- Just under three-quarters (72%) of IT executives at banks surveyed by The Economist Intelligence Unit report that incorporating the cloud into their organisation’s products and services will help them to achieve their business priorities.

- Business agility, elasticity and scalability are together cited by 40% of respondents as top drivers of cloud adoption.

- Yet barriers stand in the way of a wholehearted embrace of the cloud— including security, privacy, compliance and governance concerns. These challenges are leading firms to invest in both technology and talent.

In his latest letter to shareholders, JPMorgan Chase chief executive Jamie Dimon does not hold back in his embrace of cloud technology. “We cannot overemphasise the extraordinary importance of new technology in the new world,” he writes, referring to the turbocharging effect that covid-19 has had on the adoption of the cloud and artificial intelligence (AI) in financial services.

Before the pandemic, not all banks were quick to spot the advantages in offloading applications to the cloud, where virtually unlimited computing power allows enormous efficiencies. Banks have generally been slower to take to cloud computing than other sectors. But the adoption of software as a service (SaaS) and cloud infrastructure—for additional processing capacity, improved service capabilities and to outsource data storage—has accelerated since the start of the pandemic, as banks seize an opportunity to cut costs and ramp up their digital transformation projects.

Last year saw a flurry of deals. HSBC committed to using Amazon Web Services to develop new digital products and support security and compliance standards, while Wells Fargo has signed on Microsoft and Google as public cloud providers. Google has agreed similar partnerships with Goldman Sachs and Deutsche Bank.

This comes as established banks figure out how to use incumbency to fend off fintechs and “challenger” banks, while the newer entrants use the cloud to advance quickly into new market opportunities.

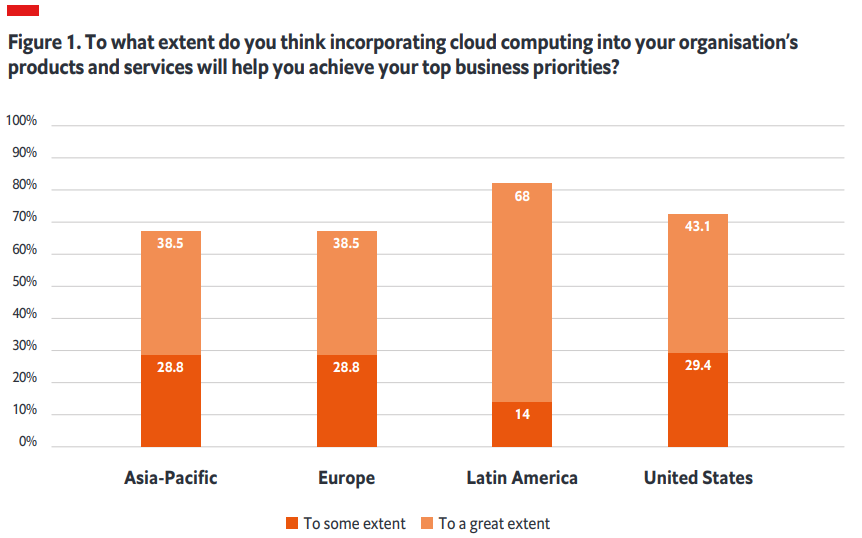

In a new survey of IT executives in the banking sector, conducted by The Economist Intelligence Unit and supported by Temenos, more than seven in ten (72%) report that incorporating the cloud into their organisation’s products and services will help them to achieve their business priorities. Just under half (47%) say that it will do so “to a great extent”, with Latin American respondents the most bullish (see Figure 1).

Microsoft, a large player in cloud services, believes that the pandemic has accelerated cloud adoption in four ways that go beyond cost considerations. The first is creation of economic efficiency, by moving away from reliance on a clunky computer mainframe environment. Second is enabling agility and speed to market by, for example, improving the customer onboarding experience in retail banking. Third is reimagining the modern workplace and process modernisation to increase productivity, while fourth is digital innovation through, for instance, the adoption of AI.