- Executives show high confidence in their abilities to meet future challenges, although expert testimony suggests they are more vulnerable than they admit

- Seven in ten executives admit that their companies will need to change in order to successfully overcome the challenges of the next three years

- Nearly 100% of executives say their organisations have a clear plan for succession, though experts suggest succession planning may be little more than a notional exercise that will be trumped by tradition and culture

Family-owned companies in Asia have new hurdles to overcome given the rapid pace of change in technology and markets. With the significance of family connections and customer loyalty diminishing, executives must acknowledge the pressing need to change their ways of doing business.

A new study, released today by The Economist Intelligence Unit (EIU), assesses the readiness of family businesses across Asia-Pacific to address future challenges to their operations.

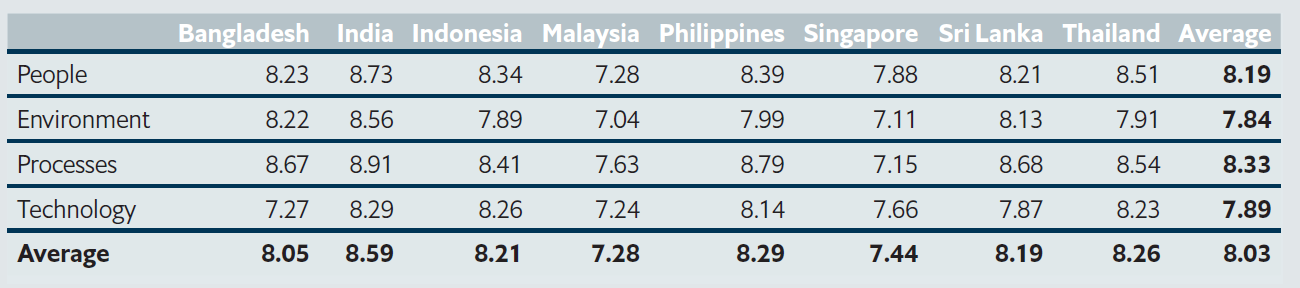

“Planning for prosperity: assessing family business future-readiness in South and South-east Asia”, sponsored by SAP, is based on the findings of a survey of 300 family business executives across eight countries in the Asia-Pacific region: Bangladesh, India, Indonesia, Malaysia, the Philippines, Singapore, Sri Lanka and Thailand. The barometer rates business confidence across four categories: people, technology, processes and environment.

Executives in the region appear highly positive in their abilities to adapt, with an average score of 8.03 on a ten-point scale across all geographies and categories. Confidence is highest in the processes category (8.33 out of ten), which looks at factors such as the likelihood of adopting a new business model. It is lowest in external environment (7.89 out of ten), which gauges aspects like national ICT infrastructure.

South Asia displays a more positive attitude compared to South-east Asia (8.31 compared with 7.90, respectively), which could be attributed to family businesses’ longer history in the former, making them more likely to have a structured system in place for both corporate governance and family succession. India’s top showing appears related to its recent fast economic progress from a relatively low base—a finding corroborated by a wide body of research.

EIU family business confidence barometer scores (out of ten)

Despite high levels of confidence, experts interviewed for our study reveal that actual preparedness to meet future challenges is not as robust as it should be. “Family businesses cannot last beyond this generation if they do not innovate,” according to Annie Koh, academic director of the Business Families Institute at Singapore Management University, as quoted in the report. This encompasses both increasing professionalism and proper management structures to encourage the younger generation to inherit their parents’ firms. The rapid pace of technological change is another key issue; 39% of respondents cite it as their top challenge, trumping all others.

Family businesses are seeking external solutions to catalyse new opportunities, such as partnerships with other companies. Foreign small and medium-sized enterprises (SMEs) are the preferred option (37%), likely due to similar long-term goals and mindset. Large domestic companies and large foreign companies follow closely behind (35% and 34%, respectively), presumably because they enable access to the latest know-how and can help expansion into new markets.

According to Michael Gold, EIU editor of the report, “Family businesses in South and South-east Asia recognise change is coming but feel they have what it takes to navigate an uncertain future. However, experts caution that the next generation may not throw in their chips with their parents’ companies, suggesting uncertainty might be greater than our executives acknowledge.”

The full report is available for download here. We have also created an online benchmarking tool where users can assess their own future-readiness against the executive panel, available here.

Press enquiries:

Jusnita Chang, senior marketing manager, content solutions, Asia-Pacific

+65 6428 2659

Michael Gold, editor, thought leadership, Asia-Pacific

+852 2585 3886

About the Economist Intelligence Unit:

The Economist Intelligence Unit is the world leader in global business intelligence. It is the business-to-business arm of The Economist Group, which publishes The Economist newspaper. The Economist Intelligence Unit helps executives make better decisions by providing timely, reliable and impartial analysis on worldwide market trends and business strategies. More information can be found at www.eiu.com or www.twitter.com/theeiu.

About SAP:

As market leader in enterprise application software, SAP helps companies of all sizes and industries run better. From back office to boardroom, warehouse to storefront, desktop to mobile device, SAP empowers people and organizations to work together more efficiently and use business insight more effectively to stay ahead of the competition. SAP applications and services enable more than 378,000 business and public-sector customers to operate profitably, adapt continuously and grow sustainably. For more information, visit www.sap.com.