China’s healthcare sector began privatising in the 1990s, along with the founding of special economic zones based on a famously repeated pledge not to worry about if a cat was white or black so long as it caught mice. Since then, a mostly healthy path of economic growth has played out in China, attracting international capital. In an Economist Intelligence Unit survey from November 2019, institutional investors and asset owners showed a bullish stance on the country, with 84% saying they had increased

exposure in the past 12 months, while 81% expected they would in the next 12 months—a period now ending.1 About 41% of respondents in the same survey highlighted services such as healthcare as a likely sector for investment.

With China’s National Health and Family Planning Commission (NHFPC) aiming to expand the size of the nation’s health service industry to about US$2.4trn by 2030,2 essentially doubling from today, it’s no wonder investors have taken notice.

China’s burgeoning incomes and an ageing population have driven the fastest growing major healthcare market in the world. According to 2018 data from the WHO, its five-year compound annual growth rate was 17%, compared to just 4% in the United States, and -2% in Japan.3 Chinese per-capita health spending rose from just US$42 in 2000 to US$441 in 2017, which lingers far below the US$6,500 average in the world’s top eight healthcare markets4 and indicates room for signifi cant growth ahead.

One of the major drivers is life expectancy. In China it has been steadily rising—from 69 years in 1990 to 77 today (projected to reach 79 in 2030).5 That sets up several trends, as longer life expectancy goes hand-in-hand with healthcare spending.

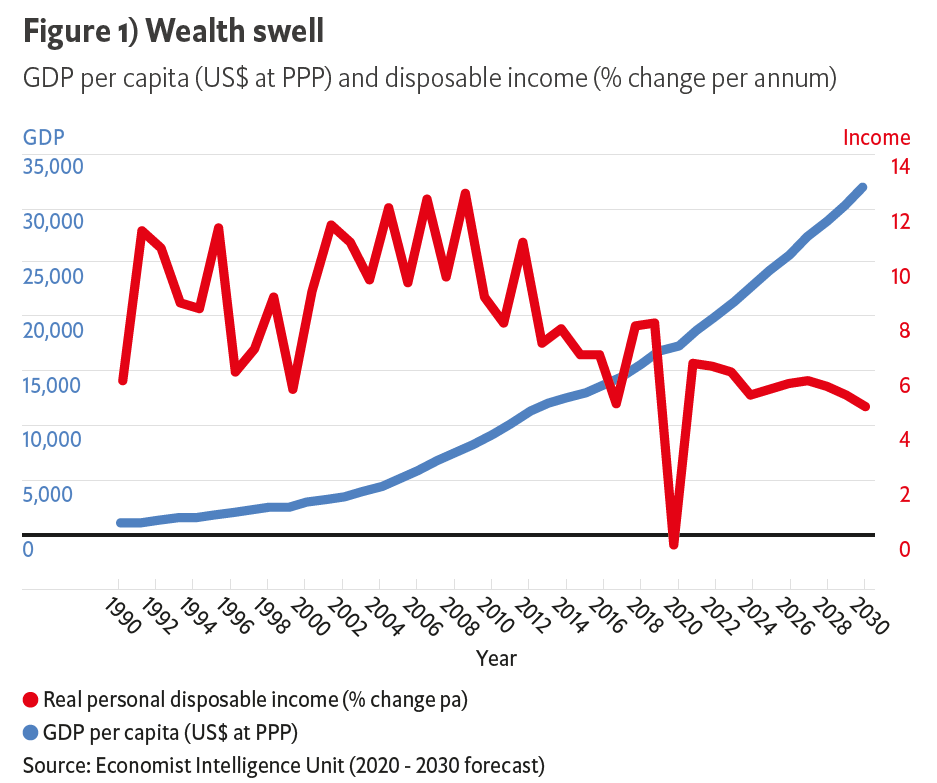

Consider the scale. By 2027, the number of people aged 60+ in China is on track to double to 324 million—nearly the size of the US population. At the same time, China’s non-retired citizens have growing wages. GDP per capita on a PPP basis was US$9,190 in 2010; and it is forecasted to reach US$17,220 in 2020 and more than US$30,000 in 2030.6 Excluding 2020, disposable income in China has grown at a consistent rate above 5% since 1990, which burgeons family reserves for luxuries or specialised pharmaceuticals and biomedical devices.

Covid-19 has likely served to accelerate industry growth, particularly in sub-sectors like telemedicine or biotech.

An outbreak break out

“Covid’s impact has made telemedicine more viable and pushed it to grow from maybe 3% of the market to as much as 10% at its height,” says Jessica Tan, group co-CEO of Ping An, a Chinese holding conglomerate in the insurance industry. Before the pandemic, China’s online medical services market was predicted to reach over 59 million users by the end of 2020 and, by 2026, is expected to be worth US$28bn.7 However, January 2020 saw new user registrations on Ping An’s Good Doctor service surge by 900% from the previous month. And more than a billion users visited the platform between January 20 and February 10.8

Biotech is another growing subsector that has adjusted to the new demands created by the pandemic. For example, applications have been developed to help patients access medication through alternative channels such as infusion centres for cancer patients. The shift to digital engagement with healthcare professionals and patients was already under way but ramped up significantly when covid-19 hit.9 Biotech companies, research institutes and healthcare media in China have used WeChat, a “super” app, to organise webinars on topics such as different R&D approaches to developing a treatment or support ongoing clinical trials.10

Opportunities have arisen from the crisis for businesses to provide innovative healthcare services. For instance, JD.com, an online retailer, ramped up its telemedicine offerings, adding more doctors to its network and becoming a frontline covid-19 triage service, as well as launching a smart epidemic assistant to share official information.11 Others quickly upped their game and expanded as demand shot up; large names like Ping An’s Good Doctor, Tencent’s WeDoctor, AliHealth and Baidu rapidly improved their services. Telehealth had already been on an upward trajectory in China prior to the pandemic; in November 2019 JD.com spun out its healthcare unit into a subsidiary, JD Health, raising US$1bn and valuing the company at US$7bn,12 and possibly offering a sign of things to come.

