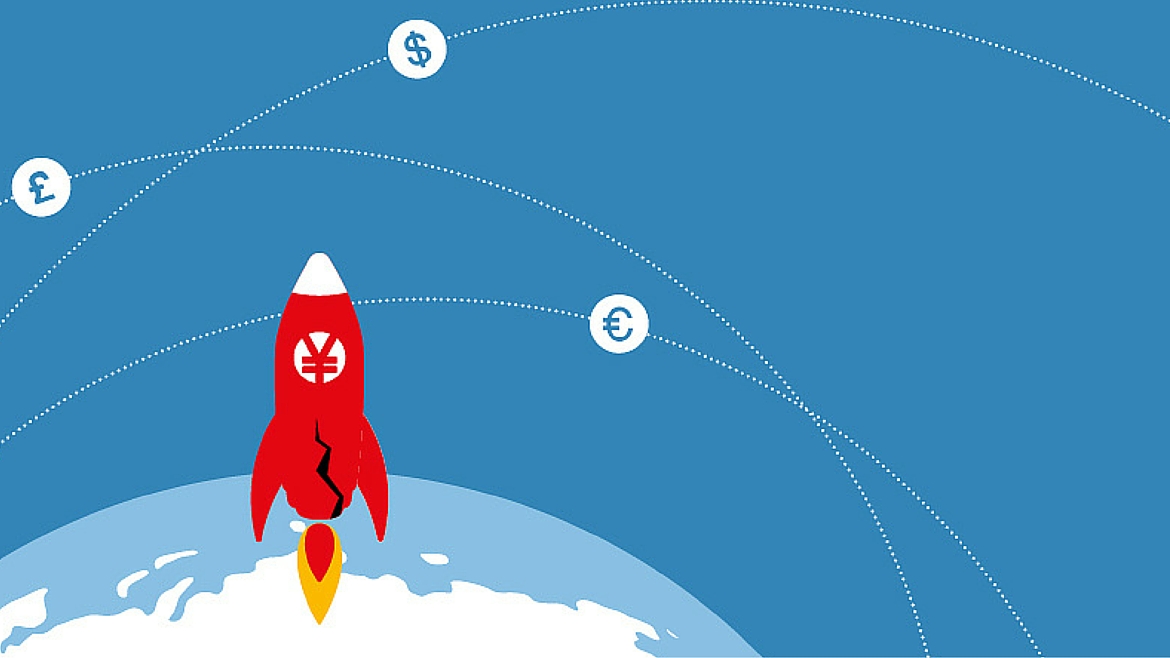

China’s currency, the renminbi (RMB), is already internationalised: it ranks fourth globally by value of payments, behind only the US dollar, the euro and the British pound. The size of China’s economy and its dominant position in international trade mean that its use in transactions is already commonplace. Yet it is still not comparable to the four major denominations (including the Japanese yen) as an investment currency—i.e. one that is freely usable and enjoys the full confidence of international investors and the companies that service them. Without their support, the RMB cannot reach full maturity.

Until recently it seemed inevitable that China would take the steps necessary to win their confidence and that the RMB would soon join this elite band of global investment currencies. Yet the events of the summer of 2015, during which China’s authorities sought unsuccessfully to prop up a collapsing stock market and also suddenly devalued the RMB’s exchange rate anchor (ostensibly to take market forces more into account), raised questions about the country’s commitment to liberalising its capital markets. Doubts were reinforced by successive data points that suggested its economy was slowing far more rapidly than expected.

Looking beyond recent short-term volatility, the research asks about perceived demand for international usage of the RMB, what reforms are most urgently required, and what steps global financial services companies must take to prepare for a world in which the RMB vies with the US dollar.

The EIU also conducted in-depth interviews with a range of market participants and experts for this report, globally and in China, including with senior officials from the People’s Bank of China (PBOC), China’s central bank.

Key Findings

- A market driven process with Chinese characteristics

- Despite recent events, the RMB's global status looks assured

- Regulatory and legal reform will be needed for full RMB maturity

- To succeed, financial services companies need to drive the process