It will be another challenging year for the global economy in 2023. The long-lasting effects of covid, macroeconomic shocks and geopolitical risks will likely lead to a global recession. Like most crises, the poor will be disproportionately affected. The World Bank estimates that by the end of 2022, as many as 685 million people will be living in extreme poverty [1].

The pandemic taught us that equity cannot be an afterthought of the economic response to these challenges: it must be a vital lever of economic development. In fact, crises can create opportunities to tackle inequalities that are holding back growth. The progress that we’ve seen in achieving financial inclusion shows that countries and businesses can accomplish more equitable growth while they face a crisis.

In 2022, the World Bank released its highly anticipated Findex report, which confirms that the world is going through an unprecedented wave of adoption of financial services. According to Findex, over 76% of the world has access to at least one account, compared to 51% in 2011. Covid-19 catalysed the adoption of financial services–particularly digital payments— but the pandemic is only part of the story. Using our Global Microscope Index, Economist Impact has tracked policies, regulations and investments that countries have undertaken in the past decade to enable digital finance in low- and mid-income countries since 2007.

By pursuing the following vital enablers, countries can improve financial access, respond to crises and drive equitable economic development.

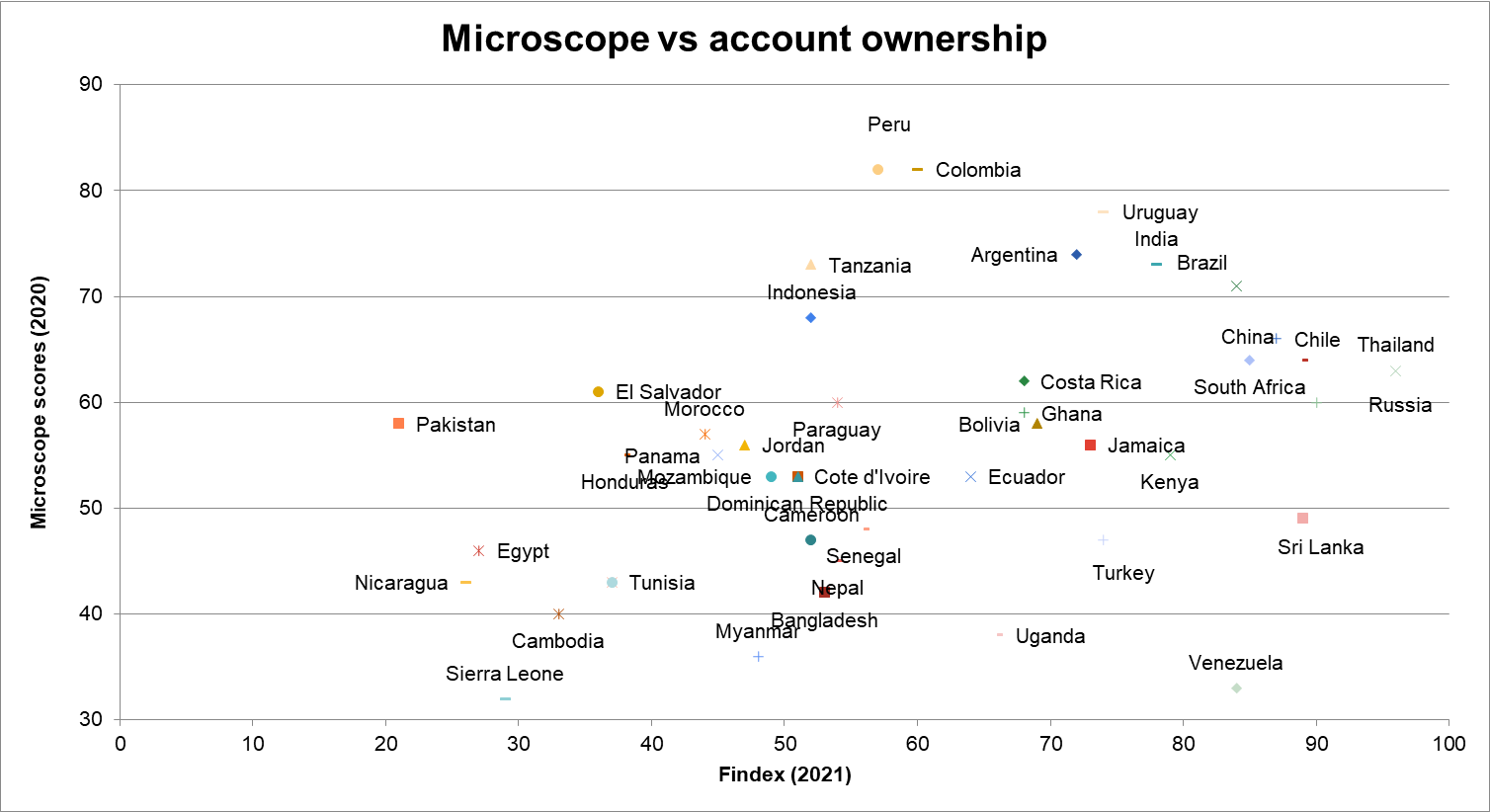

In our 2021 Rethinking the Global Microscope report, Economist Impact found a significant relationship between the overall enabling environment for financial inclusion and the prevalence of financial accounts. The new Findex confirms the relationship between these policy inputs and the rates of account ownership.

Figure 2: the relationship between the enabling environment for financial inclusion and account ownership

[1] World Bank (2022) Poverty and Shared Prosperity 2022 https://www.worldbank.org/en/publication/poverty-and-shared-prosperity

[2] The definition of a digital public good: open-source software, open data, open AI models, open standards, and open content that adhere to privacy and other applicable best practices, do no harm by design and are of high relevance for attainment of the United Nations 2030 Sustainable Development Goals (SDGs)

[3] USAID (2022) Resilience Links https://www.resiliencelinks.org/building-resilience/financial-inclusion

[4] CGAP (2022) The Evolving Nature and Scale of Consumer Risks in Digital Finance https://www.cgap.org/blog/evolving-nature-and-scale-consumer-risks-digital-finance

[5] Center for Financial Inclusion (2022) Global Findex 2021: Growth, Stagnation, and (Relative) Decline in Global Financial Inclusion https://www.centerforfinancialinclusion.org/global-findex-2021-growth-stagnation-and-relative-decline-in-global-financial-inclusion