrive only when required. That was true of globalisation’s previous chapter. Companies now use diversification, regionalisation and reshoring to cope with shocks, alongside building inventories for resilience. Our survey of 3,500 supply chain executives shows that companies, on average, maintain nine weeks of inventories—"just in case" has replaced "just in time". Higher stocks and ongoing reconfigurations mean businesses face increased supply-chain management costs.

The trend towards self-sufficiency is inefficient

Many countries want to be self-sufficient, which sounds reasonable in an uncertain economy. However, it’s impractical and costly. The global pandemic highlighted vulnerabilities that can arise in extreme circumstances. Policymakers have lost trust in the global system, despite global trade’s role in meeting the pandemic’s challenges. Russia’s invasion of Ukraine and the ongoing US-China trade war have emphasised these concerns. Many countries are reducing their trade exposure to markets of concern and are trying to increase self-sufficiency in areas of strategic importance.

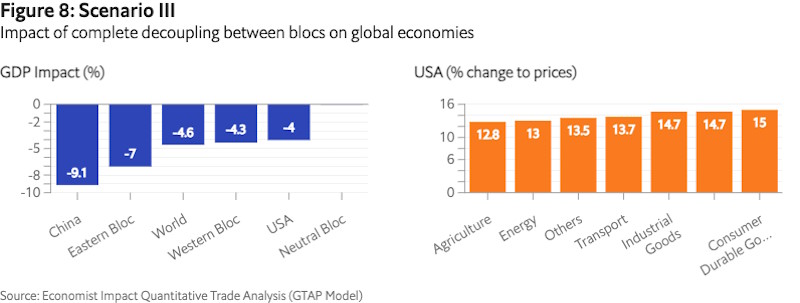

The global economy is fragmenting along geopolitical lines, and the effects are alarming. Economist Impact has modelled a worst-case scenario that sees the complete decoupling of the world into three blocks—western, eastern and neutral. The global economy would be almost 5% smaller in this scenario, with the western and eastern blocks 4.6% and 7% smaller, respectively. With decoupling comes inflation. For example, the US economy would see price increases of 12-15%, which would be crippling for businesses and consumers.

Geopolitical tensions are unlikely to ease soon. However, political leaders need to be careful as they pursue growth and resilience. Policymakers must design trade-friendly growth policies that treat domestic and foreign firms equally, avoiding the desire for self-sufficiency. Until then, business costs will keep rising.

Climate disasters are more common, highly disruptive and expensive

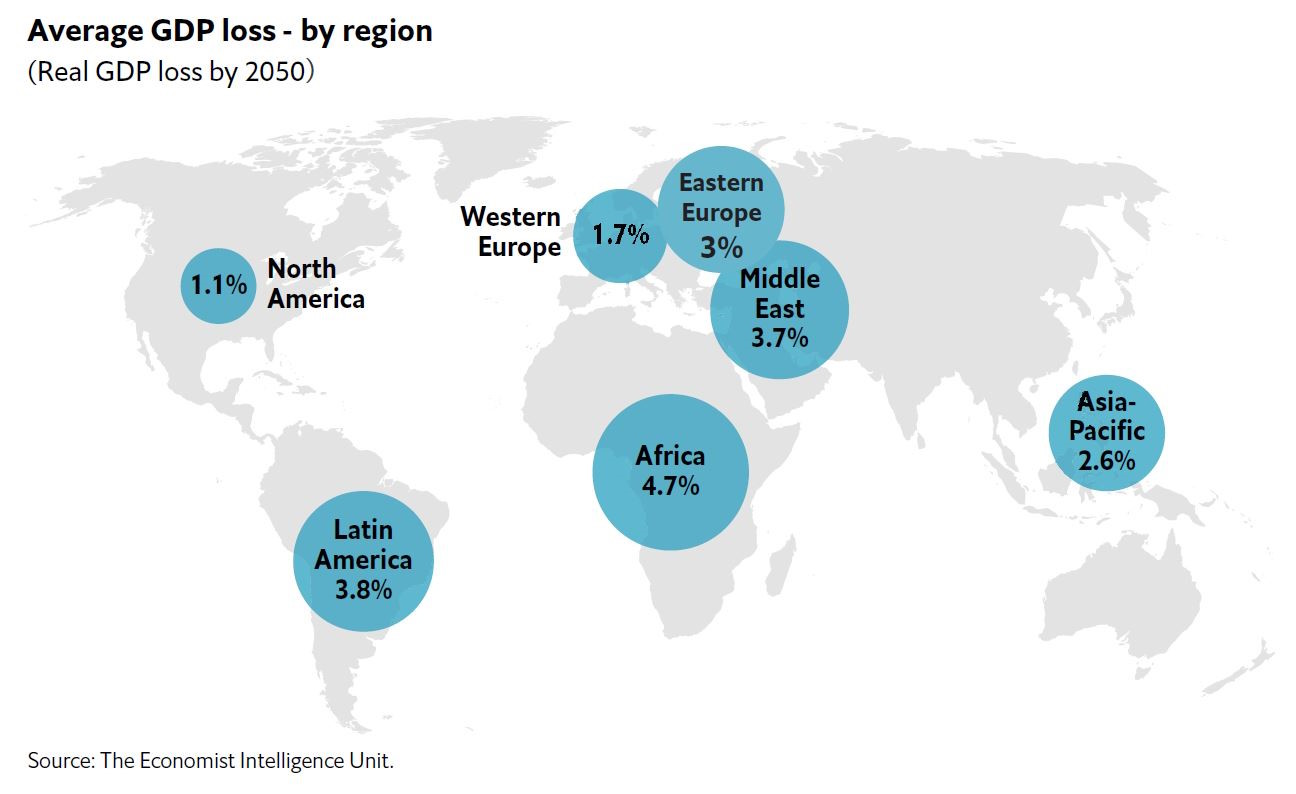

A 2019 Economist Intelligence Unit study estimated that climate change will shrink the global economy by at least 3% by 2050—equivalent to removing Britain or France from the global economy. This estimate is likely conservative, as the cumulative negative impacts and climate trigger points are hard to quantify. Companies are realising that more severe and frequent climate disasters will define this new chapter for the global economy.

Companies cannot predict the timing or location of these disasters. Supply chains are disrupted when they strike, making parts hard to replace. Resilience strategies developed since the pandemic will help companies source new parts and fulfil orders, regardless of whether shocks are geopolitical or climate-related. However, the unpredictability of these events means some disruption, costs and shortages are unavoidable.

AI will ease price pressures—but not offset them

In our survey, 93% of supply chain executives are using or planning to use AI. AI-powered supply-chain management will offer real-time insights and better disruption forecasts. Company experimentation with AI, especially generative AI, shows promise for innovation and productivity. However, it will take time to offset global economic challenges, meaning inflation and interest rates will remain elevated. Higher rates will make loans harder to get—especially for small companies—reducing investment and hiring.

With geopolitical tensions remaining high and climate disasters increasing, innovation is crucial. Under new globalisation’s third driver, productivity growth from AI offers the best hope to curb inflation. Companies must get it right.