Moving up the value chain

In 2018, China was already the world’s second largest pharmaceutical market, with US$137bn in sales,13 but generics manufacturers and suppliers of active pharmaceutical ingredients accounted for most of that. Instead, the country is aiming to develop an innovative biotech sector, which is among the goals of the Made in China 2025 initiative and falls under the Healthy China 2030 blueprint from the NHFPC. This also aims to make artificial intelligence (AI) a cornerstone in a “smart health” industry.

China’s latest economic plan touts building 10-20 life-science parks dedicated to biomedicine by the end of 2020.14 Government R&D spending on biotech topped US$291bn in 2019, while companies raised US$16.5bn across 90 equity and debt offerings (a 17% increase in volume and 13% increase in value from 2018).15 The ability to fundraise is clear and the fundamental drivers—consumer wealth and longevity—show no sign of slowing. Areas with priority for funding include treatments for diseases that are becoming more prevalent as the Chinese population becomes older and richer, such as diabetes.

As a strategic development area, internet-based healthcare featured heavily in the 13th Five-Year Plan and the Healthy China 2030 strategy. Internet hospitals, such as Ping An’s Good Doctor, can operate as standalone entities providing online consultations with doctors—reimbursed by social health insurance—or back-ups for overwhelmed physical hospitals.

Ms Tan explains how AI can extend doctors’ reach and the volume of patients they can treat—a necessity in a country of 1.4 billion people, which she says has only about 3.8 million doctors. “Remote diagnostics, AI-enhanced reading of scans and things of this nature are where the industry will grow,” she explains. “It is a good way to treat chronic conditions like hypertension and diabetes, which require a lot of monitoring that can be done virtually. And that ease of seeing the doctor might increase patient willingness to stick to their treatment, thus growing the market.”

Growth in private healthcare

Healthcare costs are rising faster than GDP and outpacing what public services can support. So the government is looking for ways to stimulate other means of payment, according to Ms Tan, which could drive growth in private health insurance and therefore private health provision.

“Social health insurance covers about half of healthcare costs, and right now private insurance is still a very small percentage [of the market], around 6%,” she says. “So the government is encouraging pilot schemes to figure out how to bundle social health insurance to provide more basic affordable coverage across all, but then on certain segments, let’s top-up coverage with private insurance.”

Considering that most of China’s growth, in healthcare and otherwise, has so far been in tier-one cities (T1, home to about 100m people by official counts), the lower-tier cities contain huge potential as latent markets.

Yuwan Hu, research director at Daxue Consulting, a market research firm, expects insurance, as well as preventative health products like supplements, to become more prevalent as incomes continue rising and lower-tier cities develop.

“In T1 cities we have seen a growing awareness of healthcare, both physical and mental health, and increasing purchasing power,” she says. “Particularly the younger generations want a healthier lifestyle; they see the growth in diseases like diabetes linked to obesity and want to take preventive measures. This is now moving from T1 to lower-tier cities.”

“Using technology to support the government and the whole market structure is something we have identified as a significant opportunity, especially because of covid,” says Ms Tan. “For example, we are helping the government to upgrade public health infrastructure so it is able to detect problems much faster and handle them with a better level of coverage.”

“About two-thirds of hospitals and clinics in China are private businesses, but these only service about 15% of patients,” she says, which again suggests growth potential

The road ahead

“I think in the healthcare industry there is so much more that we can do,” says Ms Tan. “It would be really a shame if political tensions impede the use of technology.”

While medical technology (medtech) hasn’t grabbed as many headlines as 5G, it’s not immune to trade tensions. US tariffs that went into effect in 2018 impacted about US$1bn16 of Chinese medtech products, giving the country more reason to look inward. Covid-19 may have strengthened the move towards self-sufficiency.

Still, collaboration with foreign pharmaceutical companies continues. Many are choosing to outsource development and production to Chinese clinical research organisations and contract manufacturing organisations owing to the increased demand from the Chinese market for biologic drugs and therapies, as well as the expansion of genetic engineering, specialised medicine and clinical trials. Other multinational firms like Charles River Laboratories have invested heavily in Chinese biotech firms and localised production models.17

Ms Hu says that although local Chinese governments will support local companies, they still welcome foreign firms with more advanced technology that can improve treatments. “While most foreign medical groups already in the Chinese market are in the B2B market, such as medical equipment, some are now looking to break into the B2C market,” she says. “With Covid they have moved into products they can direct at B2C like PPE. They are now looking at their branding, at consumer insights, to break into that market.”

Chinese companies have their own global ambitions but are looking less to the West than to their own backdoor. Ping An’s Good Doctor, according to Ms Tan, has growing numbers of subscribers in Indonesia, the Philippines and Singapore. She sees a real market for it in Asia’s emerging markets. “There is a shortage of 5 million doctors and nurses in Asia’s emerging markets, so we are looking at how to manage that with technology,” she says. “Using AI to complement human healthcare professionals benefits everyone with reduced costs and better outcomes.”

China’s healthcare sector is growing and has protection from decoupling pressures. With its advances in telemedicine, AI and biotech, the industry has come a long way since the 1990s, catching all kinds of mice with all kinds of cats. And that likely offers opportunities to all kinds of investors.

The report was written by Monica Woodley and edited by Jason Wincuinas.