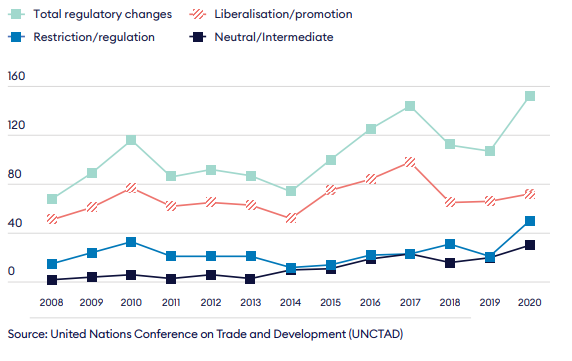

Trade restrictions, such as temporary export bans and other non-tariff barriers, have mushroomed while many multinational negotiations on trade are at an impasse.1 The pandemic imposed an unprecedented shock on global trade and investment as lockdowns and border closures fettered the free movement of people and goods. Capital flows plunged by 35% to US$1trn in 2020, while trade in services declined by 20%.2,3 On the other hand, global trade in goods proved remarkably resilient. Goods trade fell by more than 5% in 2020, bouncing back after a bottom-out in the second quarter, and rebounding by more than 10% in 2021.4,5 Some industries are emerging from the pandemic stronger than others. Digital technology and low-carbon goods and services are among the industries set to benefit the most as businesses and investors increasingly target long-term resilience.

Global trade: Back in black: World Merchandise Export Volume, Index (2015=100)

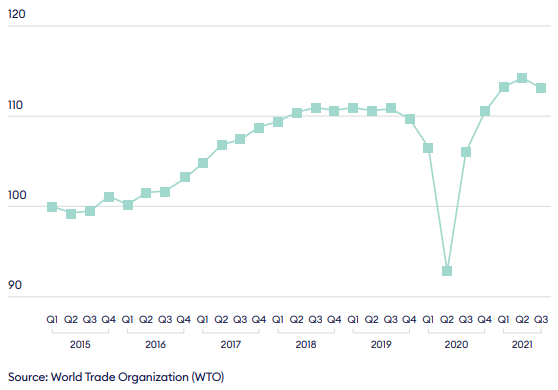

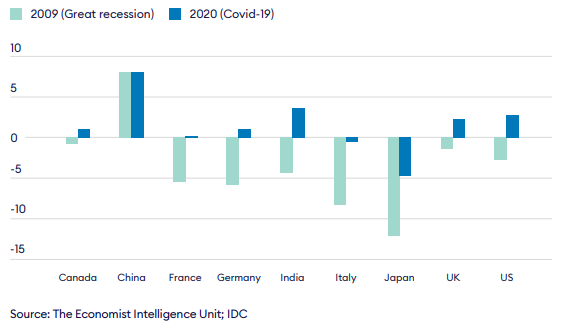

Covid-19 accelerated the uptake of technology in business and society by many years, as digitalisation became a necessity rather than a choice. Notably, the digitalisation of global value chains (GVCs) for goods and services is one of the most visible trends. Supporting infrastructure and services for digital GVCs will see rapid expansion in the years to come. Unlike in the Great Recession (2007–09), ICT spending remained strong during the pandemic, and is set to increase further to reach US$5.8trn in 2023, while AI-based software and services will grow from US$62bn in 2020 to US$998bn in 2028.6,7 Global revenue for cyber-security services are projected to rise from US$67bn in 2019 to US$111bn in 2025.8 Mass digitalisation is, in turn, supporting vibrant disruptor industries such as fintech (financial services), healthtech (health and medical goods and services) and edtech (education services) among others. Countries around the world urgently aim to develop their digital sectors, and beyond the largest economies (China and the US), countries such as the UK, India and Canada are now home to a growing base of start-ups operating in these high-growth sectors.

Resilient IT: Total IT spending on packaged software, hardware and IT services (% change year-on-year).

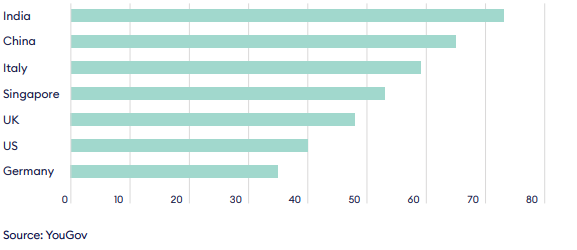

The pandemic has also put the sustainability imperative at the centre of investment and policy strategies. “Clean growth” and a drive for sustainable and resilient sourcing have become the new stated economic paradigm, impacting all sectors of the economy.9 In part this has been driven by supply-side shocks, as shortages across certain product ranges have reinforced the need for companies and governments to build greater resilience against unpredicted external events.10 On the other hand, consumers have driven demand-side shifts, as environmental and social consequences of specific patterns of consumption are increasingly factored in. This is causing companies to find new ways of bolstering resilience in their supply chains without compromising competitiveness.11 Concurrently, the pandemic is also shifting the global investment landscape towards green finance. Estimates for green investment products reached US$3.2trn in 2020, an 80% increase year on year.12 However, many more resources still need to be mobilised to finance the transition towards a climate-resilient economy. Some estimates suggest that US$100-150trn will be needed to keep the world within the Paris Climate Agreement targets.13

Sustainability matters: % who agree with the statement “I will buy more sustainable products” after the pandemic has ended

The pandemic also accelerated the return of big and national industrial policies. Governments spent billions to support business and workers.14 These measures have to a large extent staved off the expected economic damage. Some governments are also intervening in their economies through proactive industrial policy, particularly in priority industries such as digital technology, energy and health care. According to UNCTAD, 101 countries, representing 90% of global GDP, have adopted formal industrial development strategies in the past decade, mainly focused on technological innovation.15 Some governments have also become more protectionist. In light of the supply chain vulnerability and the risk of predatory takeovers of strategic industries during the pandemic, the share of restrictive or regulatory measures over measures aimed at liberalising investment increased by 41% in 2020, the highest on record.16

Policies matter: Number of investment policy measures adopted globally between 2008-2020